HMRC Appeal Form Guidance – How to Challenge a Penalty or Decision

If you have received a fine, penalty, or decision from HM Revenue & Customs (HMRC) that you believe is incorrect, you have the right to challenge it using the HMRC appeal form. Whether it’s a late filing penalty, an incorrect tax bill, or a dispute about expenses, the HMRC fine appeal form gives you the opportunity to explain your case and request a reconsideration.

Need help with your HMRC appeal submission? Explore our HMRC Appeal Form Guidance for challenging penalties or decisions efficiently and professionally.

What is an HMRC Appeal Form?

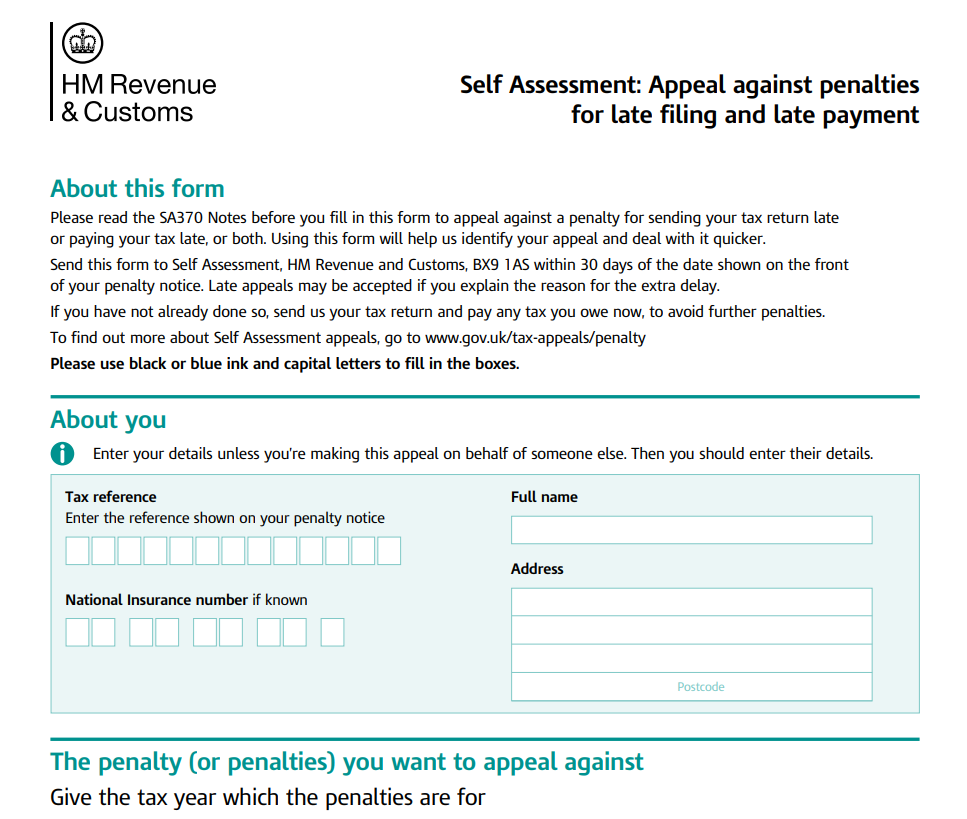

The HMRC appeal form (also known as form SA370 for Self Assessment) allows taxpayers to formally appeal against HMRC penalties and tax decisions. It is commonly used to:

- Appeal against late filing or late payment fines.

- Dispute incorrect tax calculations.

- Challenge decisions about allowable expenses.

- Correct errors where HMRC has misapplied information.

For many taxpayers, appealing can result in fines being reduced or cancelled altogether.

When Should You Use the HMRC Fine Appeal Form?

You can use the HMRC fine appeal form if:

- You filed your Self Assessment late but had a reasonable excuse.

- You paid your tax late due to circumstances outside your control.

- You believe HMRC has incorrectly calculated your tax.

- You have already contacted HMRC, but the issue remains unresolved.

If you do not appeal, penalties will remain in place, and interest will continue to grow.

How to Complete the HMRC Appeal Form

- Download or access the correct form

- Provide your personal details – including UTR and National Insurance number.

- State which penalty or decision you are appealing.

- Give your reasons for appeal – e.g. illness, HMRC error, financial difficulty.

- Attach evidence – medical records, redundancy letters, proof of communication delays, etc.

- Sign and submit – online or by post.

Example – Sample Letter to HMRC for Penalty Appeal

If you don’t use the official form, you can write a letter. A sample letter to HMRC for penalty appeal should include:

- Your name, UTR, and address.

- The penalty reference number.

- A clear statement of why you are appealing.

- Supporting evidence.

- Your signature and date.

HMRC accepts both formal letters and official appeal forms, though using the HMRC appeal form is recommended for faster processing.

Common Reasons HMRC Accepts Appeals

✔ Serious illness or hospitalisation.

✔ Bereavement of a close family member.

✔ HMRC online system failures.

✔ Postal delays outside your control.

✔ Professional adviser error (if you acted reasonably).

What Happens if You Appeal Incorrectly?

❌ If you submit the wrong form, HMRC will reject your appeal.

❌ If you don’t include evidence, your claim may be refused.

❌ If you miss the deadline (30 days from penalty notice), HMRC may not consider your appeal.

❌ Submitting incomplete information leads to long delays.

Recommendations for Success

✅ Always file your appeal within the 30-day deadline.

✅ Provide as much supporting evidence as possible.

✅ Be clear and concise – explain exactly what happened.

✅ Keep copies of everything you send.

✅ Seek professional help if you are unsure how to prepare your appeal.

Example Cases – HMRC Appeal in Action

- Case 1 – Illness

David was hospitalised during the Self Assessment deadline. Using the HMRC appeal form, he submitted medical evidence and had his £100 penalty cancelled. - Case 2 – HMRC System Failure

Emma tried to file online, but the system was down on 31 January. She included screenshots of error messages with her HMRC fine appeal form, and her penalty was waived. - Case 3 – Bereavement

Mark lost his father just before the deadline. He filed a sample letter to HMRC for penalty appeal explaining his circumstances. HMRC accepted his appeal.

FAQ – HMRC Appeal Form

Q1: How long do I have to appeal?

You usually have 30 days from the date on the penalty notice.

Q2: What if my appeal is rejected?

You can request an independent review, and in some cases, take your case to a tax tribunal.

Q3: Can I appeal online?

Yes, many appeals can now be made online through Government Gateway.

Q4: Do I need a tax adviser to appeal?

Not always, but professional help increases the chances of success.

Q5: How long does it take HMRC to respond?

It varies, but typically between 6–12 weeks.

Why Choose Audit Consulting Group?

At Audit Consulting Group, we help individuals and businesses prepare strong, evidence-backed appeals to HMRC. Our services include:

- Identifying the correct HMRC appeal form for your case.

- Drafting professional appeals or letters to HMRC.

- Gathering supporting evidence.

- Liaising with HMRC on your behalf.

- Maximising your chances of penalty cancellation.

Don’t let an unfair fine stand – contact Audit Consulting Group today and let us fight your case.

HMRC Appeal Form Submission Services Cost & Pricing UK

Appeal HMRC decisions with professional appeal form support in the UK. We help individuals and businesses prepare and submit HMRC appeal forms accurately. Our fixed-price appeal services aim to resolve disputes efficiently.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants