SA108 Form: Capital Gains Summary (Self Assessment)

The HMRC SA108 form is a supplementary page of the Self Assessment tax return. It is used to declare capital gains from the sale or disposal of assets such as property, shares, cryptoassets, or valuable personal possessions. If you sold something for more than you paid and the profit is above your annual Capital Gains Tax (CGT) allowance, you must complete the HMRC SA108.

Many UK taxpayers are surprised to learn they need to fill in this form. Even if you made a loss, reporting it can help reduce future tax bills. Navigating the SA108 can be tricky, but with the right guidance – and support from Audit Consulting Group – you can stay fully compliant and avoid unnecessary penalties.

Explore our Tax Planning Services for expert assistance in reducing capital gains liability and planning strategically for future transactions.

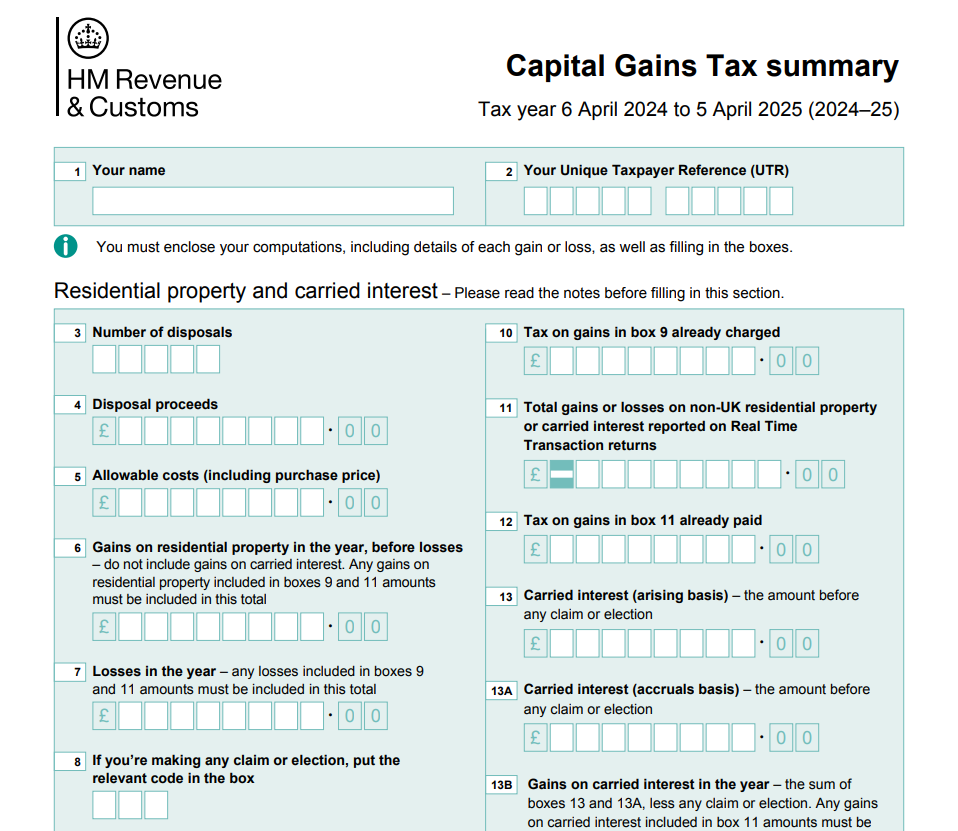

Official HMRC guidance and form SA108

What is the HMRC SA108 Form?

The HMRC SA108 is the Capital Gains summary section of your Self Assessment return. It provides HMRC with details of:

- Sales of UK residential property (not your main home).

- Disposals of shares and securities.

- Sales of cryptoassets such as Bitcoin or Ethereum.

- Disposal of valuable assets worth over £6,000 (e.g., jewellery, artwork, classic cars).

- Trust or estate disposals.

- Gains from overseas property or investments.

When Do You Need to Complete SA108?

You must file the HMRC SA108 form if:

- Your gains in a tax year exceed the Capital Gains Tax annual exemption (£12,300 for most individuals until April 2023, then reduced).

- You sold a second home, buy-to-let property, or land.

- You disposed of shares outside of ISAs or pensions.

- You received proceeds of £49,200 or more (even if your gain was within the allowance).

- You made a loss that you want to report and carry forward to offset future gains.

Example of Filling in the SA108

Case 1: Sale of a Buy-to-Let Property

- Jane sold her rental flat in Manchester for £300,000, which she bought for £220,000.

- Profit = £80,000.

- She spent £10,000 on legal fees and improvements (which qualify).

- Taxable gain = £70,000.

- On her HMRC SA108, she enters the disposal value (£300,000), the purchase value (£220,000), and allowable costs (£10,000).

Case 2: Share Disposals

- Tom sold £20,000 worth of company shares that he bought for £12,000.

- Profit = £8,000.

- Since his total gains for the year were below the allowance, no tax is due.

- However, because his disposal proceeds were over £49,200, he still needs to complete the SA108.

Case 3: Cryptoasset Gains

- Sarah sold £15,000 worth of Bitcoin, originally bought for £6,000.

- Profit = £9,000.

- She reports this on the SA108 under “Other assets”.

Common Mistakes with the HMRC SA108

- Forgetting to deduct allowable costs – legal fees, stamp duty, and improvements can reduce your taxable gain.

- Mixing income tax with CGT – rental income goes on SA105, but property sale gains go on SA108.

- Not reporting losses – even if you don’t owe tax, unreported losses cannot be used in future years.

- Incorrect asset valuation – especially for inherited property. Professional valuations are recommended.

- Missing crypto disposals – HMRC actively monitors crypto exchanges.

Key Recommendations for Completing SA108

Keep detailed records – purchase contracts, receipts, valuations, and sale documents.

Use HMRC’s worksheets – these help calculate gains correctly.

Report even exempt disposals if the proceeds are high.

Don’t forget foreign property – overseas disposals must also be declared.

Seek professional help – especially with multiple assets or mixed-use properties.

FAQ – HMRC SA108

Q1: Do I need to fill in SA108 if I sold my main home?

Usually no, if it qualifies fully for Private Residence Relief.

Q2: How much tax will I pay on gains?

Basic rate taxpayers: 10% on most gains, 18% on residential property.

Higher rate taxpayers: 20% on most gains, 28% on residential property.

Q3: Can I report losses?

Yes, and you should – they can reduce future tax bills.

Q4: Do I need to declare crypto gains?

Yes, all cryptoasset disposals must be declared on SA108.

Q5: What happens if I don’t file SA108?

HMRC can charge penalties, interest, and even investigate under-reporting.

Why Work with Audit Consulting Group?

The HMRC SA108 is one of the most detailed and risk-sensitive forms in the Self Assessment. Errors can be expensive. At Audit Consulting Group, we:

- Accurately calculate and declare all gains and losses.

- Apply reliefs like Private Residence Relief, Business Asset Disposal Relief, and rollover relief.

- Handle cryptoasset reporting with HMRC-approved methods.

- Ensure losses are carried forward properly.

- Protect you from HMRC scrutiny and penalties.

Contact Audit Consulting Group today — we’ll complete your HMRC SA108 form accurately and efficiently, giving you peace of mind.

SA108 Capital Gains Tax Form Services Cost UK

Submit the SA108 form in the UK with expert capital gains tax support. We help individuals report capital gains accurately as part of Self Assessment. Our SA108 services ensure correct calculations and HMRC compliance at a clear, fixed price.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants