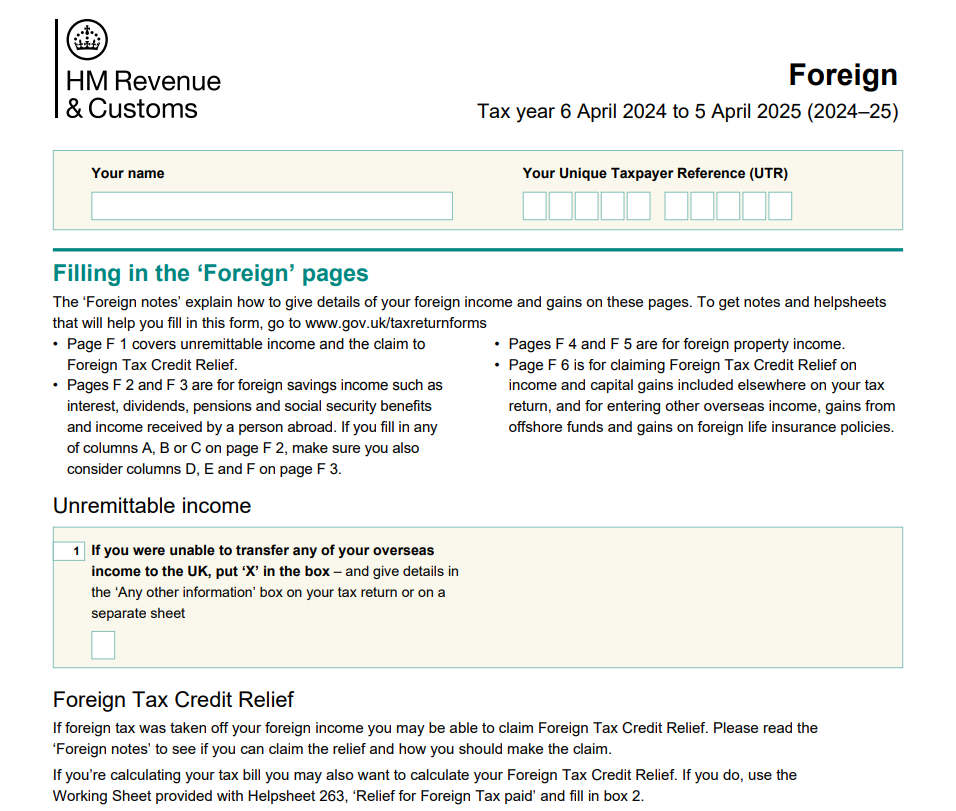

SA106 Form: Report Foreign Income to HMRC

The HMRC SA106 form is a supplementary page of the UK Self Assessment tax return used for declaring foreign income and gains. If you earn money outside the UK – whether from overseas employment, pensions, property rentals, bank interest, dividends, or trust income – this form ensures everything is reported correctly to HMRC.

Filing the SA106 can be complex. Many taxpayers are unsure how to deal with exchange rates, double taxation, or foreign property expenses. That’s where Audit Consulting Group comes in. We make the process simple, accurate, and stress-free.

What is the HMRC SA106 Form?

The HMRC sa106 is designed for people who have non-UK income or foreign gains. It works alongside your SA100 main return. You must include it if you:

- Worked abroad and earned overseas employment income.

- Received a foreign pension or annuity.

- Rented out property overseas.

- Earned interest or dividends from foreign banks or companies.

- Benefited from a foreign trust, estate, or settlement.

- Made gains on selling overseas property or shares.

For HMRC SA106 form assistance, trust our expertise in foreign income declaration support to ensure compliance and optimize your tax position.

Why is the SA106 Important?

The UK has tax treaties (double taxation agreements) with many countries. The HMRC SA106 allows you to:

- Declare income and gains from abroad.

- Claim relief if you already paid tax overseas.

- Avoid paying tax twice on the same income.

- Stay compliant and avoid penalties.

If you fail to complete the SA106 when required, HMRC may consider it tax evasion, which can result in investigations, interest charges, and penalties.

When Do You Need the SA106?

You need to complete the HMRC SA106 form if you:

- Have rental income from overseas property (e.g., a Spanish holiday villa or French flat).

- Earn dividends from foreign companies.

- Receive pension income from a former employer outside the UK.

- Work abroad temporarily or permanently but remain a UK tax resident.

- Hold savings accounts in foreign banks.

- Sold an overseas property or shares and made a capital gain.

Even if the amount is small, you are legally required to declare it.

Example of Filling in the HMRC SA106 Form

Here’s a practical walk-through of the SA106 form with examples.

Section 1: Employment income from abroad

Example: John worked in Germany for 3 months and earned €12,000. He converts this into GBP using HMRC’s exchange rate (€1 = £0.87 → £10,440). He also paid €1,500 in German tax. On SA106, he declares the £10,440 and claims foreign tax credit relief.

Section 2: Foreign pensions

Example: Margaret receives €9,000 pension from Italy. Converted at £0.85, this equals £7,650. She enters this on SA106 under pensions.

Section 3: Overseas property

Example: Tom rents out his villa in Spain, earning €15,000 in rent with €5,000 expenses (agent fees, insurance, repairs). Converted at £0.86, he declares £12,900 income and £4,300 expenses.

Section 4: Dividends and interest

Example: Emma owns shares in a US company and receives $2,000 in dividends. Using £0.75 exchange rate, she reports £1,500.

Section 5: Double taxation relief

Example: Raj has paid $300 US withholding tax on his dividends. He claims double taxation relief to reduce his UK tax liability.

Section 6: Capital gains

Example: Laura sold a French holiday home for €250,000, making a gain of €50,000. Converted into GBP, she declares this in the capital gains section of SA106.

Common Mistakes on SA106

- Not converting into GBP – HMRC requires all foreign income to be reported in sterling using their official exchange rates.

- Missing small amounts – even £10 of interest from a French bank must be reported.

- Confusing income with capital – selling shares is not income, it’s a capital gain.

- Not keeping documents – you need proof of overseas tax paid (receipts, tax statements).

- Wrong treatment of expenses – you can claim genuine maintenance costs for foreign property, but not improvements.

Case Studies – How We Help Clients

Case 1 – Double Taxation Avoided

David, a consultant, worked in the US for 6 months earning $40,000. He paid US federal tax and thought he had to pay UK tax again. Our team filed his HMRC sa106, applied double taxation relief, and reduced his UK bill to £0.

Case 2 – Overseas Property Losses

Maria had a flat in Portugal but after mortgage costs and repairs, she made a loss. HMRC allows her to carry forward these losses to offset against future rental profits. We ensured her SA106 HMRC form reflected this correctly.

Case 3 – Pension Confusion

Peter received a German pension. Unsure if it was taxable in the UK, he risked under-reporting. We checked the UK-Germany double taxation treaty, guided him, and submitted his SA106 safely.

FAQ – HMRC SA106

Q1: Do I need to declare foreign bank interest if it’s under £100?

Yes, all foreign income must be declared, regardless of size.

Q2: Can I file the SA106 online?

Yes, through HMRC online services or approved third-party software.

Q3: Which exchange rate should I use?

HMRC provides annual and monthly exchange rates (https://www.gov.uk/government/collections/exchange-rates-for-customs-and-vat). Use the rate applicable to the period when income was received.

Q4: Can I claim back foreign tax already paid?

Yes, if the UK has a double taxation agreement with that country.

Q5: What happens if I forget to file SA106?

You may face penalties, interest on unpaid tax, and HMRC may open an enquiry.

Why Choose Audit Consulting Group?

The HMRC SA106 is one of the most technical parts of the self assessment return. With multiple currencies, overseas tax credits, and complex treaties, it’s easy to make costly mistakes.

At Audit Consulting Group we:

- Prepare and submit your SA106 form correctly.

- Ensure every detail is converted into GBP using HMRC-approved rates.

- Apply all eligible double taxation reliefs.

- Handle all correspondence with HMRC on your behalf.

- Protect you from penalties and reduce your tax bill.

Contact Audit Consulting Group today — we’ll complete your HMRC SA106 form accurately and stress-free.

SA106 Foreign Income Form Services Cost in the UK

Report foreign income in the UK accurately with professional SA106 form support. We assist individuals with declaring overseas income and tax paid abroad. Our SA106 form services help avoid HMRC issues and ensure correct international income reporting.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants