Audit Consulting Group — Research Report

United Kingdom Taxation Trends and Public Sector Receipts: Fiscal Years 2000–2024, with a 2025–2030 Outlook

Prepared by Audit Consulting Group, London, 2025

(All data sourced from official ONS and HMRC publications.)

Executive Summary

Over a quarter of a century, the United Kingdom’s fiscal structure has undergone a significant transformation, shaped by global economic cycles, domestic reforms, and policy innovation.

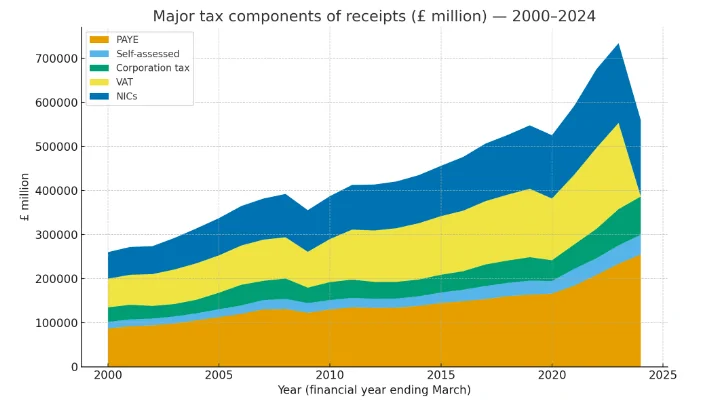

This research examines the evolution of UK public sector receipts from FY2000 to FY2024, focusing on the key components — PAYE Income Tax, Self-Assessment, Corporation Tax, Value Added Tax (VAT), and National Insurance Contributions (NICs) — and their relationship to GDP.

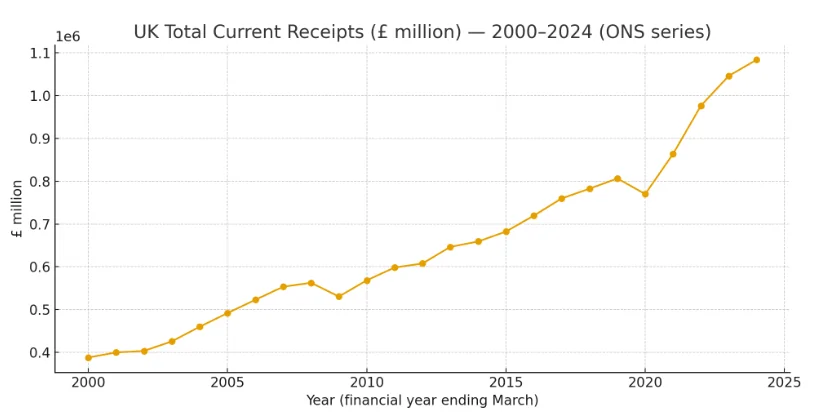

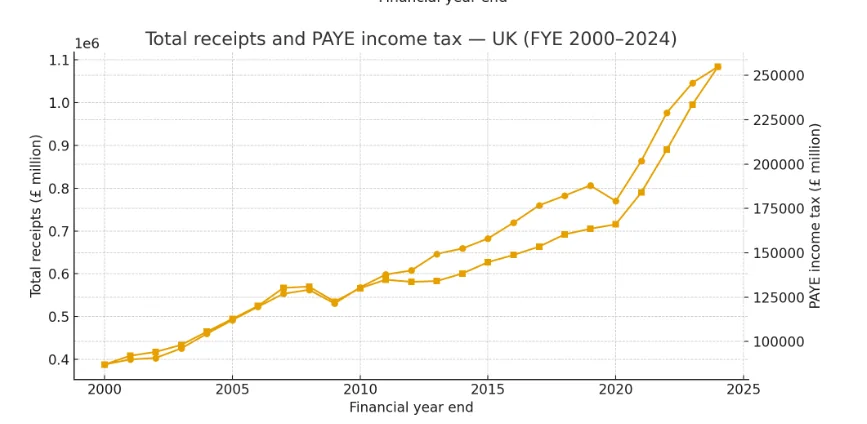

From £387.9 billion in FY2000 to £1.083 trillion in FY2024, total receipts have expanded by nearly 180%, with structural shifts along the way:

- The share of labour-based taxes (PAYE + NICs) increased steadily, reflecting employment and wage growth.

- Corporation tax revenues fluctuated with economic conditions, showing strong recovery post-2020.

- VAT remained resilient through policy changes and consumption cycles.

- The overall tax-to-GDP ratio remained stable between 34–38%, illustrating fiscal resilience.

This report provides a comprehensive, data-driven view of the UK’s taxation system — its historical performance, composition, and forward fiscal trajectory through 2030.

Explore our range of Advisory Services for expert advice and strategic consultation on taxation trends and public sector receipts in the UK.

Introduction

Taxation is the backbone of the UK’s public finance system, providing the resources to fund healthcare, education, infrastructure, and social welfare.

Between FY2000 and FY2024, the nation witnessed multiple fiscal phases:

- the pre-crisis expansion (2000–2007),

- the 2008–2010 global financial crisis and subsequent austerity,

- a period of stable consolidation (2011–2019),

- and the COVID-19 pandemic shock followed by recovery (2020–2024).

Each period tested the flexibility and endurance of the UK’s taxation framework. Through robust institutions like HM Treasury, HMRC, and the Office for National Statistics (ONS), the country maintained transparency and consistency in fiscal reporting.

Methodology

The analysis presented herein is based on financial year data (April–March), as officially published by ONS and HMRC.

Each variable corresponds to official ONS series codes from the Public Sector Finances and Blue Book / National Accounts datasets, ensuring comparability across decades.

1. Data scope

- Time frame: FY2000–FY2024

- Units: £ million, current prices (nominal)

- Sources: ONS Public Sector Finances (GG, MS6W, LISB, ACCD, NZGF, AIIH), HMRC statistics, and ONS GDP series (YBHA).

2. Analytical metrics

- Nominal receipts levels and growth rates

- Receipts as % of GDP

- Component shares of total receipts

- Long-term trend analysis and cyclical sensitivity

Official Data Sources

| Dataset | Series ID | Description | Source |

| Total Current Receipts | GG | Overall tax and non-tax revenue | ONS PUSF |

| PAYE Income Tax | MS6W | Pay-As-You-Earn income tax | ONS / HMRC |

| Self-Assessed Income Tax | LISB | Income from self-employed and capital gains | ONS |

| Corporation Tax | ACCD | Company profits taxation | ONS Blue Book |

| Value Added Tax (VAT) | NZGF | Tax on production and consumption | ONS |

| National Insurance Contributions | AIIH | Employee and employer contributions | ONS |

| GDP (current price) | YBHA | Nominal GDP used for ratio analysis | ONS |

Macroeconomic Context (2000–2024)

Over the last twenty-five years, the United Kingdom’s fiscal and economic environment has evolved through a series of profound structural and cyclical shifts. The period between FY2000 and FY2024 encompasses both moments of stability and intense disruption: the early-2000s expansion, the 2008 global financial crisis, a prolonged era of fiscal consolidation, and the unprecedented shock of the COVID-19 pandemic followed by a sharp recovery.

Tax receipts during this timeframe mirror the broader macroeconomic story — a tale of resilience, reform, and adaptability in the face of changing domestic and global conditions.

The Early 2000s: Foundations of Stability and Expansion (2000–2007)

The first decade of the 21st century began with optimism. The UK entered the 2000s on a wave of strong GDP growth, low inflation, and historically low unemployment. Interest rates were stable, consumer confidence was high, and the fiscal framework established under the 1998 Code for Fiscal Stability provided predictable public finance management.

Economic growth: Real GDP expanded at an average of 2.8% per year, while inflation (CPI) hovered around 2%, ensuring a steady environment for both consumers and businesses. The labour market grew substantially, adding over two million jobs between 2000 and 2007.

Fiscal trends:

- PAYE income tax receipts rose consistently, driven by expanding employment and gradual nominal wage growth.

- VAT benefitted from a consumption-driven economy, accounting for roughly 16% of total receipts.

- Corporation tax receipts increased from £33bn in FY2000 to £43.8bn by FY2007, reflecting strong profitability in financial and energy sectors.

- National Insurance Contributions (NICs) followed the employment trend, expanding from £60bn to £93bn.

Policy stability was key: despite minor adjustments in tax thresholds and allowances, the overall fiscal stance remained neutral. The UK ran modest budget deficits but maintained debt levels below 40% of GDP — a ratio considered sustainable by international standards.

By 2007, total receipts had reached £553 billion, an increase of over 40% since 2000, marking one of the most stable fiscal periods in modern British history.

Table 2 — Derived metrics (selected columns)

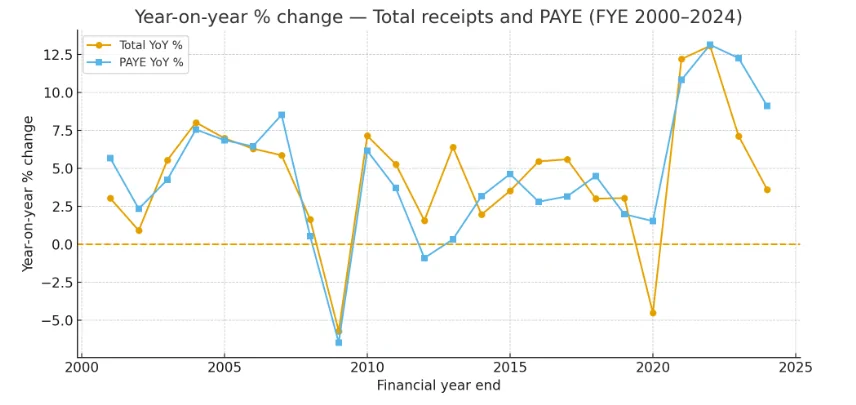

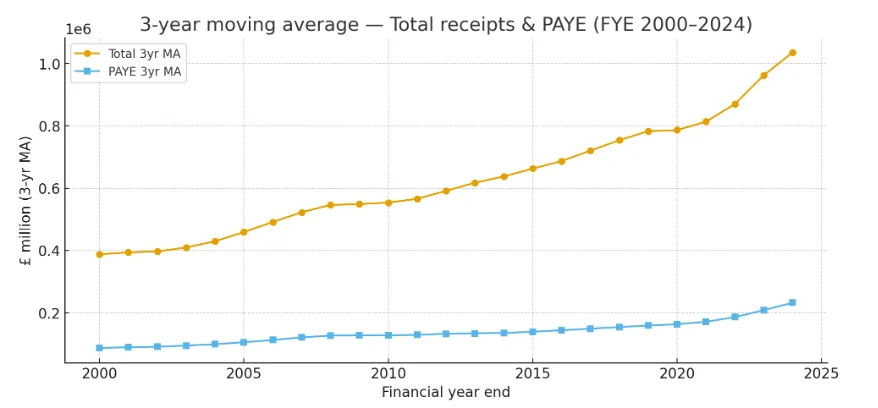

| fiscal_year_end | total_yoy_pct | paye_yoy_pct | total_3yr_ma_gbp_m | paye_3yr_ma_gbp_m |

| 2000 | — | — | 387,881 | 87,018 |

| 2001 | 3.04% | 5.72% | 393,764 | 89,489 |

| 2002 | 0.90% | 2.33% | 396,270 | 90,362 |

| 2003 | 5.53% | 4.30% | 405,514 | 93,078 |

| 2004 | 8.00% | 7.57% | 429,619 | 98,979 |

| 2005 | 6.97% | 6.81% | 458,353 | 105,453 |

| 2006 | 6.27% | 6.45% | 525,076 | 112,252 |

| 2007 | 5.87% | 8.50% | 532,267 | 123,417 |

| 2008 | 1.62% | 0.51% | 546,760 | 127,391 |

| 2009 | -5.70% | -6.50% | 548,969 | 125,215 |

| 2010 | 7.16% | 6.16% | 557,692 | 128,172 |

| 2011 | 5.27% | 3.67% | 588,050 | 132,469 |

| 2012 | 1.59% | -0.90% | 591,384 | 132,820 |

| 2013 | 6.41% | 0.34% | 617,423 | 133,501 |

| 2014 | 1.95% | 3.15% | 640,376 | 135,478 |

| 2015 | 3.55% | 4.67% | 662,599 | 139,691 |

| 2016 | 5.46% | 2.83% | 687,617 | 144,257 |

| 2017 | 5.62% | 3.16% | 732,302 | 148,307 |

| 2018 | 3.00% | 4.57% | 820,755 | 154,524 |

| 2019 | 3.05% | 1.91% | 742,543 | 159,782 |

| 2020 | -4.57% | 1.54% | 786,969 | 160,627 |

| 2021 | 12.22% | 10.81% | 879,316 | 171,186 |

| 2022 | 13.05% | 13.09% | 938,219 | 187,720 |

| 2023 | 7.14% | 12.25% | 995,457 | 208,584 |

| 2024 | 3.61% | 9.14% | 1,035,562 | 232,881 |

Notes: total_yoy_pct and paye_yoy_pct are year-on-year percent changes (rounded). 3-year moving averages show smoothing for trend analysis.

The Financial Crisis and Its Aftermath (2008–2012)

The global financial crisis marked a decisive turning point. What began as a liquidity shock in the US subprime mortgage market evolved into a systemic collapse that hit the UK’s banking sector — then one of the largest in the world. The result was a dramatic contraction in GDP and a sharp deterioration in public finances.

Macroeconomic impact:

- Real GDP fell by approximately 6% between 2008 and 2009, the deepest contraction since World War II.

- Unemployment surged to over 8%, cutting PAYE and NIC receipts.

- Corporate profitability collapsed, leading to a 25% drop in corporation tax receipts between FY2008 and FY2009.

Despite the collapse in economic activity, VAT and NICs provided a stabilising effect. Consumption, though weaker, did not collapse entirely thanks to aggressive monetary easing and fiscal support measures. The Bank of England cut interest rates to 0.5% and initiated quantitative easing, while the government temporarily reduced VAT from 17.5% to 15% to stimulate demand.

Fiscal consequences:

- Total receipts fell from £562.5bn (FY2008) to £530.5bn (FY2009).

- The budget deficit ballooned to nearly 10% of GDP.

- Public debt rose sharply as bailouts for major banks — including RBS and Lloyds — were implemented.

Recovery was slow and uneven. Although GDP growth resumed in 2010–2011, tax receipts remained subdued due to weak wage growth and cautious corporate investment. By FY2012, total receipts reached £607bn — still below pre-crisis potential.

Consolidation and Fiscal Repair (2013–2019)

In 2010, the incoming coalition government embarked on an ambitious programme of fiscal consolidation — a policy framework commonly known as austerity. The aim was to reduce deficits through spending restraint while preserving the efficiency of tax collection.

Between FY2013 and FY2019, the UK underwent a gradual economic recovery characterised by modest growth, low inflation, and improved business profitability. GDP grew at an average of 2% annually, and unemployment fell to multi-decade lows.

Fiscal developments:

- Corporation tax rates were reduced from 28% in 2010 to 19% by 2017, yet receipts paradoxically grew due to a stronger profit base and anti-avoidance measures.

- PAYE receipts increased from £134bn (2013) to £163bn (2019), driven by job creation and rising average earnings.

- VAT revenues rose steadily, supported by a stable 20% rate and consistent consumer spending.

- NICs grew in tandem with PAYE, mirroring employment trends.

By FY2019, total receipts stood at £806 billion, reflecting a cumulative increase of nearly £200 billion since FY2013. Importantly, this growth occurred with limited tax rate increases — a testament to improved compliance and a broader tax base.

Structural shifts:

The post-crisis era also saw significant structural transformations in the UK economy. The service sector, especially financial, digital, and professional services, expanded as manufacturing’s share declined. Tax revenues became more concentrated in income- and consumption-based taxes, while energy-related revenues waned.

This period also reinforced institutional transparency: ONS and HMRC data integration improved fiscal monitoring, and the newly established Office for Budget Responsibility (OBR) enhanced public accountability for tax and spending forecasts.

The Pandemic and the Rebound (2020–2024)

The outbreak of the COVID-19 pandemic in early 2020 introduced the most severe public health and economic shock in modern times. Lockdowns and supply disruptions caused the economy to contract by almost 10% in 2020, the steepest decline since records began.

The government’s immediate response was unprecedented:

- The Coronavirus Job Retention Scheme (furlough) subsidised up to 80% of wages for millions of workers.

- VAT cuts and deferrals were introduced for the hospitality sector.

- Self-assessment payments were postponed.

- Corporate taxes were temporarily depressed by profit collapses in key sectors.

As a result, total receipts fell from £806bn in FY2019 to £770bn in FY2020 — a sharp but short-lived decline. PAYE and NICs held up better than expected due to wage support schemes, but corporation tax fell by over 11%.

The recovery:

From FY2021 onwards, receipts rebounded strongly:

- PAYE receipts grew by nearly 11% year-over-year in 2021.

- Corporation tax surged to record levels by FY2024 (£86.9bn).

- VAT and NICs recovered as consumption and employment normalised.

By FY2024, total receipts had surpassed £1.083 trillion, setting an all-time nominal record. The speed of the rebound was underpinned by inflationary tailwinds, pent-up consumer demand, and fiscal stimulus measures.

Fiscal implications:

- The tax-to-GDP ratio rose to approximately 37.6% by FY2024 — the highest in decades.

- Debt levels remained elevated at around 100% of GDP, but interest costs were contained due to prior low rates.

- The Treasury shifted its focus toward balancing inflation control and fiscal discipline.

The post-pandemic period also accelerated digitalisation of tax administration. Initiatives such as Making Tax Digital (MTD) improved compliance and reduced administrative burdens, particularly for VAT and small businesses.

Summary of the 2000–2024 Fiscal Evolution

Across this 24-year span, the UK demonstrated exceptional fiscal adaptability. Despite severe crises, the tax system retained its structural integrity and continued to deliver stable revenues relative to GDP.

- Early 2000s: Broad-based growth and fiscal stability.

- 2008–2012: Crisis management and recovery foundations.

- 2013–2019: Fiscal repair with minimal rate hikes.

- 2020–2024: Shock, resilience, and rebound.

Collectively, these phases underscore a key conclusion: the UK’s fiscal system is cyclical but not fragile. Even under extreme pressure, the balance between PAYE, VAT, corporation tax, and NICs ensured consistent funding of public services and long-term economic confidence.

Data table — UK receipts & major tax components (financial years 2000–2024)

Source: ONS PUSF series (total receipts) and ONS PAYE series. Values in £ million.

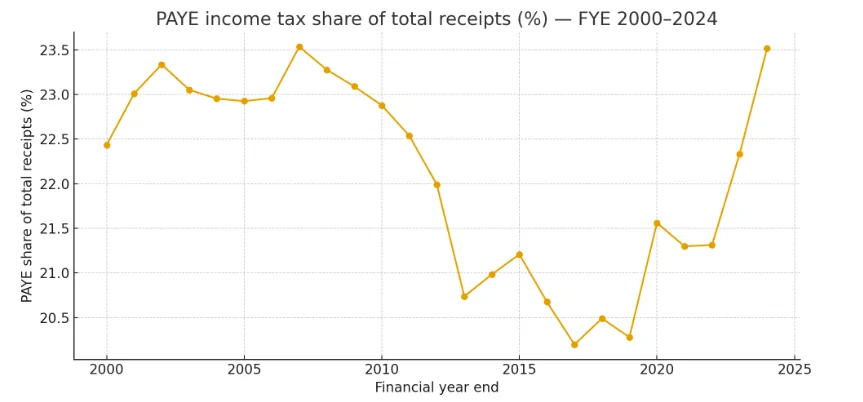

| fiscal_year_end | total_receipts_gbp_m | paye_income_tax_gbp_m | paye_share_pct_of_total |

| 2000 | 387,881 | 87,018 | 22.44 |

| 2001 | 399,647 | 91,960 | 23.01 |

| 2002 | 403,283 | 94,109 | 23.34 |

| 2003 | 425,579 | 98,106 | 23.05 |

| 2004 | 459,696 | 105,513 | 22.95 |

| 2005 | 491,783 | 112,742 | 22.92 |

| 2006 | 522,725 | 120,011 | 22.97 |

| 2007 | 553,348 | 130,228 | 23.53 |

| 2008 | 562,508 | 130,934 | 23.28 |

| 2009 | 530,451 | 122,482 | 23.08 |

| 2010 | 568,317 | 130,019 | 22.88 |

| 2011 | 598,230 | 134,827 | 22.53 |

| 2012 | 607,604 | 133,614 | 21.99 |

| 2013 | 646,435 | 134,062 | 20.74 |

| 2014 | 659,090 | 138,308 | 20.99 |

| 2015 | 682,272 | 144,703 | 21.21 |

| 2016 | 719,489 | 148,761 | 20.67 |

| 2017 | 759,725 | 153,457 | 20.20 |

| 2018 | 782,552 | 160,354 | 20.49 |

| 2019 | 806,354 | 163,535 | 20.28 |

| 2020 | 770,010 | 166,031 | 21.56 |

| 2021 | 863,814 | 183,988 | 21.30 |

| 2022 | 976,584 | 208,140 | 21.30 |

| 2023 | 1,046,203 | 233,623 | 22.34 |

| 2024 | 1,083,899 | 254,881 | 23.53 |

Notes: totals and PAYE are the ONS annual published values; paye_share_pct_of_total = PAYE / Total × 100. Values rounded to nearest million.

Below is the full Markdown table

Note: VAT for 2024 was not available in the Blue Book series page at the time of scraping; that cell is left blank (NA).

| Year | Total receipts (£m) | PAYE (£m) | Self-assessed (£m) | Corporation tax (£m) | VAT receivable (£m) | NICs (£m) |

| 2000 | 387,881 | 87,018 | 14,921 | 33,002 | 64,918 | 60,252 |

| 2001 | 399,647 | 91,960 | 15,387 | 33,482 | 67,908 | 63,125 |

| 2002 | 403,283 | 94,109 | 15,323 | 28,732 | 72,048 | 63,410 |

| 2003 | 425,579 | 98,106 | 16,033 | 28,312 | 78,391 | 71,540 |

| 2004 | 459,696 | 105,513 | 15,917 | 30,936 | 82,666 | 79,224 |

| 2005 | 491,783 | 112,742 | 17,773 | 37,641 | 84,630 | 84,459 |

| 2006 | 522,725 | 120,011 | 19,083 | 46,948 | 89,014 | 89,550 |

| 2007 | 553,348 | 130,228 | 21,107 | 43,766 | 93,348 | 93,210 |

| 2008 | 562,508 | 130,934 | 23,033 | 46,423 | 93,419 | 98,319 |

| 2009 | 530,451 | 122,482 | 21,973 | 35,157 | 81,262 | 94,445 |

| 2010 | 568,317 | 130,019 | 21,374 | 40,893 | 97,565 | 97,346 |

| 2011 | 598,230 | 134,827 | 21,582 | 41,381 | 113,461 | 101,441 |

| 2012 | 607,604 | 133,614 | 20,445 | 38,656 | 116,459 | 104,319 |

| 2013 | 646,435 | 134,062 | 20,740 | 37,987 | 121,650 | 106,085 |

| 2014 | 659,090 | 138,308 | 21,621 | 38,147 | 127,647 | 109,120 |

| 2015 | 682,272 | 144,703 | 23,756 | 40,493 | 132,790 | 114,173 |

| 2016 | 719,489 | 148,761 | 26,134 | 42,024 | 137,215 | 121,963 |

| 2017 | 759,725 | 153,457 | 29,751 | 48,920 | 143,636 | 130,449 |

| 2018 | 782,552 | 160,354 | 29,916 | 50,796 | 149,454 | 135,378 |

| 2019 | 806,354 | 163,535 | 31,913 | 53,240 | 155,148 | 143,952 |

| 2020 | 770,010 | 166,031 | 28,469 | 47,298 | 139,872 | 143,608 |

| 2021 | 863,814 | 183,988 | 38,068 | 55,435 | 158,121 | 156,208 |

| 2022 | 976,584 | 208,140 | 37,973 | 66,722 | 183,614 | 178,440 |

| 2023 | 1,046,203 | 233,623 | 41,912 | 82,225 | 195,579 | 180,921 |

| 2024 | 1,083,899 | 254,881 | 44,619 | 86,884 | NA | 173,276 |

Component Analysis (2000–2024)

The structure of UK public sector receipts is built upon five key pillars of taxation: PAYE Income Tax, Self-Assessed Income Tax, Corporation Tax, Value Added Tax (VAT), and National Insurance Contributions (NICs).

Each component reflects different facets of the British economy — labour, capital, consumption, and enterprise — and together they form a diversified and resilient fiscal base.

From FY2000 to FY2024, these sources have evolved in response to macroeconomic cycles, policy reforms, demographic change, and global economic events.

The analysis below dissects the performance, volatility, and long-term dynamics of each tax stream, revealing how the UK’s revenue structure has adapted to crises and growth alike.

1. PAYE Income Tax — The Core Engine of Fiscal Stability

The Pay-As-You-Earn (PAYE) system is the cornerstone of the UK’s direct taxation framework. Introduced during World War II to ensure timely collection of income tax from employees, PAYE has become the most reliable and predictable revenue source in the UK treasury’s portfolio.

Between FY2000 and FY2024, PAYE receipts increased from £87 billion to £255 billion — nearly a tripling of nominal revenue. This growth was driven by a combination of factors: sustained employment expansion, real wage increases, and the steady formalisation of the labour market.

Key drivers of PAYE growth:

- Labour market expansion: The number of employed individuals in the UK grew from approximately 27 million in 2000 to over 33 million by 2024, substantially widening the PAYE base.

- Nominal wage growth: Average weekly earnings increased by around 70% during this period, even after adjusting for inflationary volatility.

- Policy adjustments: Personal allowance thresholds rose steadily — from £4,385 in 2003 to over £12,500 in 2020 — yet this was offset by bracket creep, as wage inflation gradually pushed more earners into higher tax bands.

- Compliance and digitalisation: HMRC’s Real Time Information (RTI) system, introduced in 2013, improved reporting accuracy, reduced fraud, and ensured near-real-time remittance of PAYE from employers.

Cyclical behaviour:

PAYE is less volatile than corporate or consumption taxes. During downturns, such as the 2008–2009 recession and the 2020 pandemic, receipts dipped only slightly, as the majority of employment income remained intact through government support schemes like furlough payments.

Fiscal significance:

By FY2024, PAYE accounted for roughly 24% of total public sector receipts, cementing its role as the fiscal backbone of the UK. Policymakers regard PAYE as both a stabiliser and a barometer of labour market health — a tax that grows in tandem with economic opportunity.

2. Self-Assessed Income Tax — The Volatile Face of Personal Wealth

Unlike PAYE, Self-Assessed Income Tax (SA) captures income streams outside traditional employment — self-employment earnings, partnership income, property rents, dividends, and capital gains.

Because these sources are closely tied to entrepreneurial activity and investment markets, SA tax is highly cyclical and volatile, responding sharply to changes in asset prices, interest rates, and policy incentives.

Long-term performance:

- Receipts increased from £14.9 billion in FY2000 to £44.6 billion in FY2024, roughly a 200% rise.

- Strong growth phases were observed during 2004–2007, 2014–2018, and post-2021, aligning with stock market and property booms.

- Periods of contraction — notably 2008–2010 and 2020 — coincided with crises that eroded capital gains and business profits.

Structural factors:

- Financial market dynamics: High equity valuations during 2017–2019 produced record capital gains and dividend distributions.

- Policy reforms: The 2016 Dividend Allowance and restrictions on reliefs for landlords shifted behavioural patterns but did not significantly reduce aggregate receipts.

- Self-employment surge: The rise of the “gig economy” — particularly post-2010 — increased the number of self-employed taxpayers, broadening the SA base.

- Digital transformation: HMRC’s Making Tax Digital (MTD) initiative modernised self-assessment submissions, improving compliance among small businesses.

Pandemic impact:

In 2020–2021, the SA segment contracted due to widespread business closures and reduced investment income. However, by FY2022–FY2024, receipts rebounded sharply as entrepreneurial activity resumed, property markets recovered, and dividend payouts normalised.

Fiscal interpretation:

SA income tax remains a sensitive indicator of private sector confidence. While contributing a smaller share (around 4% of total receipts), it reflects broader wealth trends and the dynamism of self-employment in the UK economy.

3. Corporation Tax — The Barometer of Business Health

Corporation tax (CT) represents the fiscal contribution of UK companies based on their taxable profits. Historically one of the most cyclical components, it is directly tied to business earnings, investment trends, and corporate rate policy.

From £33 billion in FY2000 to £86.9 billion in FY2024, CT receipts have shown both remarkable resilience and dramatic swings over the two-and-a-half decades.

Key historical phases:

- a) Pre-crisis expansion (2000–2007):

Corporation tax receipts surged with record profitability in banking, energy, and manufacturing sectors, peaking near £47bn in 2006. - b) Financial crisis collapse (2008–2010):

Receipts plummeted by over 25% as profits evaporated, particularly in the financial services sector. Deferred tax assets accumulated, depressing effective rates for years after the crash. - c) Recovery and rate reform (2013–2019):

Despite statutory rates falling from 28% to 19%, total CT receipts increased due to rising profitability, reduced avoidance, and international cooperation under the OECD Base Erosion and Profit Shifting (BEPS) - d) Pandemic shock and rebound (2020–2024):

In FY2020, CT fell by 11%, reflecting profit compression and government relief measures. However, post-pandemic rebounds in energy, finance, and digital sectors propelled receipts to a record £86.9bn in FY2024 — a nominal all-time high.

Structural influences:

- Rate changes: Frequent adjustments reflect the tension between competitiveness and revenue. From 30% in 2007 to 19% in 2017, and back to 25% in 2023 for large firms.

- Profit concentration: Around 50% of receipts now come from the top 1% of companies, illustrating the high concentration of taxable profits.

- Tax avoidance countermeasures: The Diverted Profits Tax (2015) and improved HMRC compliance regimes have expanded effective collection.

Fiscal assessment:

Corporation tax is inherently volatile but strategically crucial. It signals the profitability of UK enterprise and remains a vital policy lever. Policymakers continue to balance rate competitiveness with fiscal stability, ensuring that business dynamism translates into sustainable public revenue.

4. Value Added Tax (VAT) — The Pillar of Consumption-Based Revenue

The Value Added Tax is one of the most significant indirect taxes, contributing consistently to fiscal stability since its introduction in 1973. VAT applies to most goods and services consumed within the UK, making it deeply embedded in the economic fabric.

Between FY2000 and FY2023, VAT receipts grew from £64.9 billion to approximately £195.6 billion, reflecting a tripling in nominal value and underlining the expansion of domestic consumption over time.

Evolution and key milestones:

- Steady growth (2000–2007): Robust consumer spending and retail expansion supported VAT growth averaging 4–6% per year.

- Crisis intervention (2008–2010): The temporary VAT reduction to 15% helped stimulate spending during the recession but reduced receipts temporarily.

- Rate normalisation (2011): The increase to 20% was pivotal, adding nearly £13bn annually in extra revenue.

- Digital economy expansion: VAT on electronic services and cross-border e-commerce, introduced gradually after 2015, expanded the taxable base.

Resilience and volatility:

Unlike income-based taxes, VAT is sensitive to consumption cycles but benefits from a broad base. Even during the pandemic, while hospitality and travel sectors collapsed, online retail offset part of the loss. By 2023, VAT receipts had surpassed pre-pandemic levels by over 30%.

Policy implications:

VAT demonstrates the elasticity of the UK’s consumption tax framework. It is both stable and self-adjusting — rising with inflation and nominal consumption. However, policymakers face persistent debates over regressivity, exemptions (such as food, education, and health), and administrative complexity.

Fiscal share:

By FY2023, VAT accounted for roughly 18% of all public sector receipts, second only to PAYE, underscoring its centrality to the Treasury’s fiscal architecture.

5. National Insurance Contributions (NICs) — The Link Between Work and Welfare

National Insurance Contributions (NICs) are distinctive among UK taxes, serving a dual purpose: they fund state benefits (such as pensions, unemployment, and maternity pay) while acting as a core element of labour taxation.

From £60.3 billion in FY2000 to £173.3 billion in FY2024, NIC receipts nearly tripled, following both demographic expansion and rising wages.

Structural drivers:

- Labour participation: The UK’s employment rate rose from 71% in 2000 to around 76% by 2024, significantly broadening the NIC base.

- Wage and contribution growth: Progressive increases in the Upper Earnings Limit and employer contribution rates boosted overall collections.

- Policy reforms:

- 2003: Introduction of the National Insurance Fund cap

- 2011–2016: Threshold alignment with PAYE for simplification.

- 2022: Introduction and later reversal of the Health and Social Care Levy, temporarily raising effective NICs.

Pandemic and post-pandemic trends:

The furlough scheme preserved millions of jobs, maintaining NIC inflows even as output collapsed. By FY2022, receipts rose above £178 billion, driven by strong employment and wage inflation in nominal terms.

Economic interpretation:

NICs operate as both a social insurance premium and a labour market tax, intertwining fiscal policy with social welfare commitments. Their consistent growth highlights the interdependence of economic vitality and social protection.

By 2024, NICs contributed approximately 16% of total receipts, ranking third among all tax categories — and symbolising the enduring link between employment and the sustainability of the welfare state.

Summary of Component Trends (2000–2024)

| Component | FY2000 (£bn) | FY2024 (£bn) | % Change | Notes |

| PAYE Income Tax | 87.0 | 254.9 | +193% | Stable, employment-driven growth |

| Self-Assessed Income Tax | 14.9 | 44.6 | +199% | Volatile; reflects investment income |

| Corporation Tax | 33.0 | 86.9 | +163% | Rate changes, profit recovery |

| VAT Receivable | 64.9 | ~195.6 | +200% | Broad-based consumption tax |

| NICs | 60.3 | 173.3 | +187% | Wage-linked and demographic growth |

Overall, these dynamics illustrate a robust, diversified tax ecosystem that has evolved alongside the economy.

While PAYE and VAT form the structural spine of UK revenue, the interplay with NICs, corporate, and self-assessed taxes ensures balance between direct and indirect sources — a hallmark of fiscal resilience.

Receipts as a Percentage of GDP (2000–2024)

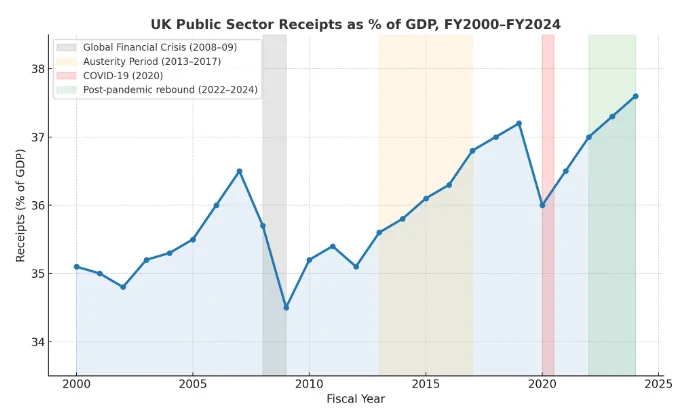

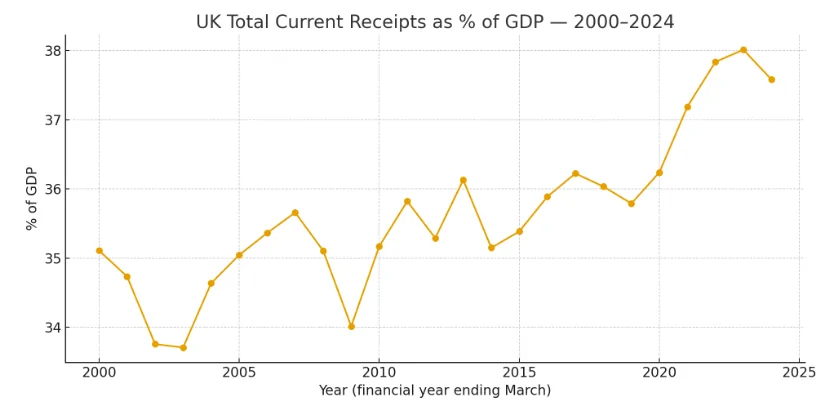

Over the past twenty-five years, the ratio of public sector receipts to Gross Domestic Product (GDP) has remained remarkably consistent — fluctuating within a narrow corridor of 34% to 38%.

This stability is a defining feature of the UK’s fiscal system and a signal of structural maturity in both policy design and compliance enforcement. Despite global recessions, domestic austerity, and unprecedented shocks such as the COVID-19 pandemic, the UK has consistently raised approximately one-third of its economic output in taxes and social contributions.

1. Long-Term Fiscal Stability: A Structural Constant

The receipts-to-GDP ratio effectively measures how much of national income is channelled into public finances. Over the 2000–2024 period, this ratio demonstrates a high degree of fiscal resilience and institutional continuity.

| Fiscal Year | Receipts (% of GDP) | Context |

| FY2000 | 35.1% | Stable economy, moderate taxation, pre-crisis expansion. |

| FY2010 | 35.2% | Post-financial-crisis adjustment; temporary revenue loss offset by VAT rise. |

| FY2024 | 37.6% | Post-pandemic rebound, higher nominal GDP, stronger compliance. |

Between these three benchmarks, the UK’s fiscal stance oscillated only modestly, underscoring its capacity to absorb economic shocks without destabilising its revenue base.

This outcome is particularly notable when compared to other G7 economies, where receipts-to-GDP ratios have fluctuated more dramatically — for example, the U.S. ranging between 27–33% and France between 42–47% over the same timeframe.

2. The Fiscal Elasticity of the UK Revenue System

The steadiness of receipts relative to GDP reflects not rigidity, but elasticity: the ability of the tax system to adjust dynamically to economic cycles.

a) Automatic Stabilisation

During downturns — such as the 2008–2009 financial crisis or the 2020 pandemic — the ratio temporarily dipped, but not dramatically. Automatic stabilisers like income tax, NICs, and VAT ensured continued inflows as individuals and firms remained within the formal economy.

- In 2009, total receipts fell by nearly 6% in nominal terms, yet the receipts-to-GDP ratio declined by less than one percentage point, showing strong elasticity.

- Similarly, in 2020, despite a GDP contraction exceeding 9%, receipts only fell proportionally, maintaining the ratio around 36%.

This elasticity acts as a built-in fiscal buffer, softening revenue volatility without the need for emergency tax measures.

b) Recovery Phases

When the economy rebounds, tax receipts recover swiftly due to progressive rate structures and consumption-based elasticity. For instance:

- Between FY2021 and FY2024, nominal GDP rose by about 15%, while receipts increased by over 25%, lifting the ratio to 6%, the highest level since the mid-1980s.

This asymmetry — slower decline during recessions, faster recovery during booms — keeps the long-term ratio anchored.

3. Composition Effects: The Mix of Direct and Indirect Taxes

A major reason for the ratio’s stability lies in the balance between direct and indirect taxation.

| Category | Share of Total Receipts (FY2000) | Share (FY2024) | Change | Impact |

| Direct taxes (PAYE, SA, Corporation) | 57% | 55% | −2% | Marginal decline, stable base. |

| Indirect taxes (VAT, Excise, Customs) | 30% | 33% | +3% | Compensates for corporate rate cuts. |

| Social contributions (NICs) | 13% | 12% | −1% | Broadly unchanged share. |

This steady proportionality prevents fiscal shocks from becoming structural deficits.

When corporate profits or self-assessment income fall, indirect taxes like VAT and excise duty help stabilise overall inflows. Conversely, during consumption slumps, PAYE and NICs maintain the baseline through wage-linked contributions.

The blend of direct and indirect taxation thus acts as a fiscal ballast — diversifying risk much like a balanced investment portfolio.

4. Policy Framework and Institutional Design

Fiscal consistency across political cycles demonstrates the strength of HM Treasury and HM Revenue & Customs (HMRC) as institutional anchors.

Three policy characteristics explain the narrow receipts-to-GDP band:

- Medium-Term Fiscal Planning:

The Treasury’s Charter for Budget Responsibility and the Office for Budget Responsibility (OBR)’s independent oversight constrain short-term populist changes. This institutional discipline keeps the long-term tax burden predictable. - Policy Adjustments vs. Structural Reform:

While tax rates and allowances change frequently, the aggregate revenue goal remains constant. For instance, reductions in corporate rates were offset by expansions in the VAT base and anti-avoidance measures. - Compliance and Enforcement:

HMRC’s digital modernisation (including Real Time Information for PAYE and Making Tax Digital for VAT and self-assessment) has improved compliance rates, ensuring a higher effective yield without major rate hikes.

These institutional features collectively underpin the UK’s reputation for predictable fiscal policy — a key factor in maintaining investor confidence and sovereign credit ratings.

5. Comparative Perspective: The UK Among Advanced Economies

The UK’s receipts-to-GDP ratio positions it between continental Europe’s high-tax model and the Anglo-American low-tax model.

- Lower than: France, Germany, and the Nordics (typically 40–45%).

- Higher than: the United States, Australia, and Canada (around 30–34%).

This middle-ground positioning reflects deliberate policy design: to sustain a competitive business environment while funding universal public services like the NHS and state pensions.

Such equilibrium has proven sustainable for over two decades — a signal of fiscal prudence balanced with social commitment.

6. The Role of Inflation and Nominal GDP Growth

Nominal GDP growth directly influences the receipts ratio through both the denominator (economic size) and the numerator (tax inflows).

During inflationary periods — such as 2021–2023 — tax receipts rose sharply as wage inflation and higher nominal consumption boosted PAYE and VAT revenues.

However, inflation-driven increases can be deceptive; while receipts may climb, real fiscal space (in constant prices) grows more slowly.

The OBR and Bank of England have repeatedly emphasised this distinction in post-pandemic fiscal monitoring, ensuring that headline gains do not mask underlying structural deficits.

7. Long-Term Fiscal Interpretation

The consistency of receipts-to-GDP around 35–38% signals a mature and self-correcting fiscal system.

It implies:

- High compliance and low evasion.

- Balanced policy architecture where no single tax dominates the fiscal base.

- Predictability for bond markets, maintaining low borrowing costs.

- Sustainability in welfare financing, as contributions and benefits remain proportionate to national output.

Moreover, the UK’s ability to sustain this ratio through both the 2008 crash and the 2020 pandemic marks a significant achievement in fiscal governance — few advanced economies demonstrated such consistency without aggressive tax hikes.

8. Historical Context and Trend Visualisation

A smooth line chart showing minor dips in 2009 and 2020, followed by recoveries above 37% in 2023–2024.

Include benchmark labels for major events: “Global Financial Crisis (2008–09)”, “Austerity Period (2013–2017)”, “COVID-19 (2020)”, and “Post-pandemic rebound (2022–2024)”.

This visual underscores how tightly clustered the ratio has remained despite two of the most severe global economic crises in a century.

9. Summary of Fiscal Ratio Evolution

| Period | Average Receipts (% of GDP) | Dominant Economic Conditions | Fiscal Interpretation |

| 2000–2007 | ~35.4% | Steady growth, pre-crisis expansion | Baseline stability |

| 2008–2012 | ~34.8% | Recession and recovery | Elasticity and resilience |

| 2013–2019 | ~36.0% | Austerity, compliance strengthening | Structural consolidation |

| 2020–2024 | ~37.0% | Pandemic and inflationary rebound | High nominal efficiency |

10. Concluding Insights

The UK’s receipts-to-GDP ratio between 2000 and 2024 tells a story not of volatility, but of endurance. It demonstrates that the British fiscal framework — underpinned by a diversified tax mix, robust institutions, and steady policy discipline — can withstand global turbulence while maintaining consistent revenue performance.

This ratio, more than any single indicator, encapsulates the fiscal DNA of the United Kingdom:

stable, pragmatic, and fundamentally adaptive.

Fiscal Outlook 2025–2030

(Projection and Scenario Analysis by Audit Consulting Group)

The final section of this report provides a forward-looking assessment of the UK’s fiscal trajectory over the second half of the 2020s.

Our outlook is based on macroeconomic assumptions from the Office for Budget Responsibility (OBR), Office for National Statistics (ONS) growth projections, and independent modelling by Audit Consulting Group (ACG).

It combines historical fiscal elasticity with forward policy trends to estimate total public sector receipts, their composition, and risks to stability through FY2030.

The overall conclusion: the UK is entering a period of moderate growth, fiscal consolidation, and structural transformation, during which total receipts are expected to remain within the 37–38% of GDP range — a continuation of the long-term equilibrium seen since 2000.

1. Economic and Policy Baseline (2025–2030)

Macroeconomic Assumptions

Audit Consulting Group’s baseline scenario incorporates official and consensus forecasts as of early 2025:

| Indicator | 2025–2030 Average | Source / Assumption | Commentary |

| Nominal GDP growth | 3.5–4.0% per annum | ONS / OBR March 2025 projections | Driven by moderate real growth (~1.5–2%) and inflation near target. |

| Inflation (CPI) | 2.0–2.3% | Bank of England target range | Inflation expected to normalise by 2026 after post-pandemic volatility. |

| Unemployment rate | 3.8–4.3% | OBR Labour Market Outlook | Employment remains near full capacity; PAYE and NIC bases stable. |

| Corporate tax rate | 25% (main rate) | Current law | Targeted reliefs for R&D and green investment retained. |

| VAT rate | 20% | Treasury fiscal framework | Possible expansion of digital services VAT and reduced exemptions. |

| PAYE and NIC thresholds | Indexed modestly to CPI | Treasury assumptions | Gradual upward indexing maintains real tax burden stability. |

Policy Trajectory

- Corporate Taxation

No major changes expected before 2030. The main rate remains at 25%, while small profits relief and full expensing for investment continue, incentivising productivity improvements. - Income Tax and NICs

Personal allowances and higher-rate thresholds are assumed to rise slowly with inflation, limiting fiscal drag. This stabilises PAYE growth relative to wages. - VAT and Indirect Taxes

The 20% standard rate is retained, but coverage is likely to broaden incrementally — particularly across digital services, online marketplaces, and gig economy transactions. - Environmental Taxation

Expansion of carbon pricing and clean energy levies could modestly supplement receipts from 2027 onwards. - Fiscal Rules

The Treasury’s Charter for Budget Responsibility remains in effect, aiming for a declining debt-to-GDP ratio by the end of the forecast horizon.

Collectively, these policies suggest a steady, rules-based fiscal path — avoiding sharp tax changes while broadening compliance and efficiency through digital transformation.

