SA103 Form: Self-Employment Self Assessment

If you are self-employed in the UK, you will likely need to fill in the SA103 form as part of your annual Self Assessment tax return. This document, issued by HMRC, is designed specifically to report self-employment income, expenses, and profit. Without it, your Self Assessment submission is incomplete.

At Audit Consulting Group, we help freelancers, sole traders, and contractors file the SA103 form accurately, claim the right expenses, and avoid costly HMRC penalties.

Opt for our Self-Employed Bookkeeping Service to maintain accurate financial records and stay audit-ready with ease.

What is the SA103 Form?

The SA103 form is a supplementary page to the main SA100 tax return form. While the SA100 covers general income and personal details, the HMRC SA103 deals specifically with self-employment.

There are two versions:

- SA103S (short form) – for straightforward self-employment with turnover below the VAT threshold.

- SA103F (full form) – for more complex businesses, or if your annual turnover is above the VAT registration limit.

You can download the SA103 forms directly from HMRC:

Download the SA103S short form 2025

Download the SA103F full form 2025

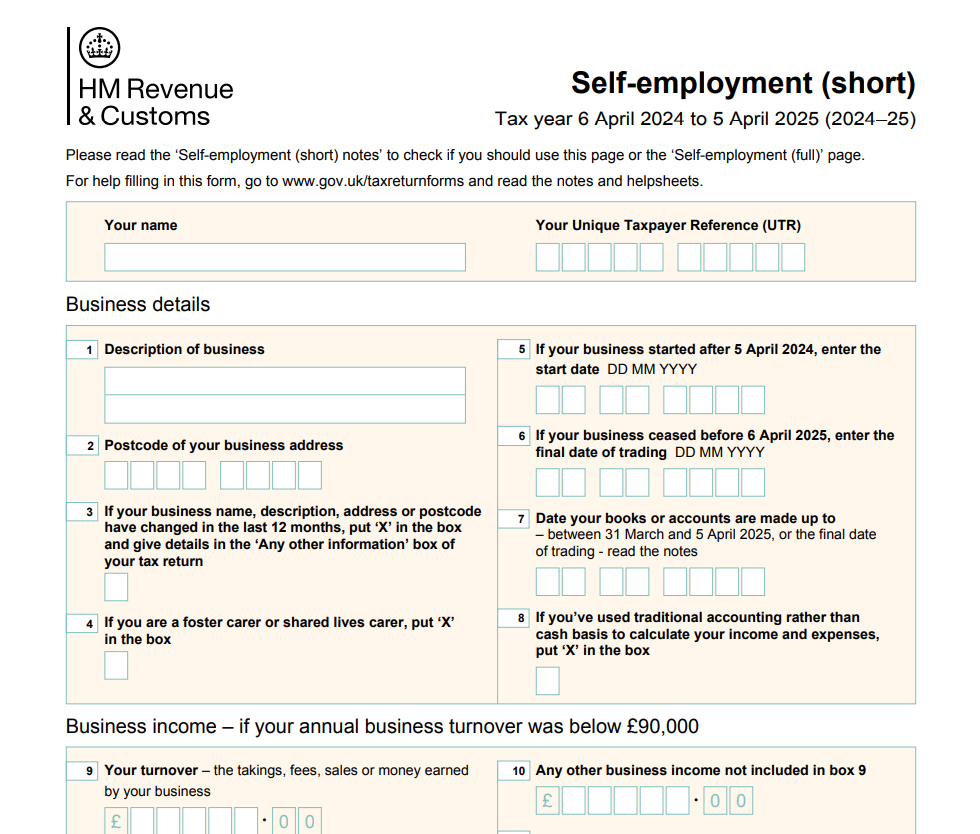

Example of the SA103 Form

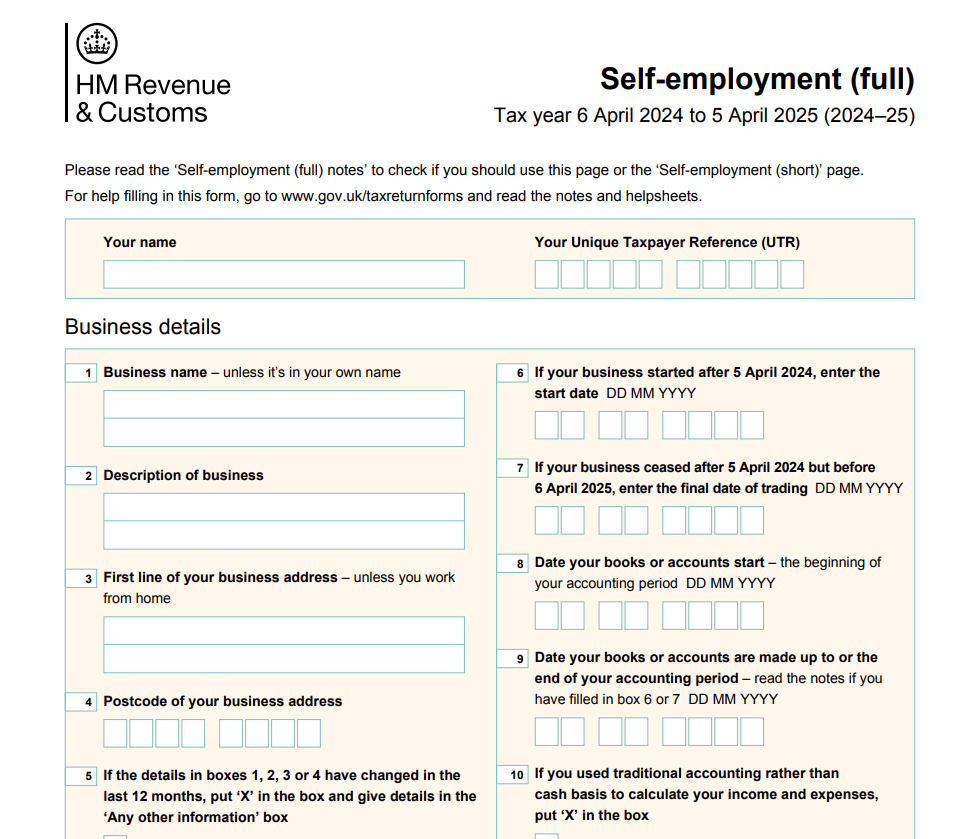

The SA103F form includes detailed sections such as:

- Personal and business details.

- Business income (sales, services, other income).

- Allowable expenses (office, travel, staff costs, professional fees).

- Adjustments (capital allowances, private use of assets).

- Net profit or loss calculation.

- Balancing charges and overlap reliefs.

For many freelancers and sole traders, the SA103S is enough. But if you have a larger or more complex business, HMRC will expect the SA103F form.

How to Fill in the SA103 Form Correctly

- Business details – enter your trading name, start date, and accounting period.

- Income – report total sales and any other income received.

- Expenses – claim only allowable business expenses (see HMRC’s guide: https://www.gov.uk/expenses-if-youre-self-employed).

- Adjustments – apply capital allowances for equipment, and adjustments for private use.

- Final profit/loss – this figure will feed into your SA100 to calculate tax due.

- Check before submission – small mistakes often lead to delays or unnecessary tax bills.

What Happens if You Fill in the SA103 Incorrectly?

Filing the HMRC SA103 form with errors can have serious consequences:

- Underpayment of tax – leading to fines and interest charges.

- Overpayment of tax – meaning you lose money unnecessarily.

- HMRC enquiries – your return may be flagged for investigation.

- Penalties – late or incorrect submissions attract automatic penalties.

This is why many self-employed professionals choose expert help to ensure their SA103F form is correct the first time.

Case Studies – How ACG Helped Clients

Case 1 – Sarah, a freelance designer

Sarah completed the SA103S herself but forgot to claim for software subscriptions and travel expenses. After working with Audit Consulting Group, she reclaimed over £1,200 in overpaid tax.

Case 2 – David, an IT contractor

David’s turnover exceeded the VAT threshold, but he mistakenly used the short SA103S instead of the full SA103F form. HMRC raised queries. Our team corrected his submission, filed the SA103F, and avoided penalties.

Case 3 – Priya, a small shop owner

Priya’s first self-assessment was stressful. With ACG’s help, her SA103F was submitted early, all expenses were claimed correctly, and she received a tax rebate instead of a bill.

FAQs – SA103 Tax Form

Q1: What’s the difference between SA103S and SA103F?

The SA103S is for small, straightforward businesses. The SA103F form is for more complex or higher turnover businesses.

Q2: Do I need to fill in the SA103 every year?

Yes, every self-employed person must complete either SA103S or SA103F annually with their SA100 tax return.

Q3: Can I file the SA103 online?

Yes. Online filing is recommended, as HMRC’s system guides you through the form and reduces errors.

Q4: What expenses can I claim?

You can claim office costs, travel expenses, professional fees, business insurance, marketing costs, and more – provided they are wholly and exclusively for business.

Q5: What happens if I miss the deadline?

If you file your SA103 late, you face a £100 automatic fine, with additional daily penalties if the delay continues.

Why Choose Audit Consulting Group?

Filling out the HMRC SA103 form can feel overwhelming, especially if you’re unsure which version you need. At Audit Consulting Group we:

- Help you decide whether you need SA103S or SA103F form.

- Ensure every expense and relief is claimed.

- File your tax return on time to avoid HMRC penalties.

- Represent you if HMRC raises queries about your return.

Don’t risk mistakes or penalties. Contact Audit Consulting Group today – we’ll make your SA103 form stress-free, accurate, and fully compliant.

SA103 Self-Employed Form Filing Services Cost UK

Prepare and submit the SA103 form in the UK with expert self-employed tax support. We assist sole traders with reporting business income and expenses correctly. Our affordable SA103 form services help ensure accurate Self Assessment submissions.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants