Making Tax Digital & VAT Thresholds in 2025–2026:

What It Means for Small Businesses and How to Prepare

Audit Consulting Group

Phone: +44 7386 212550 · Email: info@auditconsultinggroup.co.uk · auditconsultinggroup.co.uk

Contents (expanded)

- Executive summary

- UK VAT in numbers (context & why it matters)

- What is Making Tax Digital (MTD)? (VAT & Income Tax overview)

- The 2025–2026 VAT threshold & phased MTD timeline — who’s in scope

- Why the changes matter to SMEs — operational & commercial effects

- Key risks, common failure modes, and how businesses typically break down

- Concrete step-by-step readiness plan (detailed phases, owners & timeline) — includes workflows & sample checklists

- Technology & software: selection criteria, integration and compliance details

- Cost modelling and ROI: realistic numbers, scenarios and waterfall example

- Case studies and pragmatic examples (two fully fleshed sample scenarios)

- KPI, monitoring, and governance: what to measure and how to report internally

- FAQs, references and next steps (how Audit Consulting Group can help)

- Executive summary (expanded)

By 2025–2026 small businesses in the UK confront two related trends: (A) VAT remains a dominant revenue stream for government (and the VAT registration threshold has changed recently), and (B) HMRC is extending its Making Tax Digital programme beyond VAT into Income Tax Self Assessment (ITSA). For many micro and small enterprises this will mean:

- Mandatory digital books (no more paper ledgers or ad-hoc spreadsheets for core taxable events);

- Quarterly digital updates for Income Tax (for those above thresholds) and ongoing digital VAT returns;

- An operational shift: continuous bookkeeping, new software and changed internal roles.

This is not purely compliance friction — businesses that embrace accurate digital processes can unlock faster financial insight, better cashflow management and lower error/penalty risk. But the transition requires planning, testing and sometimes modest investment in software and training. The rest of this report explains how to prepare in practical terms and where the greatest risks and wins lie.

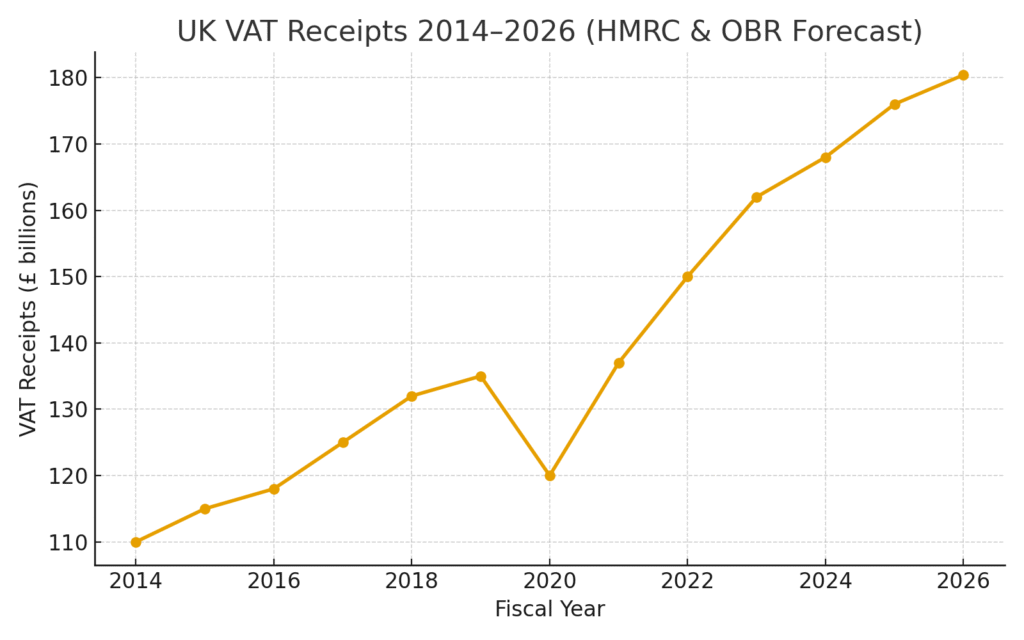

Growth of UK VAT receipts between 2014 and 2026 (based on HMRC and OBR data).

This chart highlights the consistent increase in VAT revenues over the past decade, reflecting both inflation and economic recovery. It also demonstrates why the government continues to prioritise VAT efficiency through Making Tax Digital.

- UK VAT in numbers — context & why it matters (expanded)

Understanding scale helps prioritise action. Key figures:

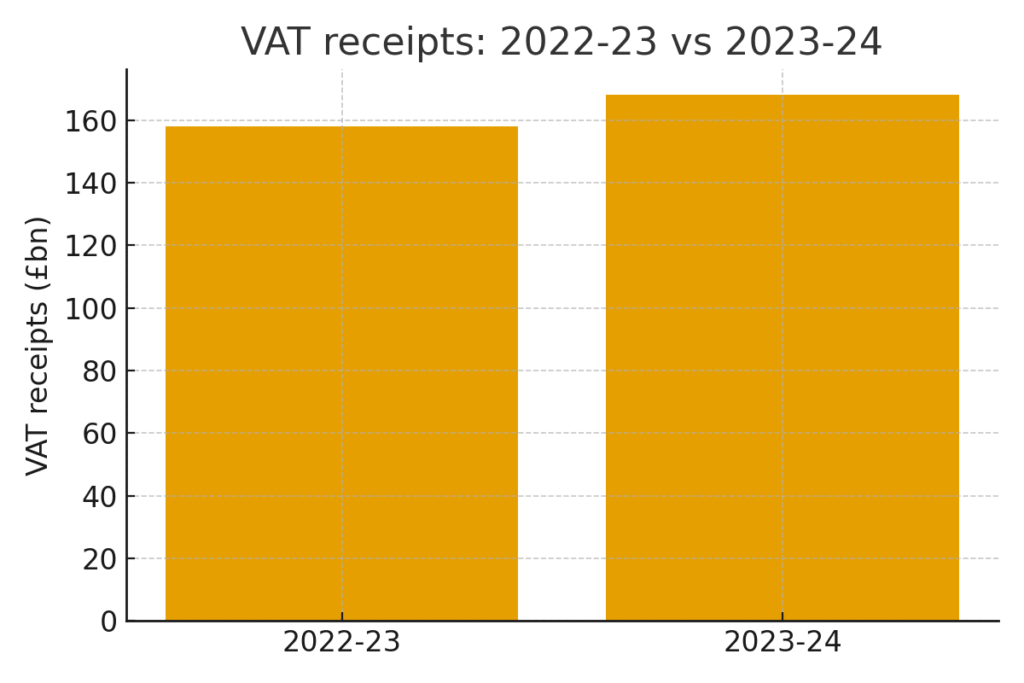

- VAT receipts 2023–24: £168 billion (total VAT receipts for FY 2023–24). GOV.UK

- OBR forecast for 2025–26: VAT receipts expected at £180.4 billion (OBR fiscal forecast). Office for Budget Responsibility

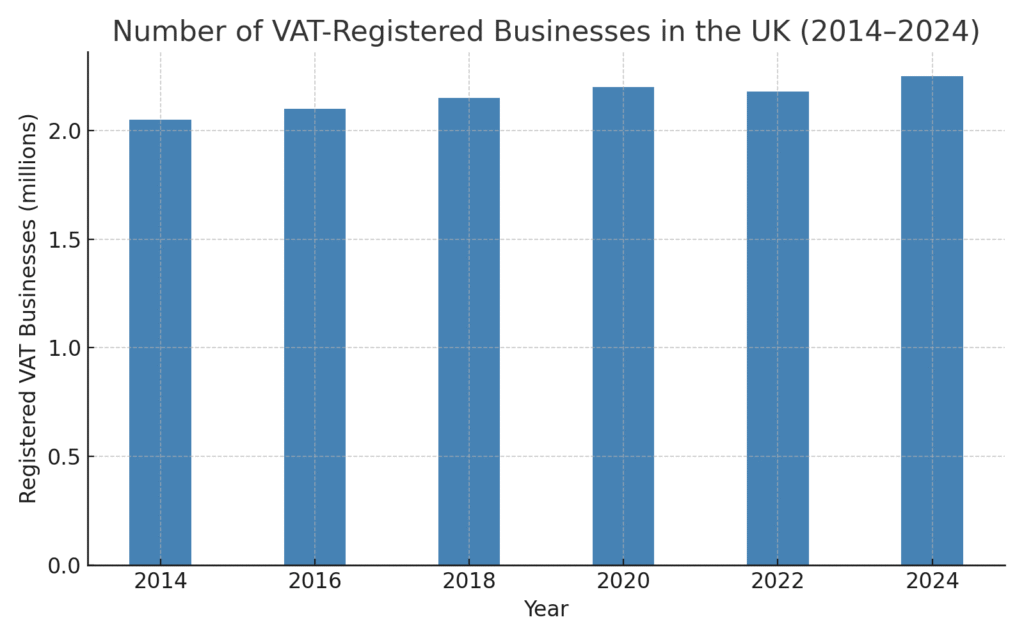

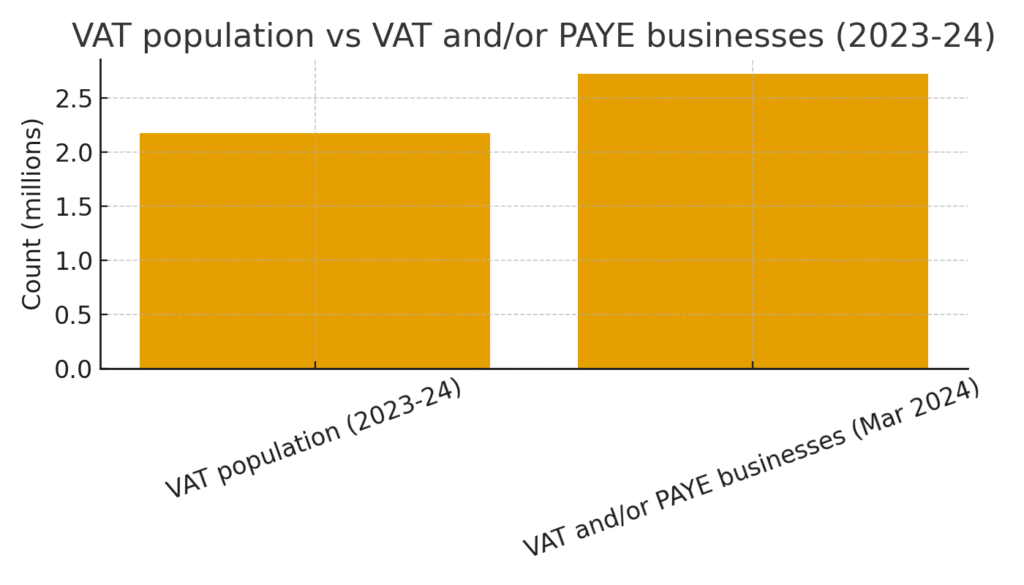

- VAT population / business scale: HMRC’s published VAT statistics show c. 2.18 million VAT-registered traders in 2023–24; ONS reports ~2.725 million VAT and/or PAYE businesses (March 2024 baseline) — underlining how many entities sit in scope for one or more reporting regimes. GOV.UK (https://www.gov.uk/government/statistics/value-added-tax-vat-annual-statistics/annual-uk-vat-statistics-2023-to-2024-commentary; https://www.ons.gov.uk/businessindustryandtrade/business/activitysizeandlocation/bulletins/ukbusinessactivitysizeandlocation/2024)

Why those numbers matter:

- VAT is a major tax head — HMRC’s drive to digitise VAT and expand MTD is partly designed to make that revenue stream more robust and easier to administer.

- Thousands of small businesses hover close to threshold levels — monitoring and preparedness affects cashflow and administrative burden.

VAT receipts: 2022–23 vs 2023–24

“UK VAT receipts: 2018–2026 (historic HMRC series + OBR 2025–26 forecast)” — place this immediately after this section. Use a 7-year line chart (2018–24 actuals + OBR 25–26 projection). Sources: HMRC Annual VAT Statistics and OBR forecast.

- What is Making Tax Digital (MTD)? (VAT & Income Tax overview) — expanded

MTD started as a program to modernize tax administration by requiring digital record-keeping and software-based submissions. The key requirements differ slightly by tax:

MTD for VAT (current, mandatory for VAT-registered businesses)

- Businesses must keep digital records of transactions and submit VAT returns via HMRC-compatible software. Manual rekeying between systems is strongly discouraged — HMRC expects digital linking where practical. See VAT Notice 700/22 for technical guidance. GOV.UK

Practical implications:

- Use software that keeps invoices, purchase records, VAT codes and adjustments in an auditable flow.

- Maintain clear processes for credit notes, adjustments, partial exemptions and EC/overseas supplies in the digital ledger.

MTD for Income Tax (ITSA) — phased roll out

- From 6 April 2026: taxpayers (self-employed and landlords) with qualifying gross income above £50,000 for the 2024–25 tax year must comply. Subsequent years lower thresholds (to £30k then £20k). See gov.uk guidance on MTD Income Tax eligibility and guidance pages. GOV.UK (https://www.gov.uk/guidance/check-if-youre-eligible-for-making-tax-digital-for-income-tax; https://www.gov.uk/government/collections/making-tax-digital-for-income-tax)

Features for ITSA:

- Quarterly updates: short digital summaries of income/expenses each quarter (not full returns in place of the annual tax liability).

- Finalising declaration: annual finalisation of the year-end position (similar to current SA self-assessment).

- Digital linking: software must maintain the same digital linking standards as VAT (no manual copy/paste). Developer guidance explains the end-to-end API and technical requirements. HMRC Developer Hub

- The 2025–2026 VAT threshold & phased MTD timeline — who’s in scope (expanded)

VAT threshold

- From 1 April 2024, the VAT registration threshold increased to £90,000 (rolling 12-month). This affects the “moment” a business must register when cumulative turnover over any previous 12 months exceeds the threshold. HMRC guidance and factsheets explain the rules for registration/deregistration. (gov.uk VAT guidance). GOV.UK (https://www.gov.uk/government/statistics/value-added-tax-vat-annual-statistics/; https://www.gov.uk/government/publications/vat-notice-70022-making-tax-digital-for-vat/vat-notice-70022-making-tax-digital-for-vat)

Practical note:

- Many small businesses previously operating under the old threshold might now have a slightly larger buffer, but rolling turnover monitoring is still essential — seasonal income can push a business across the threshold suddenly.

MTD Income Tax phased timeline (summary)

- 6 Apr 2026 — mandatory for those with qualifying income > £50,000 (for the tax year 2024–25) to start using MTD from this date. GOV.UK

- 6 Apr 2027 — threshold moves to £30,000 (qualifying income for 2025–26). GOV.UK

- 6 Apr 2028+ — further lowering to £20,000 in many cases per government plans/consultations (ICAEW/industry commentary reflect these staged reductions). ICAEW

Who that captures:

- Sole traders, freelancers, consultants, and landlords whose gross receipts exceed thresholds; also businesses registered for VAT that may already be MTD-ready.

Number of VAT-registered businesses in the UK, 2014–2024.

The growing number of VAT-registered entities shows how digital compliance now affects a broader segment of small and medium enterprises. This trend underlines the importance of preparation and professional accounting support.

- Why the changes matter to SMEs — operational & commercial effects (expanded)

5.1 Operational effects

- Higher frequency of bookkeeping: moving from annual or monthly to quarterly updates increases cadence. Errors must be caught earlier.

- Changed month-end process: period-end reconciliations become more frequent; turnaround time must tighten.

- New responsibilities: owners or finance teams must control digital flows, bank feeds and maintain audit trails.

5.2 Commercial & cashflow effects

- Price displays and invoicing: VAT registration requires clear VAT treatment on invoices; some small businesses adjust pricing or absorb VAT.

- Working capital management: VAT collected on sales vs VAT reclaimable on inputs — timing differences affect cashflow (especially for small retailers or construction businesses with long supply chains).

- Procurement & supplier management: accurate input VAT reclaim requires suppliers to issue correct VAT invoices and for bookkeeping to capture them timely.

5.3 Strategic effects

- Better real-time insight into profitability when systems are set up well — enabling earlier decisions on pricing, hiring or investment.

- Service opportunities for accountants/agents: many SMEs will prefer professional support for the transition — creating advisory demand.

- Key risks and common failure modes (expanded)

Below are the most common ways SMEs get into trouble during MTD implementation and how to avoid them.

6.1 Data hygiene & legacy errors

Problem: Old spreadsheets, inconsistent nominal codes, missing invoices.

Impact: Incorrect quarterly updates, transposition errors, penalties.

Fix: Run a data cleanse project before migration: reconcile bank statements, match supplier invoices, close legacy journals.

6.2 Software misfit or poor integrations

Problem: Picking software lacking bank feeds or audit trails (or using a suite that requires manual copy/paste).

Impact: Breach of HMRC digital link guidance, repeated manual work.

Fix: Choose HMRC-compliant software with API bank feeds and strong support; test data linking.

6.3 Human error & lack of change management

Problem: Staff stick to old ways; no training.

Impact: Low adoption, errors.

Fix: Run role-based training, set KPIs and pilot teams to champion the change.

6.4 Inadequate testing

Problem: Doing no dry runs before the first live submission.

Impact: Last minute corrections, stress, potential errors that cause penalties.

Fix: Run two or three simulated quarterly submissions and reconcile.

6.5 Cashflow planning failures

Problem: Not modelling VAT registration impact on prices and working capital.

Impact: Surprise cash shortfalls.

Fix: Run a cashflow sensitivity model for crossing the VAT threshold; plan a buffer for first 1–2 VAT cycles.

- Step-by-step readiness plan (detailed phases, owners & timeline)

A practical timeline with owners, deliverables and acceptance criteria. Use this as an implementation checklist with owners (owner = business owner / finance lead / external advisor).

Phase 0 — Discovery & Triage (Owner: Business Owner + Accountant) — 0–1 month

Deliverables:

- Rolling 12-month turnover dashboard (weekly update).

- Digital records audit (list of software, data gaps, manual processes).

Acceptance: Dashboard operational; list of top 10 data gaps.

Phase 1 — Design & Software Selection (Owner: Finance Lead + IT / Advisor) — 1–2 months

Deliverables:

- Shortlist 2–3 HMRC-approved software packages (e.g., Xero, QuickBooks, Sage, FreeAgent).

- Integration plan: bank feeds, payroll, invoicing, POS.

- Budget estimate for migration and annual costs.

Acceptance: Signed procurement decision and timeline.

Phase 2 — Data Migration & Cleanup (Owner: Accountant / Implementation Partner) — 1–3 months

Deliverables:

- Migrated customer/supplier lists, opening balances, 12 months of transactions.

- Reconciliation report (bank, A/R, A/P).

Acceptance: No unreconciled major balances; sample audit trail validated.

Phase 3 — Training, Dry Runs & Internal Controls (Owner: Finance Lead + External Trainer) — 1–2 months

Deliverables:

- Standard operating procedures (SOP) for data entry, approvals, and reconciliations.

- Two simulated quarterly submissions with reconciliation reports.

Acceptance: Dry runs produce clean reconciliations; SOPs signed off.

Phase 4 — Go-Live & Monitoring (Owner: Business Owner & Accountant) — live date (e.g., Apr 2026)

Deliverables:

- First live quarterly submission (for ITSA if applicable) and VAT submission cycles under MTD rules.

- Weekly KPI dashboard (errors, time to close, percentage auto-coded).

Acceptance: KPIs meet agreed thresholds after first two quarters (e.g., <2% error rate, month-end close < 5 working days).

Checklist (practical items)

- Bank feeds enabled and verified

- Supplier invoices scanned and OCR in place or manual upload process signed off

- Chart of accounts simplified and documented

- Backup and retention policy for digital records

- Agent authorisation in HMRC where advisor files on behalf of business

- Technology & software: selection criteria, integration and compliance details (expanded)

8.1 Selection criteria (must-have list)

- HMRC MTD compliant (officially supports digital links/API)

- Bank feed reliability (automatic transaction import)

- Robust audit trail (ability to show who changed records and when)

- Auto-matching & rules engine (saves manual work)

- Multi-user permissions & role management

- Exportable, archived data (for agent review or inspection)

- Scalability & connectors (E-commerce platforms, POS, payroll)

8.2 Integration architecture

- Primary ledger (Xero/QuickBooks/Sage) ← bank feeds, payment gateway feeds, POS → Reporting & dashboards (PowerBI/Excel template)

- Use middleware (e.g., Zapier, Make) only if it supports digital linking (avoid brittle copy/paste regimes).

8.3 Security & control

- Use two-factor authentication for software and HMRC agent accounts.

- Document and enforce access control reviews quarterly.

- Backups: weekly exports and monthly archived copies retained 6+ years (per HMRC recommended retention).

8.4 Agent & API considerations

- Agents should be authorised in HMRC’s Agent services — confirm agent codes and client access ahead of filing windows.

- If you host software on third party servers ensure data residency and GDPR compliance as required.

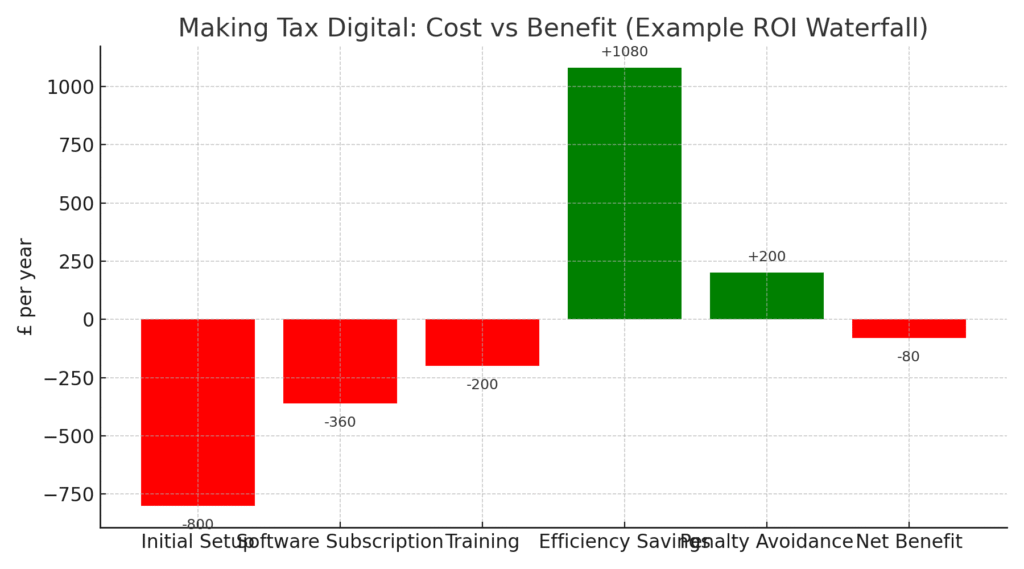

Example ROI analysis for implementing MTD-compatible accounting software.

Although adopting digital tools involves setup and subscription costs, the potential savings in efficiency and penalty avoidance often result in a positive long-term return on investment.

Useful technical references: HMRC’s developer guidance for VAT and MTD API details (end-to-end guides). HMRC Developer Hub

- Cost modelling and ROI: realistic numbers, scenarios and waterfall example (expanded)

Below are pragmatic modelling steps and example numeric scenarios: use these to build a simple Excel ROI model for your business.

9.1 Inputs to model

- Current annual admin hours (bookkeeping, reconciliations)

- Average hourly rate of staff handling books (or cost of outsourced bookkeeper)

- Software licence cost (monthly / annually)

- Migration / training one-off costs

- Expected time savings (%) from automation (conservative: 30–40%, optimistic: 50–60%)

- Probability of penalty avoidance (reduction in expected penalty cost)

9.2 Example scenario (micro business)

- Hours/year on bookkeeping: 120 hrs

- Staff cost: £18/hr = £2,160/year

- Software: £30/month = £360/year

- Setup & migration: £800 one-off

- Outsourced bookkeeping alternative: £300/month = £3,600/year

If automation reduces hours by 50%: saved staff cost = £1,080/year. Net benefit first year = £1,080 − (£360 + £800 amortized) … etc.

9.3 Waterfall example for decision making

- Initial investment (setup)

- First year subscription & training cost

- Annual recurring subscription & support

- Savings from reduced hours & error correction

- Secondary benefits (improved cashflow, earlier invoicing) — quantify conservatively

VAT population vs VAT and/or PAYE businesses

“Cost vs Benefit Breakdown for MTD Adoption — Waterfall chart” (Display one-off costs on left, recurring costs mid, benefits right showing net position over 1–3 years). Use realistic numbers above when you build the chart.

- Case studies and pragmatic examples (expanded)

Case study 1 — E-commerce retailer (B2C)

Context: Yearly sales £88k; seasonality with Q4 spike; manual Excel books.

Problem: At risk of crossing VAT threshold, poor invoice audit trail, slow monthly close.

Action taken: Migrated to cloud accounting (Xero with Zapier integration to e-commerce platform), enabled bank feeds and automated VAT codes; ran 3 dry run quarterly updates; trained 2 staff.

Result: Crossed VAT threshold with no errors, introduced pricing message to customers about VAT-inclusive pricing, time to month-end reduced from 10 → 3 days; cash buffer planning avoided shortfall during first VAT quarter.

Case study 2 — Sole trader plus rental income

Context: Self-employed graphic designer with rental income; combined gross receipts £55k.

Problem: Reliant on year-end self-assessment; worried about 2026 MTD ITSA requirement.

Action taken: Adopted FreeAgent, configured categories for rental vs trading income, started quarterly bookkeeping, engaged accountant for first two quarterly submissions.

Result: Smooth MTD onboarding, no penalty or rushed corrections; better quarterly cash insight and ability to smooth tax payments.

- KPI, monitoring & governance (what to measure and how)

To manage digital tax operations, track a small set of high-value KPIs weekly/monthly:

Operational (weekly / monthly)

- % transactions auto-coded (target > 80%)

- Number of unmatched bank transactions (target < 2% of volume)

- Time to reconcile (hours per month)

- Days to close month after period end (target < 5 days)

Compliance (quarterly)

- Number of adjustments required after quarterly submission (target: 0–1)

- Late filing incidents & penalties (target: 0)

- Percentage of invoices with valid VAT invoices for input VAT reclaim (target > 98%)

Financial

- Cash buffer weeks (target 4–8 weeks)

- Forecast variance (actual vs forecast cashflow) — track every quarter

Governance

- Quarterly internal audit of digital records (sample 20 transactions)

- Annual review of software & permission matrix

- SLA with external advisor (response times, file checks)

Use dashboards (Power BI / Google Data Studio / built-in accounting reports) to present to leadership monthly.

- FAQs, references and next steps (expanded)

Frequently asked practical questions (short answers + sources)

- Q: When exactly does MTD for Income Tax begin?

A: 6 April 2026 for those with qualifying gross income > £50,000 for the 2024–25 tax year; threshold phases down in later years (see gov.uk guidance). GOV.UK - Q: Can I sign up early?

A: Yes — voluntary early sign up is allowed to test systems. (HMRC MTD for Income Tax pages). GOV.UK - Q: Which software vendors are MTD-approved?

A: Major providers include Xero, QuickBooks, Sage and FreeAgent; always verify the vendor’s MTD certification and any agent linking requirements. HMRC’s developer and software partner pages list approved connectors. HMRC Developer Hub - Q: If my income falls below thresholds later can I disconnect?

A: HMRC allows deregistration where appropriate — consult your adviser before decommissioning systems in case of audit or retention requirements.

References (key sources used in this article)

- HMRC — Annual UK VAT statistics 2023–24 (commentary & dataset). (https://www.gov.uk/government/statistics/value-added-tax-vat-annual-statistics/annual-uk-vat-statistics-2023-to-2024-commentary)

- OBR — VAT forecasts and tax receipts (VAT 2025–26 forecast). (https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/vat/)

- ONS — Business activity, size and location (business counts). (https://www.ons.gov.uk/businessindustryandtrade/business/activitysizeandlocation/bulletins/ukbusinessactivitysizeandlocation/2024)

- gov.uk — MTD for Income Tax guidance & eligibility. (https://www.gov.uk/guidance/check-if-youre-eligible-for-making-tax-digital-for-income-tax; https://www.gov.uk/government/collections/making-tax-digital-for-income-tax)

- HMRC — VAT Notice 700/22: Making Tax Digital for VAT. (https://www.gov.uk/government/publications/vat-notice-70022-making-tax-digital-for-vat/vat-notice-70022-making-tax-digital-for-vat)

- ICAEW/ICAEW guidance — MTD information and tax guides for accountants. ICAEW