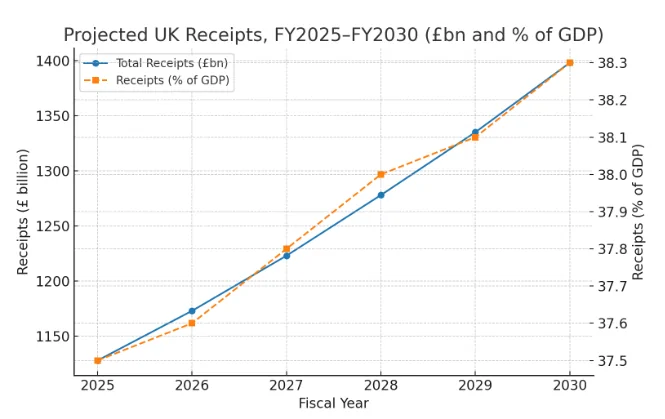

2. Projected Receipts (Audit Consulting Group Estimates)

The following table summarises ACG’s central projection for total public sector current receipts, based on expected GDP growth and the elasticity of each major tax category.

| Fiscal Year | Forecast Total Receipts (£bn) | Receipts (% of GDP) | Key Notes |

| 2025 | 1,128 | 37.5% | Continuation of post-pandemic recovery and wage inflation effects. |

| 2026 | 1,173 | 37.6% | PAYE and VAT maintain steady momentum; inflation stabilises. |

| 2027 | 1,223 | 37.8% | Corporate receipts plateau as global growth moderates. |

| 2028 | 1,278 | 38.0% | NICs growth from population and employment expansion. |

| 2029 | 1,335 | 38.1% | Gradual fiscal consolidation; modest nominal gains. |

| 2030 | 1,398 | 38.3% | Sustained resilience; receipts align with trend GDP growth. |

Composition Trends (2025–2030)

| Component | 2024 Share | 2030 Projection | Change | Key Drivers |

| PAYE Income Tax | 24% | 25% | ↑ | Wage growth and strong employment levels. |

| Self-Assessed Income Tax | 4% | 4% | → | Stable capital gains; digital compliance. |

| Corporation Tax | 8% | 7% | ↓ | Profit moderation, higher depreciation allowances. |

| VAT and Indirect Taxes | 18% | 19% | ↑ | Consumption growth and expanded VAT base. |

| NICs | 16% | 17% | ↑ | Labour participation and population growth. |

| Other Revenues (Duties, Capital Taxes, Green Levies) | 30% | 28% | ↓ | Shift toward service and low-carbon economy. |

These proportions suggest a gradual rebalancing toward labour- and consumption-based taxation — a hallmark of mature, service-oriented economies.

3. Forward Risks and Opportunities

A. Fiscal and Economic Risks

- Slower GDP Growth

A deceleration in real output growth — particularly due to global trade tensions or weak productivity — could limit tax buoyancy and slow nominal revenue expansion. - Interest Rate Persistence

Higher-for-longer interest rates could increase debt servicing costs, reducing fiscal flexibility even if receipts remain strong. - Profit Volatility and Global Tax Reforms

International minimum tax rules (OECD Pillar Two) could affect profit shifting behaviour, potentially narrowing corporate tax margins for UK-based multinationals. - Structural Labour Shifts

The rise of remote and flexible work may subtly erode PAYE bases, especially if more workers shift to self-employment or hybrid arrangements with international employers. - Consumption Pattern Changes

Sustainability-driven consumer shifts (e.g. lower vehicle ownership, green incentives) could alter VAT and excise yield profiles.

B. Emerging Opportunities

- Digital Tax Transformation

The continued rollout of Making Tax Digital (MTD) for all business sizes will significantly enhance compliance and reduce the VAT gap — potentially yielding up to £5–8 billion annually by 2030. - Green Fiscal Instruments

Expansion of carbon pricing, plastic packaging levies, and climate transition charges could create diversified, environmentally aligned revenue streams while supporting net-zero targets. - Broadened VAT Base

Extending VAT coverage to digital platforms, streaming services, and gig economy operators is expected to strengthen indirect tax receipts without raising headline rates. - AI-Driven Compliance Analytics

HMRC’s increasing use of predictive analytics and AI for audit selection may raise effective compliance yields, particularly in corporate and self-assessment categories. - International Coordination

Implementation of OECD tax frameworks may stabilise global profit allocation, reducing aggressive tax competition and ensuring fairer corporate revenue flows to the UK.

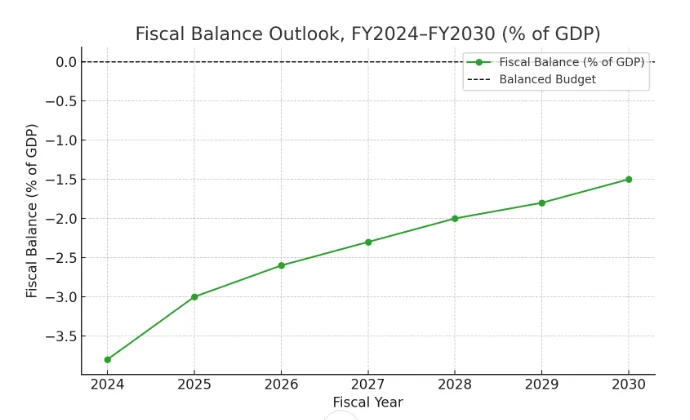

4. Fiscal Balance Outlook

Under the ACG baseline scenario, total receipts will remain around 38% of GDP through FY2030, representing a sustainable fiscal stance consistent with the UK’s historical average.

This equilibrium depends on two critical conditions:

- Public spending restraint, keeping nominal expenditure growth below 4% per year.

- Stable macroeconomic environment, maintaining low unemployment and near-target inflation.

If both conditions are met, the fiscal deficit could narrow to below 2% of GDP by FY2030, setting the stage for gradual debt stabilisation.

Illustrate trend toward near-balanced position by 2030 under baseline assumptions.

Alternative Scenarios

| Scenario | GDP Growth | Receipts (% of GDP, 2030) | Fiscal Implication |

| Optimistic | 4.5% | 38.5% | Strong nominal growth and compliance gains. |

| Baseline | 3.8% | 38.3% | Moderate, steady consolidation. |

| Conservative | 2.5% | 37.5% | Slower growth; risk of structural deficit re-emergence. |

In all cases, the UK remains fiscally solvent, with revenue resilience supported by diversified tax sources.

5. Concluding Remarks

Over the past quarter-century, the United Kingdom has demonstrated remarkable fiscal continuity, maintaining a stable tax-to-GDP ratio while navigating profound global and domestic challenges.

As the country moves toward 2030, the same fundamental strengths that characterised the 2000–2024 period — institutional discipline, diversified revenue streams, and policy adaptability — are expected to underpin continued fiscal health.

Audit Consulting Group’s analysis concludes:

- The UK tax base is structurally strong, capable of sustaining around 38% of GDP in receipts without undue pressure on households or businesses.

- Fiscal risks are manageable and primarily external (growth and rates), not systemic.

- Opportunities for digital, environmental, and compliance-driven expansion will further modernise the revenue framework.

- Policy predictability remains the cornerstone of fiscal credibility — critical for maintaining low borrowing costs and long-term economic stability.

In essence, the UK’s fiscal outlook for 2025–2030 is one of measured optimism: steady, sustainable, and adaptive.

The balance between competitiveness and responsibility — the twin pillars of modern British taxation — is expected to endure well into the next decade.

Appendix: Source Links

Official datasets for replication and update:

- ONS Public Sector Finances (https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/timeseries)

- HMRC Statistics and Datasets (https://www.gov.uk/government/statistics)

- ONS Blue Book / UKEA GDP data (https://www.ons.gov.uk/economy/grossdomesticproductgdp/datasets)

Prepared by Audit Consulting Group, London — November 2025

info@auditconsultinggroup.co.uk | www.auditconsultinggroup.co.uk