SA109 Form: UK Residence Status and Claims Guide

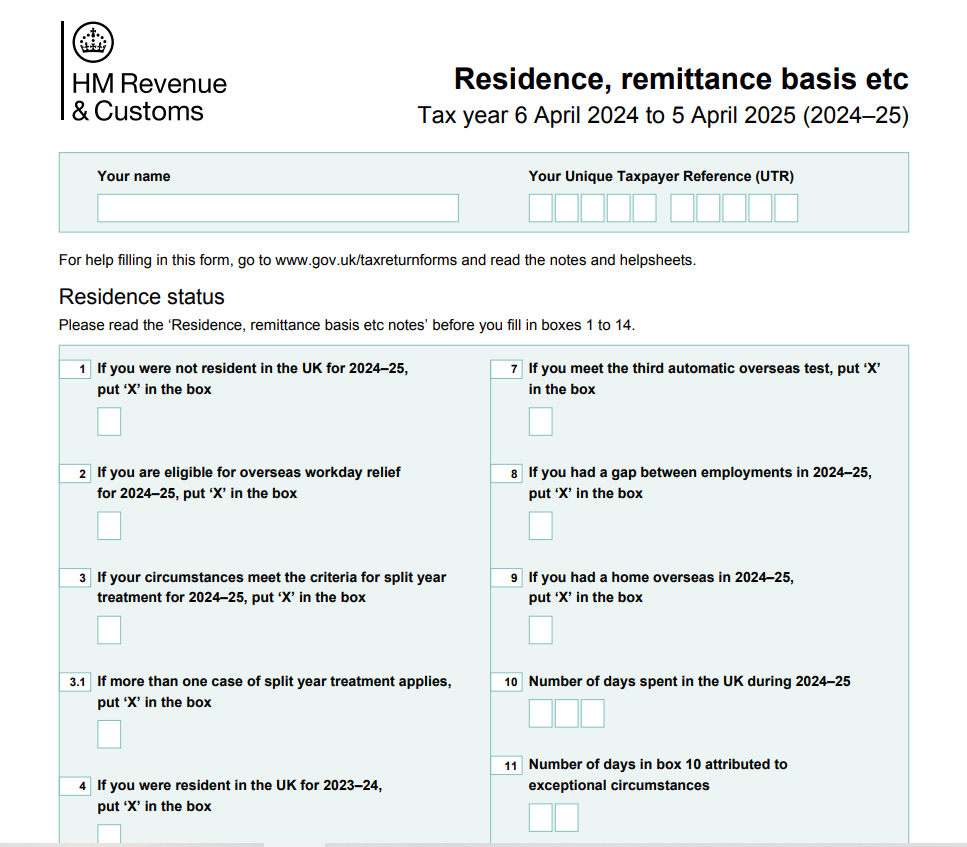

The HMRC SA109 form is a supplementary page of the Self Assessment tax return used by individuals who have income or gains outside the UK, are non-resident for tax purposes, or wish to claim the remittance basis. If you are a UK resident with international income, or a non-UK resident with UK income, this form ensures that HMRC correctly assesses your tax liability.

Official HMRC guidance and SA109 form

Completing the HMRC SA109 correctly is vital to avoid double taxation, incorrectly paying tax, or triggering an HMRC enquiry.

What is the HMRC SA109 Form?

The hmrc sa109 form is used when filing a Self Assessment tax return and you need to declare:

- Non-UK residency status.

- Split-year treatment (when you move in or out of the UK partway through a tax year).

- The remittance basis, where foreign income/gains are only taxed if brought into the UK.

- Double Taxation Relief claims.

- Overseas income, pensions, property, and capital gains.

It acts as the residency declaration and ensures your tax position is correct in line with HMRC rules.

Correctly completing the HMRC SA109 form is essential to prevent double taxation issues – Double Taxation Relief claims

Who Needs to Complete SA109?

You may need the HMRC SA109 form if you are:

- A UK resident with overseas income (property rental abroad, dividends from foreign companies, interest from overseas accounts).

- A non-UK resident who earns taxable UK income (e.g., rental income from a UK property).

- Someone who has left or moved to the UK within the tax year and qualifies for split-year treatment.

- Claiming the remittance basis instead of the arising basis for foreign income.

- Using double taxation treaties to avoid being taxed twice.

Example Scenarios

Case 1: UK Resident with Overseas Income

James lives in London but owns a rental flat in Spain. He must declare his Spanish rental income on his UK tax return and complete the HMRC SA109 to claim foreign tax credit relief.

Case 2: Non-Resident Landlord

Maria moved to Dubai but kept her UK house and rented it out. She remains liable for UK tax on her rental profits, so she files an SA100 with an HMRC SA109 to confirm her non-resident status.

Case 3: Split-Year Treatment

Alex moved from the UK to Canada in October. He claims split-year treatment on the HMRC SA109 so only UK income from April to October is taxed in the UK.

Common Mistakes with SA109

- Failing to claim split-year treatment – leading to overpayment of UK tax.

- Incorrectly applying the remittance basis – forgetting that unremitted income may still impact allowances.

- Not reporting foreign pensions – HMRC has information-sharing agreements with many countries.

- Overlooking double taxation relief – paying more tax than necessary.

- Late filing – which leads to penalties, even if no tax is due.

Recommendations for Completing SA109

Check residency carefully – use the Statutory Residence Test (SRT) before filing.

Keep records of travel dates – flights, visas, and work contracts support your residency claim.

Report all overseas income – even if you paid tax abroad.

Use double taxation treaties to avoid overpayment.

Seek advice for complex cases – especially if you’re high-net-worth or have trusts.

More on UK residency and taxation: https://www.gov.uk/tax-foreign-income

FAQ – HMRC SA109

Q1: Do I need SA109 if I live abroad but have no UK income?

No, unless you want to formally declare your non-resident status.

Q2: What is split-year treatment?

It allows your tax year to be divided into UK-resident and non-resident parts if you move.

Q3: What is the remittance basis?

It means you only pay UK tax on foreign income if you bring it into the UK.

Q4: Can I be taxed twice on foreign income?

No, you can usually claim Double Taxation Relief on SA109.

Q5: What happens if I don’t file SA109?

HMRC may treat you as UK resident for the whole year and tax your worldwide income.

Why Work with Audit Consulting Group?

Completing the HMRC SA109 is complex – mistakes often lead to double taxation or HMRC enquiries. At Audit Consulting Group, we:

- Check your residency under the Statutory Residence Test.

- Apply split-year treatment correctly.

- Optimise your use of remittance vs arising basis.

- Claim all eligible foreign tax credits.

- Protect you from overpayment and penalties.

Contact Audit Consulting Group today – we’ll handle your HMRC SA109 quickly and accurately, ensuring peace of mind.

SA109 Residency Status Form Services Cost UK

Get professional support with the SA109 form in the UK to declare residency and domicile status. We help ensure correct completion of residency information for Self Assessment. Our SA109 services reduce compliance risks and reporting errors.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants