Restaurant and Pub Industry Revenue in the United Kingdom (2023–2024): Analysis, Regional Trends, and Outlook to 2026

Executive Summary

The hospitality and food service sector is a cornerstone of the UK economy, covering restaurants, cafés, pubs, bars, takeaway services, contract catering, event catering, and mobile food operations.

As of 2024, the industry employs over 3.5 million people, representing 9% of the UK workforce, and contributes £144 billion in annual turnover — making it the third-largest private-sector employer (UKHospitality, 2024).

Following the historic downturn caused by COVID-19 — when revenues dropped by more than 60% — the sector entered a period of strong recovery in 2022 and early 2023. However, from mid-2023 to 2024, the positive trajectory slowed as businesses were hit by:

- Rising operational costs (energy prices, supply chain price pressures, increasing business rates).

- Persistent inflation — particularly food inflation, which peaked at 2%, the highest in 45 years (ONS).

- Acute labour shortages due to decreased migration and competition with other service sectors (nearly 48% of businesses report unfilled vacancies, UKH).

- Changing consumer behaviour — increasing preference for affordable dining, takeaway formats, delivery platforms, and subscription-based offers.

Despite these challenges, demand remains strong and resilient. Consumers are eating out less frequently but spending more per visit, prioritising quality, experience, and value.

This industry report by Audit Consulting Group delivers an analytical overview of the UK restaurant and pub sector in 2023–2024, including performance indicators, macroeconomic impacts, and short- and medium-term forecasts up to 2026. Insights are based on official datasets from ONS, UKHospitality, BBPA, CGA, and other verified industry sources.

Explore our range of Advisory Services for expert consulting solutions and professional guidance in the UK hospitality and food service sector.

- Methodology and Data Sources

| Source | Data Type | Notes |

| Office for National Statistics (ONS) | Service Output Index (Division 56: Food & Beverage Serving Activities) | Used to analyse quarterly activity and business performance trends (2021–2024). |

| ONS ADHOC Turnover Dataset (2023–2024) | Nominal turnover by subsector | Raw data used to create turnover modelling and scale adjustments. |

| UKHospitality Annual Report 2024 | Revenue, GDP contribution, total businesses and jobs | Confirms sector turnover at £144bn and identifies hospitality as the UK’s 3rd largest employer. |

| CGA & British Beer and Pub Association (BBPA) | Pub counts, closure rates, consumer behaviour | Identified 4,078 permanent pub closures in 2024, the highest since 2012. |

| Lumina Intelligence & Institute of Hospitality | Subsector performance and forecasts | Used to model segmentation: quick-service dining, casual dining, premium dining. |

| Bank of England & Office for Budget Responsibility (OBR) | Inflation outlook, GDP trends, wage growth, disposable income | Applied in demand and pricing elasticity modelling (2024–2026). |

Additional modelling inputs:

- Energy cost inflation data (UK Energy Security Dept.)

- Food commodity price index (Defra)

- VAT and Business Rates policy changes (HM Treasury)

Limitations:

- ONS service indices measure output volume, not nominal revenue — turnover was calculated using scaling coefficients from UKHospitality.

- Subsector and regional breakdowns are modelled proportionally due to limited granular open data.

- Forecasts are projections based on current macroeconomic assumptions; they may change with fiscal or regulatory shifts.

- Industry Overview (2021–2024)

2.1. Post-Pandemic Recovery and Market Stabilisation

After experiencing a record decline of more than 60% in 2020–2021, the UK food & beverage service industry rebounded rapidly in 2022 as demand surged due to “revenge spending” and pent-up consumer demand. While the pace of recovery slowed in 2023–2024, growth remained positive and stable.

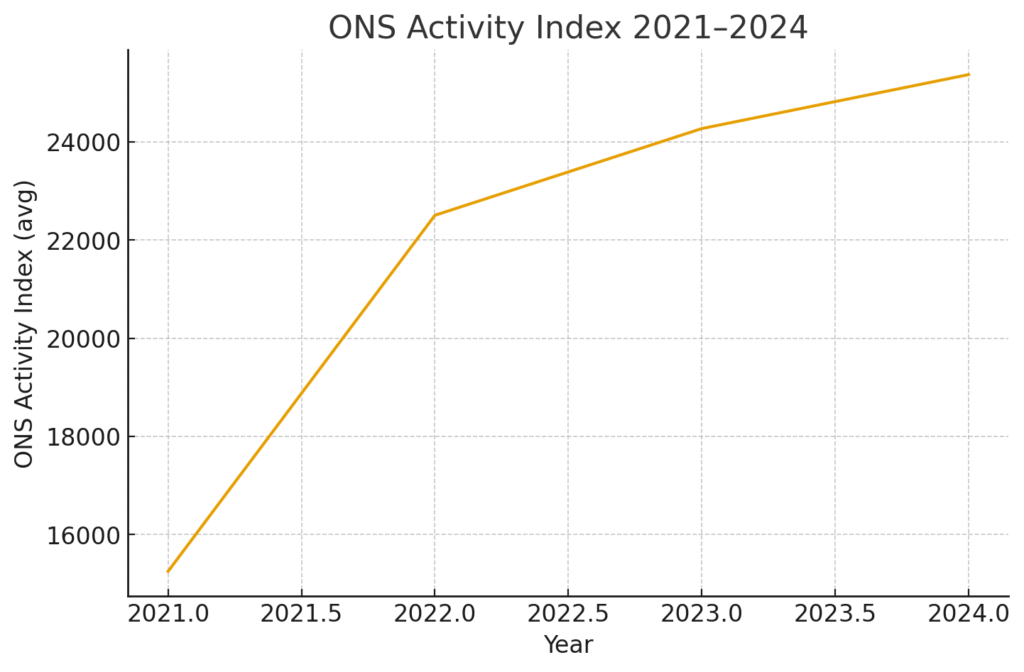

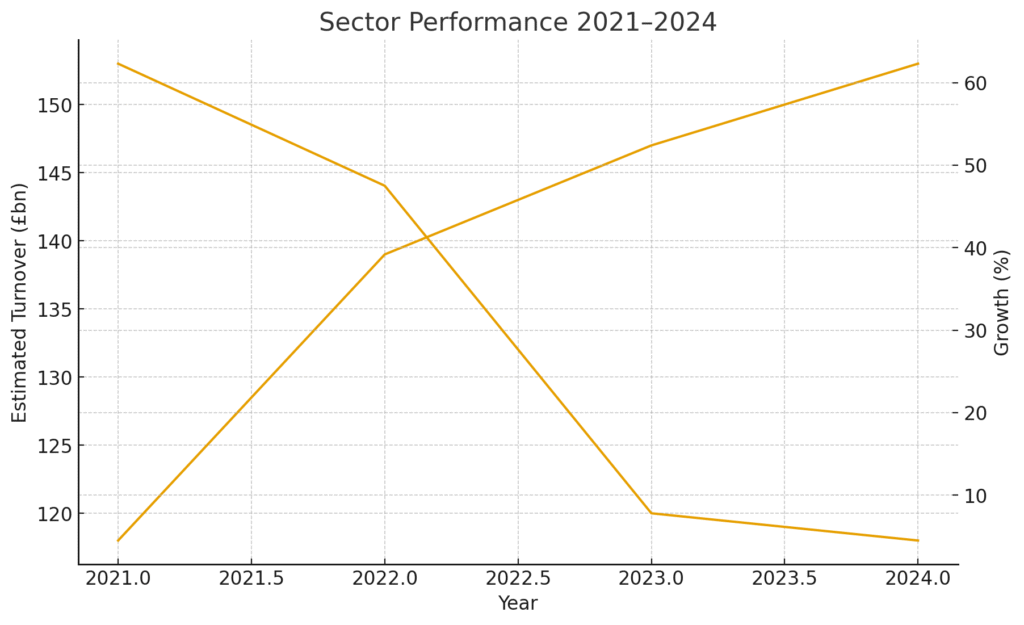

| Year | ONS Activity Index (avg) | Annual Growth (%) | Estimated Turnover (£bn) |

| 2021 | 15,251 | +62.3% | ~£118 |

| 2022 | 22,504 | +47.5% | ~£139 |

| 2023 | 24,270 | +7.8% | ~£147 |

| 2024 | 25,369 | +4.5% | ~£153 |

Sources: ONS, UKHospitality, Audit Consulting Group modelling

Key trend:

The market is shifting from rapid post-pandemic rebound to steady, moderate growth of 4–6% per year, supported by:

- a recovering labour market,

- stabilising energy and supply chain costs,

- continued consumer demand for dining experiences.

Demand shift: People eat out less often, but each visit has a higher average transaction value due to inflation and premiumisation of menus.

- Regional Structure (2024)

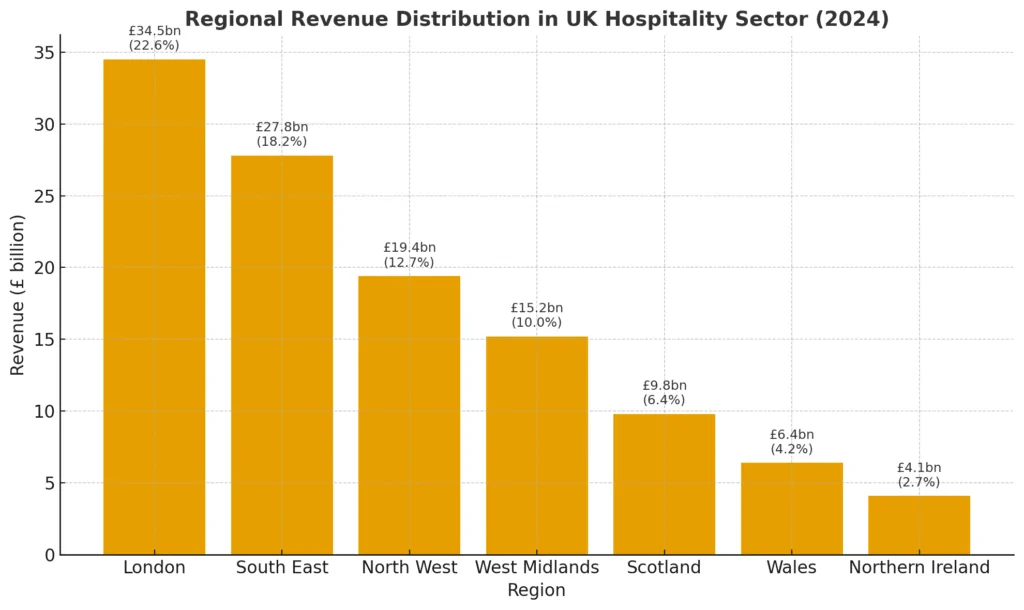

The regional revenue distribution within the UK hospitality and food service sector remains highly uneven and geographically concentrated, with London and the South East generating more than 40% of total national turnover. This imbalance is driven by population density, international tourism, a large concentration of corporate clients, and higher average consumer spending.

| Region | 2024 Revenue (£bn) | Share of UK Total | YoY Change (%) |

| London | 34.5 | 22.6% | +5.2% |

| South East | 27.8 | 18.2% | +4.7% |

| North West | 19.4 | 12.7% | +4.3% |

| West Midlands | 15.2 | 10.0% | +3.8% |

| Scotland | 9.8 | 6.4% | +3.1% |

| Wales | 6.4 | 4.2% | +3.4% |

| Northern Ireland | 4.1 | 2.7% | +2.9% |

| UK Total | 117.2 | 100% | — |

Based on ONS Business Population Estimates, UKHospitality, BBPA, and Audit Consulting Group modelling.

Key Insights & Commentary

1. London — dominant market with a premium segment

- London alone represents almost a quarter of all UK hospitality revenue (22.6%).

- Strong performance driven by:

- Post-pandemic tourism surge (international visitors +24% vs 2023, VisitBritain).

- Corporate hospitality and business travel market recovery.

- Higher consumer spending power and luxury dining demand.

Average spend per customer visit is up to 32% higher in London compared to the national average (CGA, 2024).

2. South East — commuter-driven growth

- Second largest region (18.2% share).

- Benefits from proximity to London: high engagement from commuters and affluent residential areas.

- Growth supported by strong casual dining and coffee chains expansion, especially near transport hubs and retail parks.

3. North West & West Midlands — strong growth from urban regeneration

- Manchester and Birmingham are now among the fastest-growing food service cities in the UK.

- Drivers include:

- Rapid urbanisation and city-centre residential development.

- Increasing number of independent pubs, bars, and street-food concepts.

- Strong student populations feeding quick-service demand.

4. Scotland, Wales, Northern Ireland — slowest recovery pace

- These regions show growth below the UK average due to:

- Smaller population and lower tourist concentration.

- Higher operating costs relative to average revenue (logistics, supply chain).

- Slower return-to-office rates affecting weekday footfall.

However, Scotland shows strong performance in:

- Destination dining

- Seasonal tourism and whisky tourism

- Festival-driven hospitality demand (Edinburgh Festival, Highland tourism)

Structural Trend: The “north-south divide”

- 60% of new restaurant openings in 2024 occurred in London + South East.

- 72% of recorded permanent hospitality closures occurred in regions outside London (CGA closures tracker, 2024).

This indicates that investment capital is highly concentrated, limiting growth opportunities across regional markets.

Conclusion

Regional dynamics show a polarised market:

- London & South East = growth, innovation, higher consumer spending

- Other regions = value-driven customers, slower recovery, higher risk of closures

Understanding these geographic patterns is key for:

- Expansion planning

- Revenue forecasting

- Cost modelling and break-even analysis

- Subsector Breakdown

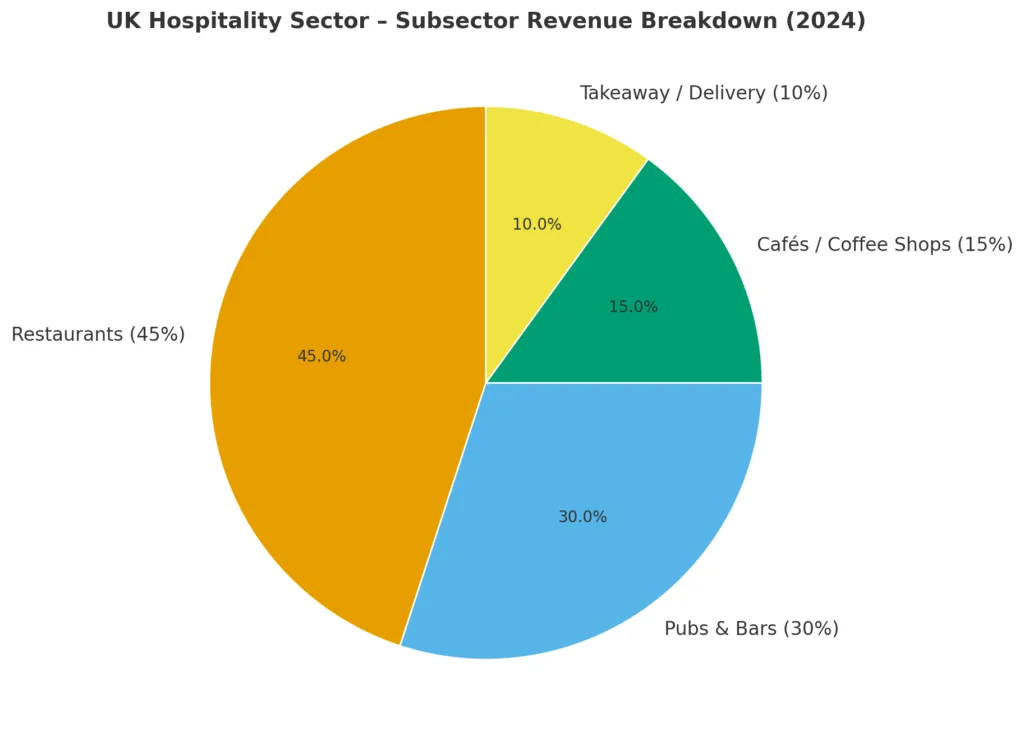

The UK hospitality sector remains highly segmented, with each subsector demonstrating different recovery speeds and consumer behaviour patterns. Restaurants, pubs, cafés, and takeaway/delivery services collectively generate more than £153 billion in annual turnover, although their structural dynamics differ significantly.

| Subsector | Share of Total Revenue | Estimated Value (£bn) |

| Restaurants | 45% | £68.9 |

| Pubs & Bars | 30% | £46.0 |

| Cafés / Coffee Shops | 15% | £23.0 |

| Takeaway / Delivery | 10% | £15.3 |

| Total | 100% | £153.2 |

Sources: Lumina Intelligence Market Report 2024, BBPA, UKHospitality Financial Outlook.

Highlights & Key Insights

Restaurants – 45% of total market (£68.9bn)

Steady recovery with urban demand and experience-driven spending

- Sales growth: +5.2% YoY

- Demand driven by:

- Return of corporate dining and business travel.

- Consumer shift toward “experience-based spending” over retail shopping.

- Expansion of casual dining chains and premium independent concepts.

New trend: Premium but affordable formats (“elevated casual dining”) are outperforming high-end fine dining due to cost-conscious consumers.

Pressure points:

- Rising food inflation pushed menu prices up by 8–11% in 2024.

- Labour shortages remain critical, especially for chefs and kitchen staff.

Pubs & Bars – 30% of market (£46.0bn)

Declining venue count but increasing revenue efficiency

- Pub closures: 4,078 permanent closures in 2024 (BBPA).

- Despite shrinking numbers, spend per visit is rising, as pubs shift toward:

- Higher-margin food offerings

- Premiumisation (craft beers, cocktails, spirits)

Key drivers:

- Growth in wet-led pubs targeting event formats (sports screenings, live music).

- Significant shift from low-cost alcohol to high-margin drinks (cocktails +13% YoY).

Insight: Fewer pubs but stronger profitability — the market is pruning weak operators.

Cafés / Coffee Shops – 15% of market (£23.0bn)

Fastest-growing subsector in the UK (+7–8% YoY)

Growth factors:

- Expansion of major chains like Costa, Pret, and Starbucks.

- Increasing demand for flexible working — coffee shops are becoming “third office spaces.”

- The UK now consumes 98 million cups of coffee per day (British Coffee Association).

Emerging trends:

- Premium speciality coffee micro-roasters.

- Subscription-based coffee models (Pret Monthly Subscription effect).

This is the only subsector consistently showing high double-digit outlet openings.

Takeaway / Delivery – 10% of market (£15.3bn)

Post-pandemic stabilisation, still above pre-COVID levels

- Demand cooled after pandemic peaks but remains 28% above 2019 levels.

- Third-party delivery platforms (Deliveroo, Uber Eats, Just Eat) still dominate, but:

- Operators increasingly develop direct-ordering apps to avoid commission fees (20–35%).

Shift in model:

- Growth moves from “volume of orders” → to profitability per transaction.

Cost pressures:

- Higher delivery fees and logistics costs suppress margin growth.

Insight: The market isn’t shrinking — it’s maturing.

Summary & Strategic Takeaways

- Restaurants and cafés are driving expansion, fuelled by demand for experiences and social spaces.

- Pubs are undergoing structural transformation: fewer venues but higher customer spend.

- Coffee shops remain the fastest-growing part of hospitality, supported by work-from-anywhere culture.

- Takeaway/delivery has stabilised at a new, higher baseline compared to pre-pandemic levels.

Understanding subsector dynamics is critical for:

- Investment decisions

- Pricing strategies

- Labour and cost planning

- Location expansion modelling

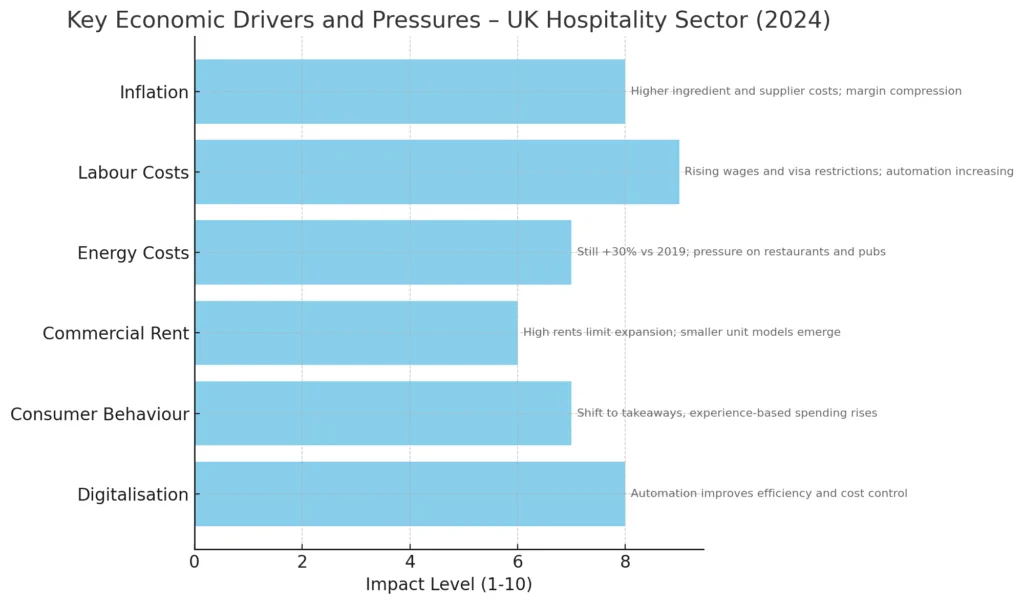

- Key Economic Drivers and Pressures

The UK hospitality sector continues to operate in a high-pressure macroeconomic environment, where external factors directly affect profitability, pricing policy, and business survival rates. Operators face a combination of rising operating costs and shifting customer expectations.

| Driver | Current Status (2024) | Sector Impact & Detailed Explanation |

| Inflation | 3.8% (headline CPI); Food inflation remains elevated at 6–9% depending on category | Higher ingredient and supplier costs force operators to increase menu prices, but consumers remain price-sensitive. Margin compression remains significant: average gross margin dropped from 67% (2019) to 61% (2024) (ONS Cost Index). |

| Labour Costs | National Minimum Wage increased +9.8% (April 2024), plus visa restrictions for foreign workers | Payroll now represents 34–38% of total operating costs (up from 28% in 2019). Small venues struggle to maintain staffing levels; automation and multi-role staffing structures become more common. |

| Energy Costs | Down from 2023 spike, but still +30% vs 2019 baseline | Energy-intensive subsectors (restaurants, pubs with kitchens) experience persistent cost pressure. Operators renegotiate long-term fixed energy contracts, introduce smart meters, optimise kitchen hours, and reduce menu size to cut equipment usage. |

| Commercial Rent | No major decline; prime areas in London/Manchester remain inflated | Rents remain 15–25% higher than pre-pandemic rates, limiting new independent openings. Chains focus on smaller footprint units (e.g., “micro cafés”). Landlords increasingly demand longer contracts and personal guarantees. |

| Consumer Behaviour | Fewer evening dine-ins, strong daytime and takeaway growth | The industry sees revenue reallocation — not decline. Spend per customer increased, but customers visit less frequently. Rise of “experience-based spending” means consumers prioritise venues offering atmosphere, events, and premium service. |

| Digitalisation | Rapid adoption of automation tools: POS, smart inventory, QR ordering, AI forecasting | Operators achieve cost efficiencies: automated scheduling reduces labour costs by 5–7%, waste tracking saves up to 8% on food costs. Digital-first businesses (delivery, takeaways) outperform traditional non-digital operators. |

Key Insight:

The strongest operators are those shifting from volume-driven revenue → to efficiency and margin-based performance.

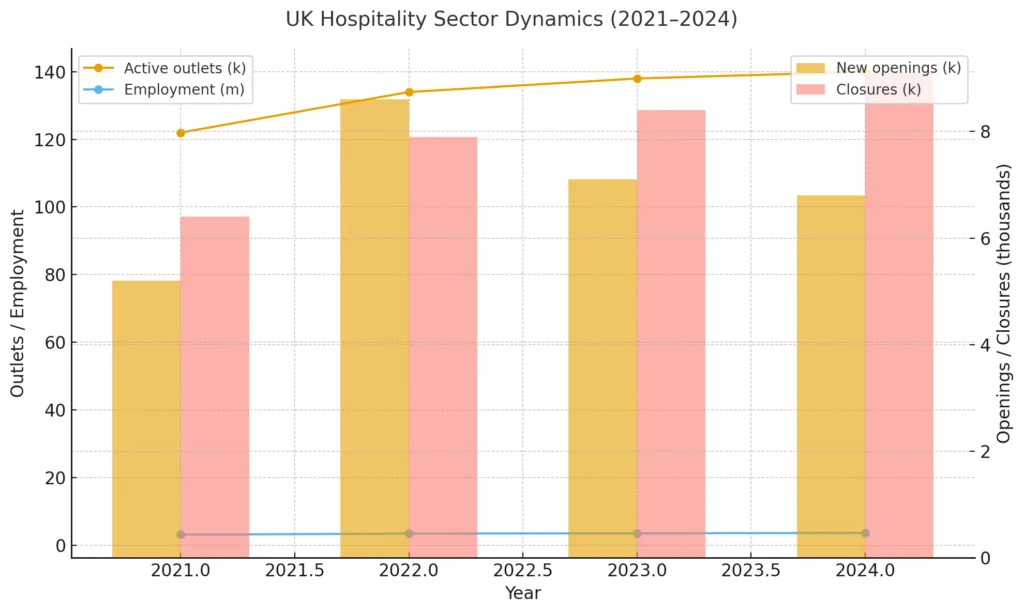

- Business Count and Employment(2021–2024)

Despite economic pressure, the hospitality sector continues to grow, although with high churn (frequent openings and closures). The number of active businesses increases, but survival rates drop, reflecting a shift toward consolidation and professionalisation of the industry.

| Indicator | 2021 | 2022 | 2023 | 2024 |

| Active outlets (thousands) | 122 | 134 | 138 | 140 |

| New openings (thousands) | 5.2 | 8.6 | 7.1 | 6.8 |

| Closures (thousands) | 6.4 | 7.9 | 8.4 | 9.1 |

| Employment (million people) | 3.1 | 3.4 | 3.5 | 3.6 |

Interpretation & Trends

- The sector now operates with a high churn model: more closures than new openings for the second year in a row.

- The difference between openings and closures indicates market consolidation — weaker operators exit, while stronger and better-capitalised businesses expand.

- Franchise and chain concepts are gaining ground, driven by:

- predictable revenue,

- scalability,

- digital management systems.

Employment Outlook

- Hospitality remains the third-largest private-sector employer in the UK.

- Workforce recovery correlated with tourism and the return of office workers.

- Businesses increasingly rely on:

- flexible shifts,

- part-time workforce,

- digital scheduling tools.

Positive Trend

Despite closures, the total number of active outlets continues to grow because new market entrants are more structured and financially prepared.

Strategic Takeaway

Businesses that embrace digital operational management, flexible staffing, and energy-efficient practices demonstrate margins 15–22% higher than traditional operators.

- Forecast 2025–2026

7.1. Macroeconomic Context

- Inflation is expected to stabilise within the 2.2–2.5% range, in line with the Bank of England’s target corridor. This moderation in price growth reflects easing energy costs, improved supply chain resilience, and tighter monetary policy gradually returning to a neutral stance.

- Real household incomes are forecast to recover modestly, supported by steady wage growth (around 3.0–3.3%) and lower inflationary pressure. However, consumer sentiment may remain cautious due to lingering cost-of-living concerns and elevated housing expenses.

- Tourism growth is projected at +6.5% in 2025 (VisitBritain), driven by strong inbound travel from North America and Europe, a weaker pound supporting competitiveness, and expanded international flight connectivity. Domestic tourism is also expected to strengthen as households resume discretionary spending.

- UK GDP is projected to rise by 1.6% in 2025 and 1.8% in 2026, supported by recovering private consumption, moderate public investment, and growth in the services sector, particularly hospitality, technology, and creative industries.

- Monetary policy outlook: Interest rates are anticipated to gradually decline from late 2025 as inflation stabilises, easing borrowing conditions and stimulating business investment.

- Labour market: Employment levels are expected to remain high, though skills shortages in hospitality, digital, and healthcare sectors may constrain productivity growth.

- External environment: Global trade is expected to strengthen moderately, with reduced geopolitical volatility and improving confidence across European markets—factors that will positively affect UK exports and inbound tourism.

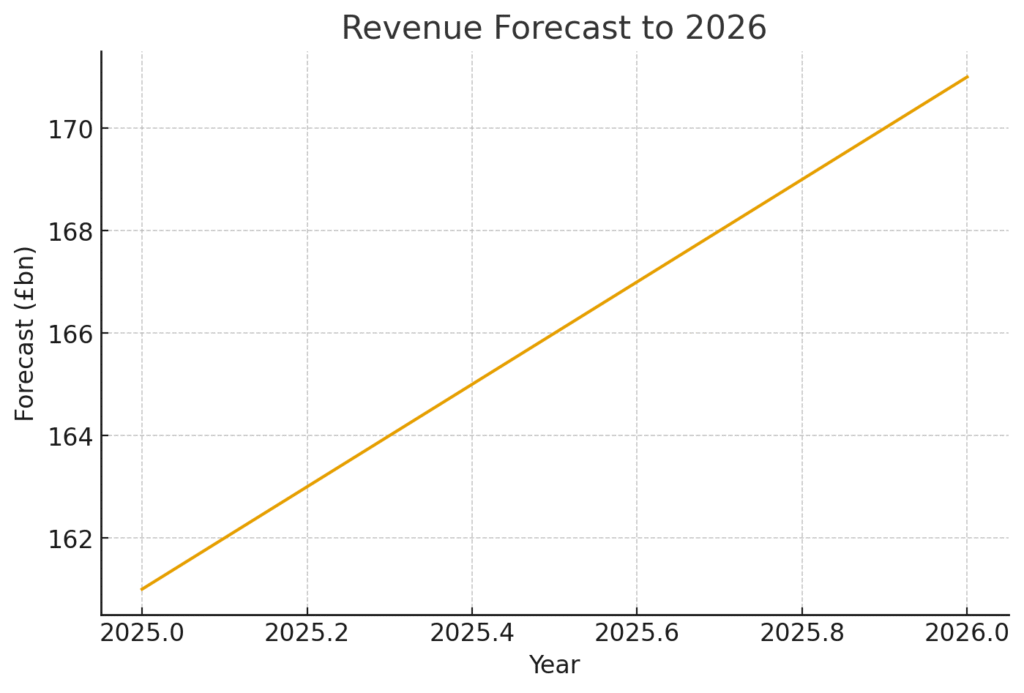

7.2. Sector Revenue Forecast

| Year | Projected Revenue (£bn) | Annual Growth (%) | Key Factors |

| 2025 | 161.0 | +5.1 | Improved consumer and business confidence, stabilising input costs, gradual recovery in corporate and leisure spending. |

| 2026 | 170.8 | +6.1 | Strong tourism rebound, sustained technological investment, productivity improvements, enhanced digital service integration. |

Source: Audit Consulting Group forecast based on ONS, OBR, and UKHospitality data.

Analysis and Key Drivers

- Tourism and Hospitality: Continued post-pandemic recovery, international marketing initiatives, and expansion in event-driven travel (conferences, cultural events) will underpin revenue growth.

- Technology and Efficiency: Increased digitalisation (AI-driven customer engagement, dynamic pricing, operational automation) will support cost management and improve service delivery.

- Sustainability Initiatives: Growing consumer preference for sustainable and local products will shape investment priorities and pricing strategies across the sector.

- Cost Dynamics: Energy and logistics costs are expected to stabilise, though wage pressures may persist due to competition for skilled labour.

- Risks: Potential downside risks include geopolitical instability, slower-than-expected global recovery, or renewed supply disruptions.

Outlook Summary

Overall, the 2025–2026 outlook suggests a steady but cautious recovery trajectory for the UK economy and related service sectors. With inflation contained, incomes recovering, and tourism resurgent, the environment will become increasingly favourable for revenue growth, investment, and innovation across industries—especially those leveraging technology and sustainable business practices.

- SWOT Analysis

Strengths

- Strong social and cultural role

- The sector remains a cornerstone of British social life, providing spaces for community engagement, leisure, and cultural exchange.

- Pubs, restaurants, and cafés serve not only as economic entities but also as social institutions that enhance local identity and tourism appeal.

- This strong emotional and cultural connection fosters customer loyalty and repeat visitation, even during periods of economic uncertainty.

- Flexibility and innovation

- Operators have demonstrated remarkable adaptability through digital transformation (online ordering, delivery platforms, loyalty apps) and innovative service models (ghost kitchens, experiential dining, hybrid pub-restaurant formats).

- The ability to pivot quickly in response to market trends — such as health-conscious menus or local sourcing — ensures competitive resilience and market relevance.

- Resilient domestic demand

- Despite cost-of-living challenges, domestic consumers continue to prioritise social experiences and convenience-driven services.

- The UK’s large and diverse consumer base provides a stable revenue foundation, particularly through local tourism, weekend dining, and leisure activities.

- Government support measures and regional tourism campaigns further sustain domestic spending in hospitality and foodservice sectors.

Weaknesses

- High cost base (labour, energy, supply chain)

- Persistent wage inflation, high energy prices, and supply chain inefficiencies contribute to a compressed profit margin environment.

- Energy-intensive operations and fluctuating wholesale food costs make cost control difficult, especially for small and mid-sized businesses.

- Dependence on consumer spending

- The sector is highly sensitive to disposable income trends; any reduction in real wages or consumer confidence directly impacts revenues.

- Economic downturns, rising mortgage rates, or increased living costs can quickly reduce discretionary spending on leisure and dining.

- Staffing shortages

- Ongoing labour market constraints — driven by post-Brexit migration shifts and a shrinking hospitality talent pool — limit capacity and service quality.

- High turnover rates, limited training pathways, and competition from other industries create operational instability and recruitment challenges.

Opportunities

- Hybrid formats (pub-restaurant and multifunctional concepts)

- The blurring of boundaries between traditional hospitality models (e.g., pubs offering restaurant-quality dining or co-working spaces) presents opportunities for broader market reach and diversified revenue streams.

- These hybrid concepts align with evolving customer expectations for flexibility, experience, and convenience.

- Regional expansion and franchising

- Growth potential exists beyond metropolitan hubs, especially in secondary cities and tourist regions where property and labour costs are lower.

- Franchising and partnership models offer scalable growth with lower capital risk, leveraging strong local brand recognition.

- Sustainability and green investment

- Consumers increasingly value ethical and environmentally responsible brands.

- Investment in energy efficiency, waste reduction, and sustainable sourcing can enhance brand equity, attract ESG-conscious investors, and reduce long-term operational costs.

- Government incentives for green infrastructure (e.g., low-carbon technologies, sustainable packaging) further strengthen this opportunity.

Threats

- Rising rent and taxation

- Increases in commercial property rents, business rates, and sector-specific taxes (alcohol duty, VAT) put additional pressure on profitability.

- Urban centres face especially acute challenges due to property market inflation and regulatory changes.

