Working from Home Tax Relief – Complete Guide to Claiming Your UK Tax Rebate

Understand Your Right to Claim for Working from Home Expenses

If you’ve been working from home — even part-time — you could be entitled to tax relief from HMRC.

The Working from Home Tax Relief allows you to claim back some of the extra household costs you pay while working remotely, such as electricity, heating, and internet.

At Audit Consulting Group, we help employees, freelancers, and small business owners understand what they can claim and make the process simple. This guide explains exactly how the working-from-home tax relief works, who qualifies, how to apply, and what you can expect from HMRC.

Learn more about tax relief for working from home and how to claim your UK tax rebate with Audit Consulting Group’s personal financial support services.

What Is the Working from Home Tax Relief?

The Working from Home Tax Relief is a UK Government tax allowance that compensates workers who use part of their home for their job.

It covers additional costs that arise directly from working at home — such as heating, electricity, business phone calls, or broadband usage.

This relief is available whether you work full-time or part-time from home — as long as it’s necessary for your job, not just personal choice.

Who Can Claim Working from Home Tax Relief?

You can claim if:

-

You work from home because your employer requires it (not voluntarily).

-

You pay for part of your household expenses yourself.

-

You use your own home broadband, phone, or utilities for work.

-

You do not receive a separate allowance from your employer to cover those costs.

This applies to:

-

Employees (PAYE)

-

Freelancers or contractors who use part of their home for business

-

Company directors who manage their business from home

Who Cannot Claim

You cannot claim if:

-

You choose to work from home voluntarily when your employer provides office space.

-

Your employer already reimburses you for these costs.

-

You only occasionally check emails from home without regular work duties.

How Much Can You Claim?

You can claim one of two ways:

-

Flat Rate Allowance (no receipts needed)

HMRC allows employees to claim a fixed amount of £6 per week (£312 per year) without keeping receipts or calculating actual expenses. -

Actual Costs (if you can provide proof)

You can claim a higher amount if you can show evidence of your household bills and the proportion used for work (e.g. electricity, internet, gas).

For example, if you use one room of five in your home for work half the time, you can claim 10% of relevant bills.

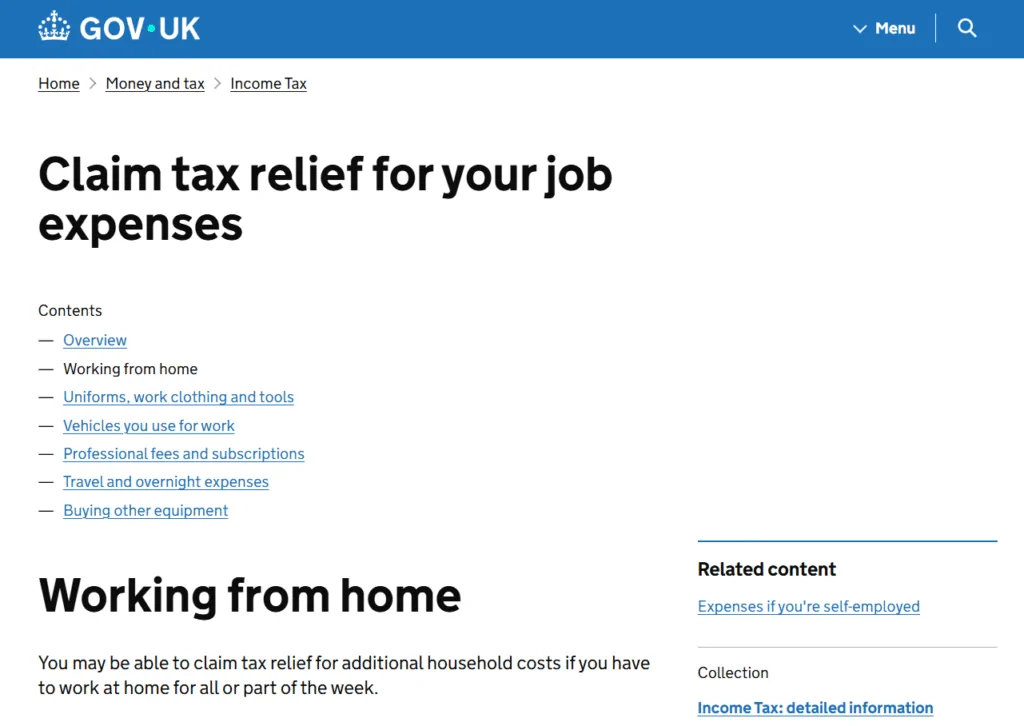

Full HMRC explanation:

https://www.gov.uk/tax-relief-for-employees/working-at-home

What Expenses Qualify

You can include:

-

Heating and electricity

-

Water and metered utilities

-

Business phone calls

-

Internet access used for work

-

Equipment maintenance (if used mainly for work)

You cannot claim:

-

Rent or mortgage payments

-

Council Tax

-

TV licence

-

Personal phone or entertainment costs

How to Claim Working from Home Tax Relief – Step by Step

Step 1: Check Your Eligibility

Confirm that you are required to work from home by your employer and that you pay part of the household costs.

Step 2: Gather Information

You’ll need:

-

Your National Insurance number

-

Your employer’s PAYE details

-

Proof of identity (for online claims)

-

Details of household expenses (if claiming actual costs)

Step 3: Claim Online (Quick Method)

HMRC’s online claim service is the fastest route:

https://www.gov.uk/tax-relief-for-employees/working-at-home

You’ll log in using your Government Gateway account or create one if you don’t have it.

Once approved, HMRC adjusts your tax code so you pay less tax throughout the year.

Step 4: Claim Through Self Assessment

If you already complete a Self Assessment Tax Return (SA100), you can include your working from home relief under the “Employment Expenses” section.

This is often done by those with freelance or multiple income sources.

Step 5: Claim for Past Years (Backdated Claims)

You can claim for up to four previous tax years.

Example: In 2025, you can still claim for 2021/22, 2022/23, 2023/24, and 2024/25 tax years.

Backdated claims are processed through HMRC’s online service or by post if required.

How Long Does It Take to Receive the Relief

-

Online claim: Usually updated in your tax code within 2–6 weeks.

-

Postal or backdated claim: Up to 12 weeks.

If HMRC owes you a refund, the money is typically paid into your bank account.

Common Mistakes to Avoid

-

Claiming when working from home is optional, not required.

-

Submitting incomplete information (missing NI number or address).

-

Forgetting to update address or employer details in your Personal Tax Account.

-

Claiming duplicate relief (if your employer already pays you an allowance).

Audit Consulting Group helps ensure your claim is valid and error-free, so you receive your refund smoothly and on time.

How We Can Help

Our UK-based specialists guide you through every step of claiming Working from Home Tax Relief. We help you:

-

Confirm eligibility

-

Prepare documents or receipts (if needed)

-

Complete your online or paper claim

-

Communicate with HMRC on your behalf

We make sure you get the maximum refund you’re entitled to — correctly, quickly, and with zero stress.

Case Studies

Case 1 – Employee Working Remotely Since 2020

Client: Claire H., Customer Support Agent

Issue: Worked from home during and after the pandemic but never claimed.

Result: Backdated claim for three tax years; refund of £936 approved in six weeks.

Case 2 – Hybrid Worker

Client: Michael T., Financial Analyst

Issue: Works two days a week from home without reimbursement.

Result: Claimed flat-rate allowance through HMRC portal; refund applied to new tax code within a month.

Case 3 – Small Business Owner

Client: J. Reynolds, Freelance Consultant

Issue: Uses one room in home as office.

Result: Claimed proportion of household bills via Self Assessment; £482 deducted from taxable income.

Frequently Asked Questions (FAQ)

Q1: Can I claim if I work from home by choice?

No. HMRC only allows claims if working from home is required by your employer.

Q2: How do I know if my claim was accepted?

HMRC will update your tax code and confirm via letter or your Personal Tax Account.

Q3: Can I claim if I’m self-employed?

Yes, but you claim it as part of your Self Assessment under business expenses, not through the employee scheme.

Q4: Can I claim if my employer pays me an allowance?

No. You cannot claim the tax relief if you already receive reimbursement for home-working costs.

Q5: How far back can I claim?

Up to four tax years, if you met the conditions in each year.

Q6: What if I moved homes during the year?

You can still claim, but you’ll need to calculate only for the period you worked from home.

Q7: Will this affect my benefits or other allowances?

No, this is a tax relief — not income — and it won’t affect your benefits or tax credits.

When to Get Professional Help

If you’ve never claimed before or aren’t sure how to calculate actual costs, getting help ensures your claim is accurate and compliant.

We’ll review your circumstances and make sure you claim everything you’re entitled to — nothing missed, nothing overclaimed.

Start Your Claim Today

At Audit Consulting Group, our goal is simple: to help you understand and claim the tax relief you deserve.

Working from home shouldn’t cost you extra — let us help you get your refund quickly and correctly.

Official guidance is available here:

https://www.gov.uk/tax-relief-for-employees/working-at-home

Working From Home Tax Relief Claim Services Cost UK

Claim working from home tax relief in the UK with professional HMRC support. We help individuals submit accurate claims for allowable expenses. Our working from home tax relief services ensure correct calculations and timely submissions.

Service Cost Estimation

Select the service category below to calculate the estimated cost of either accounting & tax services or forms and submissions.

Select Required Services / Forms

Select one or more services/forms to receive an accurate cost estimate. You can adjust your selection at any stage.

How would you like to engage our services?

Please select whether you require a one-off service or ongoing monthly support.

Contract Duration

Your cost estimate

Apply now and get 10% OFF

Submit your request today and receive an exclusive 10% discount on your selected service.

All prices are estimates. To receive a personalised quote, please fill out the form or contact us.

Ready to get started?

Get professional support from experienced UK accountants