HMRC SA105 and SA105 Guidance

The HMRC SA105 form, also known as the SA105 HMRC supplementary page, is a key part of the UK self assessment tax return for anyone with property income. If you rent out property in the UK, whether as a landlord, holiday let owner, or even through room rentals, this form ensures your income is declared and taxed correctly.

At Audit Consulting Group, we help landlords, investors, and private individuals complete the SA105 form accurately, avoid costly mistakes, and stay compliant with HMRC.

What is the HMRC SA105 Form?

The HMRC SA105 is a supplementary page to the main SA100 self assessment tax return. It is specifically designed for:

- UK property rental income (houses, flats, commercial property).

- Furnished holiday lettings.

- Rent-a-room scheme.

- Shared property ownership.

When to Use the SA105 HMRC Form?

You must complete the SA105 HMRC form if during the tax year you:

- Rented out a residential or commercial property in the UK.

- Claimed expenses related to property letting.

- Used the rent-a-room scheme but exceeded the allowance.

- Operated a furnished holiday letting.

If you only received income from overseas property, you should instead use form SA106.

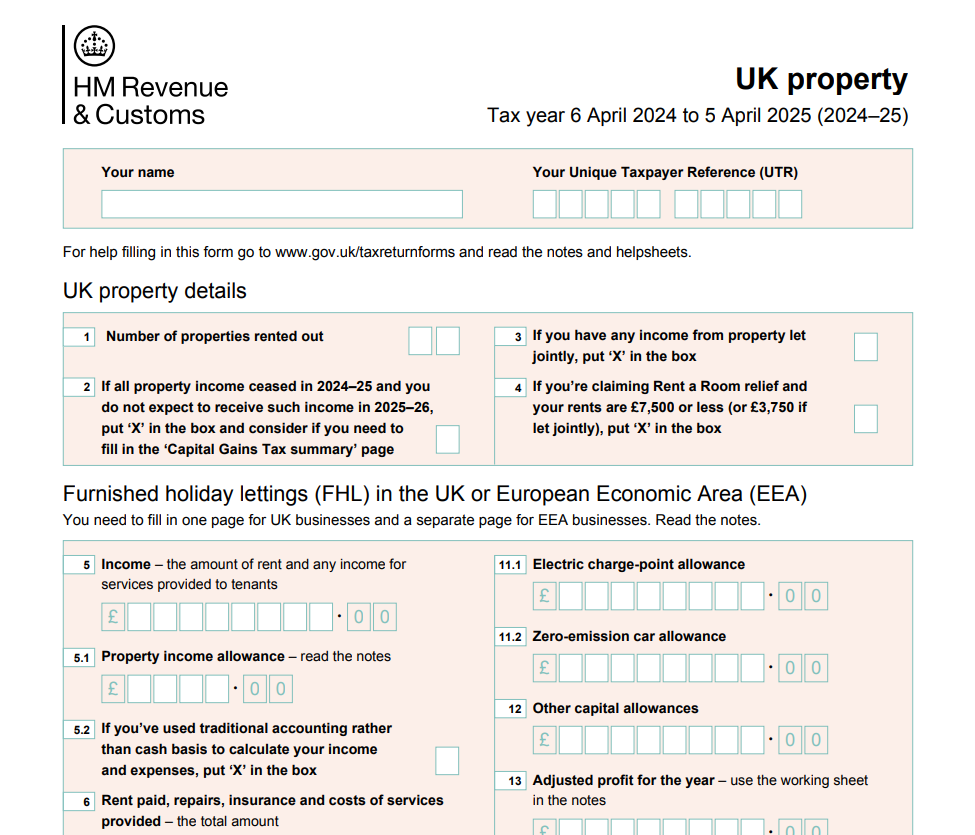

How to Fill in the SA105 Form

The form covers several key sections:

- Property income details – total rental income received.

- Allowable expenses – mortgage interest, repairs, maintenance, insurance, letting agent fees.

- Capital allowances – if applicable (e.g., furnished holiday lets).

- Tax adjustments – losses brought forward, balancing charges.

- Final calculation – taxable profit or allowable loss.

Common Mistakes Landlords Make

- Forgetting to claim allowable expenses – many landlords miss tax relief opportunities.

- Mixing personal and business expenses – such as personal phone bills.

- Incorrect treatment of mortgage interest – since April 2020, it is restricted to a 20% basic rate credit.

- Late filing – penalties start at £100, even if you owe no tax.

Case Studies – Real Client Scenarios

Case 1 – Missed Expenses

Sarah rented out a flat in London. She filed her return without the SA105, missing £3,000 of deductible expenses. We amended her return and saved her over £600 in tax.

Case 2 – Furnished Holiday Let

Tom had a holiday property in Cornwall. He incorrectly reported it under normal rental rules. Our team corrected his return using SA105 HMRC, unlocking special allowances available for furnished holiday lets.

Case 3 – Mortgage Interest Relief

Raj claimed full mortgage interest as an expense, which is no longer allowed. We corrected his HMRC SA105 form, avoiding an HMRC enquiry and penalties.

FAQ – SA105 HMRC

Q1: Do I need to fill SA105 if I live abroad?

If your property is in the UK, yes – you must still complete SA105 even if you are a non-resident landlord.

Q2: Can I use SA105 for overseas property?

No. Overseas property goes on form SA106.

Q3: Can I claim repair and maintenance costs?

Yes, but only if they are genuine repairs (not improvements).

Q4: What if I make a loss on rental income?

You can carry forward losses to offset against future rental profits.

Q5: Where do I submit the SA105?

It is filed alongside your SA100 self assessment return, either online or on paper.

Why Work with Audit Consulting Group?

Filling out the HMRC SA105 form can be complex, especially with rules around mortgage relief, furnished holiday lettings, and expense deductions. Errors can lead to HMRC investigations or overpayment of tax.

At Audit Consulting Group, we:

- Ensure your SA105 HMRC form is filed correctly and on time.

- Maximise allowable expenses to reduce your tax liability.

- Handle HMRC correspondence and protect you from penalties.

- Save you time and stress so you can focus on growing your property investments.

👉 Contact Audit Consulting Group today – we’ll complete your SA105 form accurately and ensure full compliance with HMRC.