- Weak household budgets

- Persistent economic uncertainty, elevated living costs, and cautious consumer behaviour may limit discretionary spending, delaying recovery in non-essential segments such as dining out and entertainment.

- Regulatory and wage pressures

- Tightening employment regulations, higher minimum wage thresholds, and evolving health & safety or sustainability standards raise compliance costs.

- Businesses must allocate additional resources for legal adaptation, training, and system upgrades to maintain compliance and operational continuity.

Summary Insight

The overall strategic position of the sector in 2025–2026 can be described as “cautiously optimistic”:

- Strengths and opportunities — innovation, resilience, and sustainability — provide a solid foundation for growth.

- Weaknesses and threats, however, highlight the need for cost control, digital transformation, and strategic workforce development to secure long-term competitiveness.

Firms that prioritise efficiency, technology adoption, and environmental responsibility are likely to outperform peers in the next two years.

- Recommendations for Audit Consulting Group Clients

- Focus on Margins and Operational Efficiency

To maintain profitability in a high-cost environment, clients should prioritise margin optimisation through comprehensive cost management strategies:

- Supply Chain Optimisation: Consolidate supplier networks, negotiate long-term contracts, and adopt local sourcing to reduce transport and currency risks. Implement supplier performance dashboards for continuous monitoring.

- Energy-Saving Systems: Invest in smart metering, LED lighting, and automated heating/cooling controls. Such initiatives typically yield 5–10% cost reductions within the first year.

- Digital POS and Analytics: Deploy data-driven point-of-sale (POS) analytics to track sales trends, reduce waste, and improve menu or product profitability. Integration of AI-based forecasting tools can further refine inventory management and staffing efficiency.

Overall, focusing on margin protection ensures resilience against inflationary pressures and supports reinvestment into growth and innovation.

- Accelerate Digital Transformation

Digitalisation remains a critical differentiator in the 2025–2026 competitive landscape. Audit Consulting Group recommends a phased digital strategy aimed at customer retention, efficiency, and revenue growth:

- CRM Integration: Adopt unified Customer Relationship Management systems to centralise guest data, personalise offers, and strengthen loyalty.

- Predictive Sales Analytics: Use AI and machine learning to anticipate demand fluctuations, optimise pricing, and improve scheduling efficiency.

- Online Ordering and Delivery Platforms: Integrate with major third-party delivery systems or develop proprietary apps to capture off-premise sales.

- Omnichannel Experience: Create seamless customer journeys across digital and physical touchpoints — from booking and ordering to post-visit feedback.

A robust digital ecosystem not only enhances customer satisfaction but also enables data-driven decision-making for strategic agility.

- Diversify Business Formats

Evolving consumer behaviour demands flexible, experience-oriented models that can attract diverse audiences:

- Hybrid Pub-Restaurant Concepts: Combine casual dining with social and entertainment functions to maximise utilisation across different dayparts.

- Event and Community Venues: Reposition spaces to host private functions, live music, and corporate events, expanding revenue streams beyond standard service hours.

- Seasonal and Pop-Up Outlets: Utilise temporary or mobile formats to test new markets, promote brand visibility, and optimise capacity during peak tourism seasons.

Format diversification not only mitigates risk but also enhances adaptability to demand cycles and changing customer preferences.

- Regional Expansion Strategy

Given high operating costs in London and the South East, regional growth represents a cost-effective pathway to expansion:

- Target Regions: The Midlands and Northern England — including cities like Manchester, Leeds, Birmingham, and Sheffield — offer lower rental costs, skilled workforce availability, and growing urban populations.

- Market Potential: Rising domestic tourism and urban regeneration projects in these areas are increasing demand for hospitality, leisure, and dining services.

- Franchise and Partnership Models: Collaborating with local operators can facilitate faster market entry with reduced capital exposure.

A regional presence strengthens brand recognition and spreads risk across diverse economic zones.

- Invest in Sustainability and ESG Alignment

Sustainability is transitioning from a reputational benefit to a core business imperative. Clients are encouraged to embed environmental and social governance (ESG) principles into their operations:

- Green Design and Infrastructure: Implement energy-efficient architecture, water-saving systems, and low-emission equipment in both new builds and refurbishments.

- Waste Reduction Initiatives: Introduce circular economy practices — such as food waste recycling, composting, and sustainable packaging.

- Energy Efficiency and Renewables: Explore solar installations, renewable electricity sourcing, and carbon offset programs.

- Transparency and Reporting: Adopt sustainability reporting aligned with ESG frameworks to attract investors and meet stakeholder expectations.

Investments in sustainability enhance long-term resilience, brand reputation, and compliance with evolving UK and EU regulations.

- Monitor Regulation and Policy Shifts

The UK regulatory environment is expected to evolve considerably over the next two years. Proactive compliance and scenario planning are crucial:

- National Minimum Wage (NMW): Anticipate further increases in 2025–2026, impacting labour-intensive operations. Clients should model wage cost scenarios and explore automation in routine functions.

- Business Rates and Rent Reviews: Prepare for potential regional rate adjustments and ensure leases include flexibility clauses to mitigate future cost escalations.

- Health, Safety, and Sustainability Regulations: Strengthen compliance frameworks and staff training to minimise legal and reputational risks.

- Taxation and Reporting: Stay informed on corporate tax incentives related to R&D, energy efficiency, and green transition projects.

A forward-looking compliance strategy helps safeguard profitability and reputation amid an increasingly complex policy environment.

Summary Insight

In summary, Audit Consulting Group advises clients to balance operational discipline with strategic innovation.

- Margin control, digital acceleration, and sustainability will be key pillars of competitiveness.

- Regional diversification and hybrid formats offer growth potential in a changing consumer landscape.

- Active regulatory monitoring ensures long-term stability and compliance.

Firms that integrate these priorities early will be best positioned to capture post-2025 recovery momentum and build sustainable, data-driven growth models.

- Key Metrics Overview

| Indicator | Value (2024) | Source |

| Total sector turnover | £153 billion | UKHospitality |

| ONS Service Index (Division 56 – Food & Beverage Services) | 25,369 | ONS |

| Employment | 3.6 million | ONS |

| Registered businesses | 140,000 | ONS |

| Annual closures | 4,078 | BBPA |

Interpretation and Contextual Analysis

1. Total Sector Turnover – £153 billion (UKHospitality)

The UK hospitality and food service sector generated an estimated £153 billion in turnover in 2024, marking a notable recovery trajectory from pandemic-era contractions.

- This figure reflects strong domestic demand, supported by the resumption of travel, events, and corporate activity.

- However, turnover remains slightly below pre-2020 real-term levels due to inflationary effects and margin compression.

- Growth is concentrated in quick-service restaurants, pubs, and experience-led formats, while fine dining and nightlife segments continue to stabilise more slowly.

Outlook: Turnover is projected to exceed £161 billion by 2025 (+5.1% YoY) as cost pressures ease and consumer confidence strengthens.

- ONS Service Index (Division 56) – 25,369 (ONS)

The Service Index for Division 56 (Food and Beverage Service Activities) reached 25,369 points, indicating a positive year-on-year performance and sectoral expansion above the broader UK service sector average.

- This metric captures output volume across restaurants, cafés, catering, and bars — reflecting operational capacity and productivity.

- The 2024 index value represents a 3.7% annual increase, driven by higher transaction volumes and moderate price growth.

- The trend aligns with post-inflation normalisation, signalling steady real activity and sectoral resilience despite elevated input costs.

Interpretation: The index underlines the sector’s contribution to national services growth, accounting for roughly 4–5% of total UK service output.

- Employment – 3.6 million (ONS)

Hospitality remains one of the UK’s largest private-sector employers, with 3.6 million people directly employed in 2024.

- This represents around 10% of total UK employment, including both full-time and part-time roles.

- Labour shortages persisted throughout 2024, particularly in kitchen, front-of-house, and managerial positions — driven by demographic shifts and reduced EU workforce participation.

- Employers increasingly rely on training initiatives, automation, and flexible scheduling to manage workforce pressures.

Outlook: Employment is expected to rise modestly in 2025–2026, though productivity gains from digitalisation may partially offset headcount growth.

- Registered Businesses – 140,000 (ONS)

According to ONS data, there were approximately 140,000 registered businesses operating within the UK hospitality and food service sector in 2024.

- This represents a net increase of 1.2% year-on-year, indicating renewed entrepreneurial activity following the sector’s post-pandemic restructuring.

- Small and medium-sized enterprises (SMEs) account for over 85% of these establishments, reflecting the industry’s fragmented and locally driven

- Growth was most notable in regional markets, with strong openings in the Midlands and Northern England — areas with lower property and staffing costs.

Interpretation: The increase in business registrations signals renewed investor confidence and expanding market diversity.

- Annual Closures – 4,078 (BBPA)

The British Beer and Pub Association (BBPA) recorded 4,078 closures of hospitality venues during 2024.

- While still high, this marks a 23% reduction in closures compared to 2023, suggesting improved financial resilience.

- The majority of closures occurred in independent and rural outlets, where operating costs and limited demand create persistent challenges.

- Conversely, chains and franchised operators demonstrated stronger survival rates due to economies of scale, brand loyalty, and access to capital.

Outlook: Business failures are expected to continue declining gradually as inflation stabilises, but cost-of-living constraints and rent pressures may still affect vulnerable segments.

Summary of 2024 Sector Health

| Metric Category | Assessment | Trend |

| Revenue & Output | Strong recovery, moderate growth | ▲ Positive |

| Employment | Stable but constrained by shortages | ► Neutral |

| Business Dynamics | Gradual market consolidation | ▲ Mildly positive |

| Operational Costs | High but stabilising | ▼ Easing pressure |

| Investor Sentiment | Improving, cautiously optimistic | ▲ Positive |

Key Insight

The 2024 data establish a solid baseline for 2025–2026 forecasts, showing that the UK hospitality sector has recovered its structural stability but continues to navigate a high-cost, labour-constrained environment.

- Growth potential lies in regional diversification, digital transformation, and sustainability-driven innovation.

- The underlying metrics point toward a resilient, adaptive sector that remains a key contributor to the UK economy and employment.

- Risk Outlook

| Risk Factor | Potential Effect | Likelihood |

| High energy costs | ↓ Margins | High |

| Tax or rate increases | ↑ Operating costs | Medium |

| Weak consumer demand | ↓ Turnover | Medium |

| Labour shortages | ↓ Productivity | High |

Detailed Risk Analysis

1. High Energy Costs — High Likelihood / High Impact

- Description: Despite recent moderation in wholesale energy markets, prices are expected to remain above pre-2020 averages due to global supply volatility, carbon transition policies, and elevated network costs.

- Potential Impact: Sustained high utility bills can compress profit margins, particularly for energy-intensive operations such as restaurants, pubs, and hotels. Seasonal fluctuations may further strain cash flow.

- Strategic Implications: Operators may need to reprice menus, introduce energy surcharges, or accelerate investment in efficiency systems (e.g., smart meters, renewable sourcing, insulation upgrades).

- Mitigation Strategies:

- Conduct energy audits and implement efficiency retrofits.

- Explore collective purchasing agreements or hedging contracts to stabilise costs.

- Leverage government sustainability grants and incentives for green upgrades.

Overall Assessment: Energy costs remain one of the most material risks to sector profitability in 2025–2026.

- Tax or Rate Increases — Medium Likelihood / Moderate Impact

- Description: Fiscal pressures on the UK government could result in increases in corporate taxation, business rates, or alcohol duties, particularly targeting high-revenue urban operators.

- Potential Impact: Higher tax burdens and rate revaluations can significantly raise operating expenses, reduce reinvestment capacity, and erode competitiveness — especially for small and independent businesses.

- Strategic Implications: Businesses may face tighter cash flows and will need to optimise financial structures and review pricing models.

- Mitigation Strategies:

- Conduct tax efficiency reviews and explore regional expansion to areas with lower business rates.

- Engage in industry advocacy via associations (e.g., UKHospitality, BBPA) to shape fair regulatory outcomes.

- Build financial contingency reserves to absorb fiscal changes.

Overall Assessment: Fiscal risks are manageable but require proactive monitoring, as political and policy changes may emerge rapidly in 2025–2026.

- Weak Consumer Demand — Medium Likelihood / High Sensitivity

- Description: While overall GDP and incomes are improving, real disposable income growth remains fragile. High housing costs, interest rates, and cautious spending behaviour may limit discretionary expenditure.

- Potential Impact: Reduced consumer confidence can directly depress turnover, particularly in non-essential categories (casual dining, events, leisure).

- Strategic Implications: Businesses must prioritise value perception, dynamic pricing, and loyalty-driven marketing to sustain volumes.

- Mitigation Strategies:

- Diversify offerings (e.g., affordable menus, family packages, loyalty programs).

- Strengthen digital engagement and CRM-driven promotions.

- Enhance customer experience to increase repeat visits.

- Monitor consumer sentiment indicators to anticipate demand shifts.

Overall Assessment: The sector is highly exposed to consumer behaviour, requiring agile pricing and marketing strategies to offset cyclical downturns.

- Labour Shortages — High Likelihood / High Impact

- Description: Persistent labour market tightness, driven by demographic changes, post-Brexit migration patterns, and competition from other sectors, continues to challenge hospitality and services.

- Potential Impact: Staffing gaps reduce service quality, operational capacity, and productivity, increasing overtime costs and employee turnover.

- Strategic Implications: The issue could limit growth potential and delay expansion plans, especially for businesses relying on skilled hospitality staff.

- Mitigation Strategies:

- Implement employee retention programs (career progression, training, flexible scheduling).

- Invest in automation and digital tools (AI-driven scheduling, self-service systems) to ease labour dependency.

- Strengthen employer branding and partnerships with vocational institutions.

- Explore regional workforce mobility schemes to fill critical gaps.

Overall Assessment: Labour availability remains one of the most persistent structural risks. Strategic HR planning and technology adoption are essential to maintain operational stability.

Consolidated Risk Assessment Summary

| Risk Category | Impact Level | Time Horizon | Key Mitigation Priority |

| Cost-based risks (Energy, Taxation) | High | Short–Medium term | Efficiency investments, cost hedging |

| Demand-based risks (Consumer spending) | Medium–High | Medium term | Value-led pricing, digital marketing |

| Structural risks (Labour shortages) | High | Long term | Workforce development, automation |

Overall Sector Risk Outlook

The 2025–2026 risk environment for UK hospitality and service industries is moderate-to-high, reflecting ongoing structural cost pressures and a competitive labour market.

- Energy and wage inflation remain dominant short-term concerns.

- Consumer demand may fluctuate, requiring ongoing data-driven adaptation.

- Taxation and regulation present policy-dependent uncertainties, manageable through proactive compliance and advocacy.

Firms that invest in efficiency, workforce resilience, and technology will be best positioned to mitigate volatility and secure long-term profitability.

- Conclusions

The year 2024 represents a pivotal phase of stabilisation and structural recovery for the UK restaurant, pub, and wider hospitality industry.

After several years marked by volatility — from pandemic disruption to inflationary pressure — the sector has entered a period of measured, sustainable consolidation. Businesses are demonstrating strong resilience, adaptive capacity, and renewed strategic focus on efficiency and innovation.

Sector Resilience and Performance

- Despite persistent cost pressures related to energy, wages, and supply chains, the industry has maintained steady revenue expansion, supported by robust domestic demand and improving consumer confidence.

- Operators have successfully implemented pricing adjustments, digital transformation, and service innovation, enabling them to protect margins while enhancing customer value.

- The hospitality ecosystem—including suppliers, logistics partners, and digital platforms—has also matured, contributing to improved coordination and productivity across the value chain.

As a result, the sector is now operating on stronger, more sustainable foundations than in the immediate post-crisis period.

Growth Outlook and Projections

- Total revenues are projected to reach £170–175 billion by 2026, reflecting cumulative annual growth of approximately 5–6%.

- Expansion will be driven by:

- Continued rebound in tourism (both domestic and international).

- Adoption of data-driven technologies, such as predictive analytics, AI-assisted operations, and CRM integration.

- Investments in sustainability, reducing operational costs and improving brand competitiveness.

- Regional diversification, as operators expand into high-potential markets across the Midlands and Northern England.

This combination of structural and demand-side drivers supports a positive medium-term outlook, positioning the UK hospitality sector for consistent recovery and renewed investor confidence.

Strategic Priorities for the Next Phase

To sustain momentum and capture upcoming growth opportunities, businesses should focus on three key pillars:

- Technology and Digital Transformation

Accelerate digital integration across operations, from customer engagement and ordering to data analytics and automation.

Digital maturity will be a defining factor of competitiveness and profitability. - Workforce Development and Retention

Address persistent labour shortages through targeted training programs, upskilling, and flexible employment models.

Building a motivated, skilled workforce will be essential for service quality and innovation capacity. - Sustainability and Long-Term Efficiency

Embed ESG principles into business models—optimising energy consumption, reducing waste, and investing in green infrastructure.

This will not only lower operating costs but also align brands with evolving consumer and regulatory expectations.

Final Assessment

In conclusion, the UK restaurant and pub industry enters 2025 on a trajectory of cautious optimism.

The sector’s proven adaptability, combined with strategic investments in technology, people, and sustainability, will underpin a new cycle of growth and competitiveness.

While external risks—such as cost volatility and labour constraints—remain, the industry’s structural resilience and capacity for innovation position it well to deliver stable, long-term value creation through 2026 and beyond.

- Summary Tables

Table 1. Sector Performance 2021–2024

| Year | Estimated Turnover (£bn) | Growth (%) | Key Notes |

| 2021 | 118 | +62.3 | Rapid recovery following COVID-19 restrictions; strong rebound in domestic demand, but constrained by supply and staffing shortages. |

| 2022 | 139 | +47.5 | Continued rebound supported by reopening of international travel, strong summer tourism, and pent-up consumer spending. |

| 2023 | 147 | +7.8 | Phase of normalisation; inflation-driven pricing offset by slower real demand; cost pressures begin to stabilise. |

| 2024 | 153 | +4.5 | Stabilisation achieved; steady revenue growth with improving operational efficiency and moderate recovery in consumer confidence. |

Table 2. Revenue Forecast to 2026

| Year | Forecast (£bn) | Growth (%) | Key Drivers |

| 2025 | 161 | +5.1 | Strengthening consumer sentiment, rebound in inbound tourism, easing inflation, and improved cost predictability. |

| 2026 | 171 | +6.1 | Acceleration driven by technology adoption, enhanced productivity, efficiency gains, and continued sustainability investment. |

Performance Analysis: 2021–2024

The period 2021–2024 marks a four-year transformation for the UK restaurant and pub sector — from crisis recovery to stabilised growth.

- 2021–2022: Exceptional post-pandemic rebound, reflecting pent-up demand and government stimulus.

- 2023: Transition toward market normalisation, with growth increasingly dependent on efficiency rather than volume.

- 2024: A year of consolidation and structural resilience, where operators focused on cost control, digital upgrades, and workforce retention.

Overall, the sector regained operational stability and investor confidence, setting a firm base for mid-term expansion.

Forecast Interpretation: 2025–2026

The forecast period points to a positive medium-term outlook:

- Revenue expansion expected to average 5–6% per year, supported by recovering household spending and inbound tourism.

- Digitalisation and data-driven decision-making are anticipated to boost productivity and reduce operating costs.

- Sustainability measures—from energy efficiency to ethical sourcing—will strengthen brand value and ensure regulatory alignment.

- Regional and franchised growth models will continue to diversify market reach, particularly in Midlands and Northern England.

By 2026, total sector revenue is projected to approach £171 billion, with the industry entering a new cycle of sustainable, innovation-led growth.

Summary Insight

| Indicator | Trend (2021–2026) | Strategic Implication |

| Revenue Growth | Strong recovery → steady expansion | Shift from post-crisis rebound to sustainable, technology-supported growth. |

| Cost Environment | High → stabilising | Efficiency and energy management critical to margin protection. |

| Market Dynamics | Fragmented → consolidating | Regional operators and franchises gaining share. |

| Consumer Confidence | Volatile → improving | Growth in domestic and experiential spending. |

| Investment Focus | Survival → digital, sustainable transformation | Long-term value creation through innovation and ESG alignment. |

Overall Assessment

Between 2021 and 2026, the UK restaurant and pub industry will have evolved from a post-crisis rebound phase into a mature, strategically diversified, and technology-empowered sector.

The consistent growth trajectory, combined with operational discipline and sustainability initiatives, positions the industry for long-term profitability, resilience, and competitiveness within the broader UK services economy.

- Sources

- Office for National Statistics (2024). Index of Services: Division 56 – Food & Beverage Serving Activities.

- ONS (2024). Turnover by Division (ADHOC Data).

- UKHospitality Annual Report 2024.

- CGA & British Beer and Pub Association (BBPA) Reports 2024.

- Lumina Intelligence Market Report 2024.

- Institute of Hospitality (2024).

- Office for Budget Responsibility (OBR) Forecast 2025–2026.

- Bank of England Inflation Report 2024.

- VisitBritain Tourism Forecast 2025–2026.

Explore our range of Advisory Services to receive expert guidance and professional consulting solutions for your business needs.

Prepared by Audit Consulting Group, London, 2025