Form CT600 – Corporation Tax Return and HMRC Explained

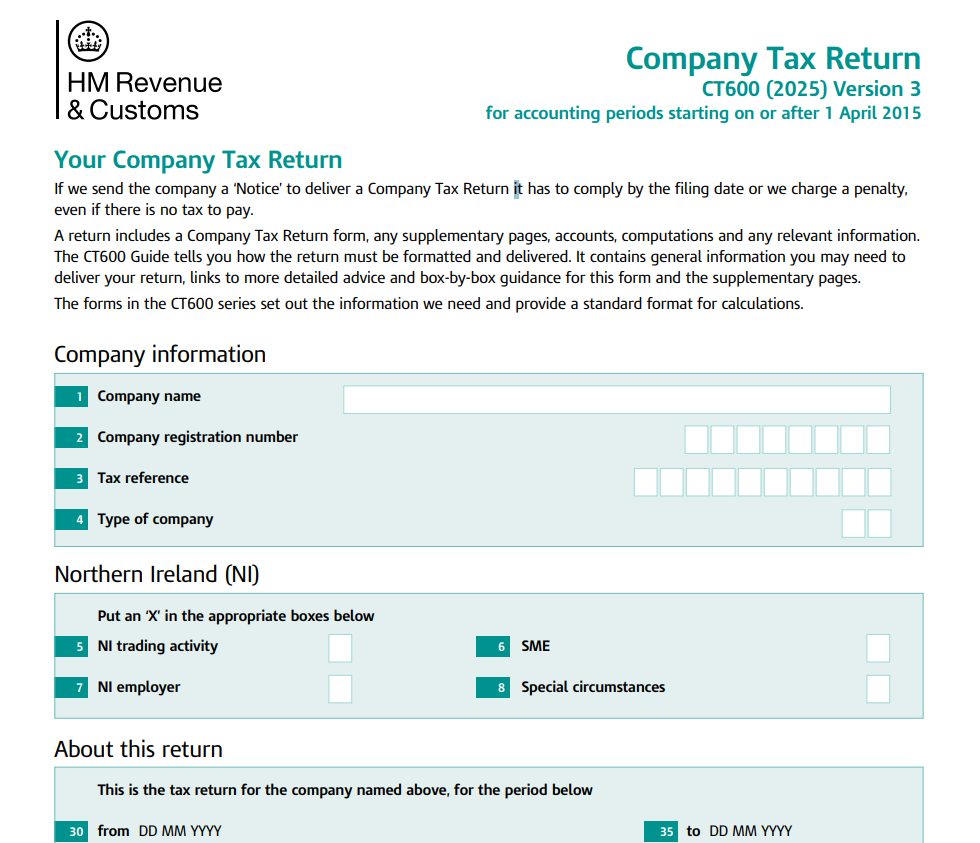

The CT600 form is the official HMRC Corporation Tax Return form used by limited companies in the UK to declare their profits, claim reliefs, and calculate Corporation Tax liability. Every trading company registered with Companies House must complete and submit the CT600 each financial year, even if it made no profit.

ACG offers CT600 Form services for Corporation Tax Filing, providing assistance and support for Tax Planning.

What is the CT600 Form?

The form CT600 is the main document companies use to report:

- Annual trading profits and losses.

- Income from investments, property, or other sources.

- Tax reliefs and allowances (e.g., R&D tax relief, capital allowances).

- Corporation Tax due.

It is also linked to supplementary schedules such as the CT600A (loans to participators), CT600C (group and consortium reliefs), or CT600B (charitable donations).

Who Must Submit a CT600?

- All UK-registered limited companies, even dormant ones in some cases.

- Non-UK companies with a UK branch or permanent establishment.

- Community Interest Companies (CICs) and charities that trade.

If your company is registered with Companies House, you will most likely need to file the CT600 form annually.

Deadlines for CT600 Submission

- Corporation Tax returns must be filed within 12 months of the end of the company’s accounting period.

- Corporation Tax payments must be made 9 months and 1 day after the end of the accounting period.

❌ Missing deadlines results in penalties, starting from £100 for late submission.

👉 Official guidance from HMRC Deadlines explained – Download PDF 2025

How to Submit the CT600 Form

There are two ways to file:

- CT600 Online Form (recommended)

- File directly via HMRC online services.

- Required for most companies since paper filing is restricted.

- Access

- CT600 Software Filing

- Many companies use HMRC-approved third-party accounting software.

Key Steps:

- Prepare annual company accounts.

- Complete computations of taxable profit.

- Fill out the CT600 form online.

- Attach accounts and computations in iXBRL format.

- Submit via HMRC’s online portal.

Common Mistakes When Filing the CT600

- Filing late, resulting in penalties.

- Forgetting to submit iXBRL tagged accounts and computations.

- Incorrectly claiming reliefs (especially R&D, capital allowances).

- Confusing dormant status with non-trading — HMRC may still expect a return.

- Submitting the wrong supplementary schedule (e.g., missing CT600C for group reliefs).

Example Cases

Case 1: Dormant Company

ABC Ltd thought they didn’t need to submit a CT600 since they had no activity. HMRC still required a “nil return”. Audit Consulting Group submitted on their behalf and avoided penalties.

Case 2: R&D Relief Claim

A tech startup filed their CT600 online form but missed the R&D relief section. ACG amended their CT600, securing a £15,000 tax refund.

Case 3: Late Filing

XYZ Consulting submitted their CT600 two months late, incurring penalties. With ACG’s help, they appealed successfully, proving HMRC had given incorrect notice.

FAQ – CT600 Form

Q1: Can I file the CT600 on paper?

Only in very limited cases. Most companies must submit CT600 online.

Q2: What happens if I don’t submit a CT600?

HMRC issues penalties, and interest accrues on unpaid tax.

Q3: What is CT600C?

It is a supplementary schedule for group and consortium reliefs.

Q4: Do I need to submit CT600 if my company made no profit?

Yes – even companies with no activity may be required to file.

Q5: Can Audit Consulting Group help with my CT600?

Yes – we prepare company accounts, complete your CT600 form, and submit on time to HMRC.

Why Choose Audit Consulting Group for CT600?

At Audit Consulting Group, we:

- Ensure your CT600 is correctly completed and submitted.

- Handle CT600C, CT600A, and other supplementary forms.

- Minimise your Corporation Tax liability through reliefs and allowances.

- Protect your company from HMRC penalties.

- Provide long-term tax planning to support business growth.

Don’t risk costly mistakes – let our experts handle your CT600 HMRC form from start to finish.

CT600 Corporation Tax Return Form Services Cost & Pricing UK

Prepare and submit the CT600 Corporation Tax Return in the UK with professional and affordable support. We help limited companies complete CT600 forms accurately, calculate corporation tax, and submit returns to HMRC on time. Our fixed-price CT600 services help businesses stay compliant and avoid late filing penalties.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants