SA100 Form: Complete Your Self Assessment Return

Filing your annual tax return can feel overwhelming, especially if you’re new to the UK’s self-assessment system. The SA100 tax form is the main document you use to declare your income, claim allowances, and report any additional earnings.

At Audit Consulting Group, we specialise in helping individuals, freelancers, and business owners complete the SA100 form correctly, on time, and without stress.

What is the SA100 Form?

The SA100 form (often called the self assessment SA100) is HMRC’s main tax return document. Everyone who needs to file a self-assessment must complete it.

You’ll need the SA100 tax return form if:

- You’re self-employed and need to declare your earnings.

- You have rental income.

- You’ve received dividends or capital gains.

- You’re a company director or have foreign income.

- You need to claim tax relief or expenses not covered by PAYE.

This form is essential for calculating your Income Tax and National Insurance contributions.

Ensure compliance with Small Business Tax Returns by partnering with Audit Consulting Group for comprehensive tax solutions.

Official HMRC guidance: Self Assessment tax return

Download the SA100 form current for 2025

Download form SA100 from the HMRC website

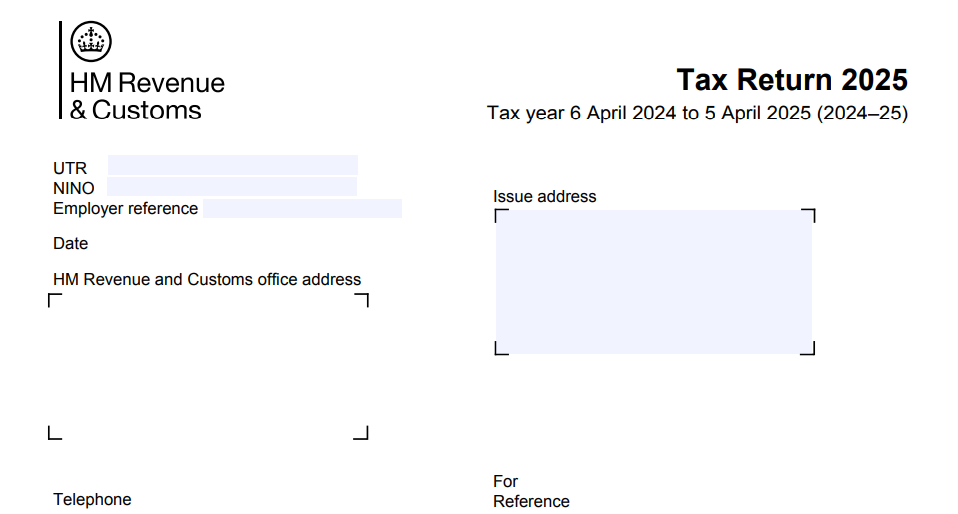

Example of the SA100 HMRC Tax Form

The HMRC SA100 form is a multi-page document that includes sections such as:

- Personal details – your name, UTR number, and National Insurance.

- Income – employment income, pensions, and benefits.

- Self-employment – profits from business or freelance work.

- Savings and investments – dividends, interest, and capital gains.

- Tax reliefs – pension contributions, charitable donations, and allowances.

- Other income – property rentals, foreign income, or partnership earnings.

When you file online, these sections are interactive and adapt to your situation. If you file a paper return, the SA100 PDF must be printed and posted before the deadline.

How to Correctly Fill in the SA100 HMRC Form

Here’s a step-by-step guide to ensure you complete your self assessment tax return form SA100 properly:

- Gather all your documents – P60s, P45s, bank statements, invoices, and receipts.

- Log in to HMRC Online Services or download the SA100 form.

- Fill in your personal information – double-check your UTR and NI numbers.

- Report your income – from employment, self-employment, property, and investments.

- Claim allowable expenses – office costs, travel, professional fees, etc.

- Declare tax reliefs – such as pension contributions or charitable donations.

- Check HMRC calculations – the system automatically estimates your tax.

- Submit the form – online submission is faster and gives instant confirmation.

Common Mistakes People Make with the SA100

- Missing the submission deadline (31 January for online returns, 31 October for paper).

- Forgetting to include small income streams (like interest or dividends).

- Entering incorrect figures from P60 or invoices.

- Not claiming allowable expenses, which can reduce your tax bill.

- Failing to register for self-assessment before filing the SA100.

Useful Links for the SA100 Tax Return

SA100 tax return form download

Claim expenses if you’re self-employed

FAQs – SA100 Tax Return

Q1: Who needs to complete an SA100 form?

Anyone required to file a self-assessment tax return – including self-employed workers, landlords, directors, and people with additional income.

Q2: Can I fill in the SA100 tax form online?

Yes, most people now complete the HMRC SA100 form online. It’s faster and reduces errors.

Q3: What happens if I miss the deadline?

HMRC charges a £100 fine for late filing, with further penalties if the delay continues.

Q4: Is the SA100 form the same every year?

Yes, the structure is broadly the same, though HMRC updates certain sections annually.

Q5: Do I need professional help to complete my SA100?

Not always, but tax advisors can save you money by ensuring all reliefs and expenses are correctly applied.

Why Choose Audit Consulting Group for Your SA100 Tax Return?

Completing the SA100 tax form on your own can be stressful and time-consuming, especially if you are unsure about expenses, allowances, or multiple sources of income. At Audit Consulting Group, we make it simple:

- We complete the self assessment SA100 form on your behalf.

- We ensure every section is filled in accurately to avoid penalties.

- We help you claim all eligible expenses and reliefs to reduce your tax bill.

- We keep track of deadlines so you never pay fines again.

Contact Audit Consulting Group today and let us handle your SA100 submission quickly, accurately, and stress-free.

SA100 Tax Form Preparation & Submission Cost in the UK

Get professional support with the SA100 Tax Form in the UK at transparent and affordable pricing. We help individuals complete and submit the main Self Assessment tax return accurately and on time. Our SA100 form services reduce errors, avoid penalties, and ensure full HMRC compliance.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants