HMRC SA110 Form for CGT – Tax Calculation Summary

The HMRC SA110 form is the Tax Calculation Summary within the Self Assessment process. It is used to calculate the exact amount of tax you owe (or are due as a refund) after completing your Self Assessment return. While HMRC’s system often generates this automatically, understanding the SA110 HMRC form helps you verify accuracy and ensures you are not paying more than necessary.

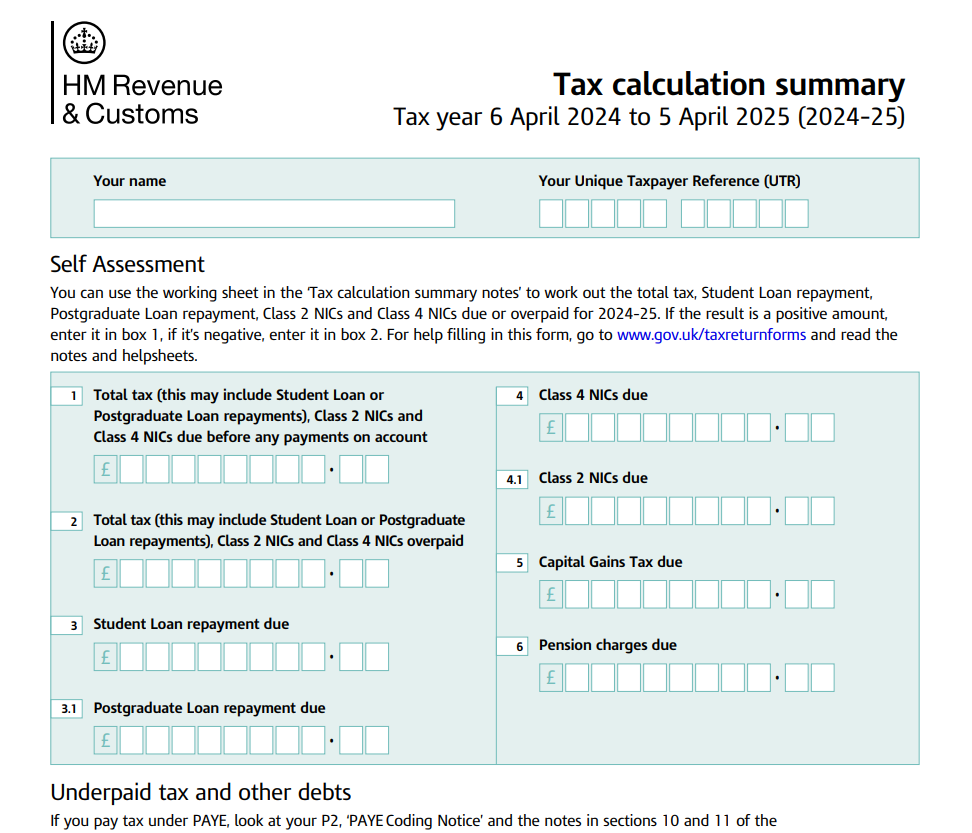

Official HMRC SA110 form and notes

What is the HMRC SA110 Form?

The HMRC SA110 form summarises:

- Total taxable income from employment, self-employment, pensions, property, savings, and dividends.

- Income tax owed at each band (basic, higher, and additional rate).

- National Insurance contributions (if applicable).

- Tax reliefs, allowances, and adjustments.

- Payments on account already made.

- Final amount payable or refundable.

It acts as the final reconciliation of your tax return.

Our Personal Tax Filing Services ensure accurate tax calculations align with HMRC data, avoiding overpayments and reflecting your real position.

Why is the SA110 Important?

Even if you file online and HMRC generates the calculation, mistakes can happen if figures are entered incorrectly. The SA110 HMRC form helps:

- Double-check that your tax bands were applied correctly.

- Confirm reliefs (like Gift Aid, pensions, or trading allowances) were used.

- Identify underpayments before HMRC issues penalties.

- Give lenders proof of income when applying for a mortgage or loan.

Example of SA110 in Action

Case 1: Self-Employed Contractor

Emma earns £45,000 from freelance design. Her SA110 shows income tax split into 20% basic rate and 40% higher rate portions, plus National Insurance. She checks the figures to make sure her allowances reduced the bill correctly.

Case 2: Higher Rate Taxpayer with Dividends

James earns £70,000 salary plus £10,000 in dividends. The SA110 calculation highlights dividend tax separately, ensuring he pays the correct rate.

Case 3: Mortgage Application

Sarah needed her SA110 tax calculation summary to prove her earnings for a mortgage. HMRC accepts the HMRC SA110 form as evidence of verified income.

Common Mistakes with HMRC SA110

- Not checking allowances – Missing out on Marriage Allowance, Blind Person’s Allowance, or reliefs.

- Incorrect dividend or savings figures – Leads to higher tax liability.

- Payments on account not included – Double paying tax unnecessarily.

- Ignoring the form entirely – Some rely only on HMRC’s online calculation without reviewing.

- Using outdated versions – Always ensure you use the correct year’s form.

How to Complete SA110 Correctly

- Download the correct year’s SA110 form directly from HMRC (link above).

- Copy your income and relief figures from your SA100 and supplementary pages.

- Ensure Gift Aid and pension relief adjustments are applied.

- Double-check National Insurance is only included where relevant.

- Review your payments on account and deduct them properly.

Guidance on Self Assessment and calculations – https://www.gov.uk/self-assessment-tax-returns

FAQ – HMRC SA110

Q1: Do I need to fill in SA110 if I file online?

Usually, HMRC generates the calculation automatically, but filling in or reviewing SA110 ensures accuracy.

Q2: Can SA110 be used as income proof?

Yes – many banks and lenders accept the HMRC SA110 form for mortgages or loans.

Q3: What if my SA110 calculation doesn’t match HMRC’s?

Check your inputs on SA100 and supplementary forms. If unsure, seek advice from a tax advisor.

Q4: What happens if I ignore SA110 errors?

You may overpay tax or face penalties if HMRC later finds underpayment.

Q5: Can Audit Consulting Group help with SA110?

Yes – we review, complete, and cross-check your SA110 for accuracy and peace of mind.

Why Choose Audit Consulting Group?

At Audit Consulting Group, we specialise in ensuring your SA110 HMRC form is 100% accurate. We:

- Review all entries across your Self Assessment.

- Check that allowances and reliefs are maximised.

- Ensure no overpayment or underpayment occurs.

- Provide SA110 summaries for mortgage or loan applications.

- Handle correspondence with HMRC on your behalf.

Don’t risk mistakes. Contact Audit Consulting Group today and let us manage your SA110 submission professionally.

SA110 Additional Information Form Services Cost UK

Complete the SA110 form in the UK with expert HMRC support. We assist with additional tax information required alongside Self Assessment returns. Our SA110 form services help ensure accuracy and full compliance with HMRC requirements.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants